Bermuda-based re/insurers monitored by Fitch are expected to see a drop in underwriting profit in 2025, reporting an average combined ratio of 92%, up from 90.7% in full-year 2024, the ratings agency said.

For the first nine months of 2025, Fitch said the group of Bermuda re/insurers it tracks posted solid underwriting profits, with a combined ratio of 91.0%, up from 86.4% for 9M 2024. (Combined ratios below 100% indicate underwriting profits).

“This increase [in combined ratios] was due to higher catastrophe losses, slightly less favorable reserve development and a deterioration in the underlying underwriting result,” Fitch said, noting that all companies in the group posted underwriting gains, although most posted a higher combined ratio in 9M 2025 than in 9M 2024.

The exceptions were AXIS and Aspen, which posted combined ratios below 90% — both at 89.5%. (Fitch monitors nine Bermuda re/insurers of which two do not report 9M results).

Catastrophe losses will represent about 8 percentage points on the 2025 combined ratio, primarily from the California wildfires, up from 6.4 points in 2024, according to Fitch Ratings in its “Bermuda Re/Insurance Monitor: 2026.”

The California wildfires in January 2025 resulted in US$40 billion of insured losses and US$53 billion of economic losses. (Insured losses are included in the economic totals).

“The January 2026 reinsurance renewals demonstrated a strong shift to a buyers’ market, particularly for property risk, which experienced its largest rate declines in over a decade,” said the Fitch report.

“Terms and conditions marginally loosened, although attachment points and retentions generally held. Pricing decreases in specialty were more modest, while casualty was stable as the market continues to manage increasing loss costs from social inflation,” the report continued.

“Bermuda re/insurers will produce reduced returns in 2025 and 2026, as record high capital levels push a softening market, although profitability will remain favorable by historical standards,” commented Brian Schneider, senior director, Fitch Ratings, who was quoted in the report.

Shareholders’ equity grew 12% at 9M 2025 from year end 2024 as a result of underwriting gains, strong investment income and equity and bond market gains, said Fitch, adding that return on equity will remain favorable in 2025 at near 17%, down only slightly from 17.8% in 2024.

M&A Activity Escalates as Organic Growth Wanes

Fitch noted that large-scale Bermuda-focused mergers and acquisitions have been limited in recent years as a result of good premium pricing and beneficial terms and conditions, which boosted organic growth opportunities.

Fitch noted that large-scale Bermuda-focused mergers and acquisitions have been limited in recent years as a result of good premium pricing and beneficial terms and conditions, which boosted organic growth opportunities.

“However, as these organic opportunities have subsided in the softening market, M&A has returned in 2025 and should continue into 2026 as companies with accumulated capital look to acquire other re/insurers,” said Fitch, explaining that recent transactions include the purchase of newer companies formed since 2019, international diversification efforts and continued interest by asset managers.

“Consolidation may moderate competitive pressures as overall capacity is reduced, but Fitch is likely to view negatively any individual deal driven to achieve greater scale and diversity without a clear strategic rationale,” the report said.

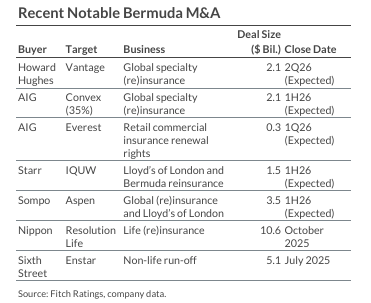

Fitch went on to list notable M&A activity in Bermuda during 2025:

- Vantage Group Holdings announced in December it had agreed to be acquired by Howard Hughes Holdings for US$2.1 billion.

- American International Group (AIG) announced several Bermuda-related transactions in the Q4 2025, including an agreement to acquire the renewal rights for a majority of Everest Group’s retail commercial insurance portfolios worldwide for approximately US$300 million.

- AIG also announced it will acquire a 35% equity interest in Convex Group, the privately held global specialty re/insurer.

- In October 2025, Starr International Co. announced it will acquire IQUW Group, a specialty re/insurer backed by private equity firms Aquiline and Abry Partners. IQUW writes at Lloyd’s and operates IQUW Re Bermuda, a Bermuda-based reinsurance platform formed in 2021.

- In August 2025, Sompo Holdings entered an agreement to purchase 100% of Aspen Insurance Holdings Ltd. for US$3.5 billion (1.3x book value). Apollo Global Management acquired Aspen in February 2019 for US$2.6 billion (1.1x book value). Apollo currently owns 82.1% of Aspen, following Aspen’s partial IPO in May 2025.

Fitch anticipates softening market conditions to continue at the midyear 2026 renewals as the competitive environment intensifies. Return on average equity (ROAE) should remain attractive at mid-teen levels as re/insurers remain disciplined in selectively deploying capital.

Fitch maintains a “deteriorating” fundamental sector outlook on global reinsurance and a “neutral” sector outlook on U.S. property/casualty insurance. These sectors include coverage for Bermuda market re/insurers.

Fitch analyzes nine Bermuda re/insurers: Arch Capital Group Ltd.; Ascot Group Ltd.; Aspen Insurance Holdings Ltd.; AXIS Capital Holdings Ltd.; Everest Group Ltd.; Hamilton Insurance Group Ltd.; PartnerRe Ltd.; RenaissanceRe Holdings Ltd., and SiriusPoint. (9M data excludes Ascot and PartnerRe as they did not report results).

Topics Mergers & Acquisitions Carriers Profit Loss Reinsurance

Was this article valuable?

Here are more articles you may enjoy.

Zurich Insurance Said to Near Beazley Deal Funded by Equity Sale

Zurich Insurance Said to Near Beazley Deal Funded by Equity Sale  Travelers Stranded by War Learn Insurance Won’t Cover Flight Cancellations

Travelers Stranded by War Learn Insurance Won’t Cover Flight Cancellations  Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates

Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates  Trump’s Hormuz Assurances Are Only a Partial Fix, Shippers Say

Trump’s Hormuz Assurances Are Only a Partial Fix, Shippers Say