Illinois, the worst-rated U.S. state, received a one-notch upgrade from Moody’s Ratings for its rising reserves and improving finances.

Moody’s raised the state’s rating to A2, five steps above junk, from A3, with a stable outlook, according to a report on Thursday. The move is Illinois’ 10th credit rating hike since Governor JB Pritzker took office in 2019. The billionaire Democrat and lawmakers have worked to turn around the state’s finances by paying down more than $16 billion in unpaid bills, passing budgets on time and boosting the rainy day fund.

“The upgrade is driven by realized and expected improvement in the state’s financial metrics,” according to the Moody’s report. “Illinois continues to add to its reserves and fund balance, growth in which is a crucial element in mitigating risks associated with the state’s high leverage, as well as shifts in federal policy.”

Pritzker, who is running for a third-term and is a frequent critic of President Donald Trump, has been warning for months about the challenges the GOP-controlled Congress and administration pose for the budgets of Illinois and other states. He is also in a standoff with the White House over immigration agents and federal troops coming into his state.

“Our tenth credit upgrade speaks volumes to the state’s commitment to consistent fiscal discipline – even as the Trump Administration creates widespread economic uncertainty,” Pritzker said in a statement. “With each credit upgrade, Illinois saves taxpayers millions of dollars in interest payments and further demonstrates the benefits of long-term improvements to our fiscal position.”

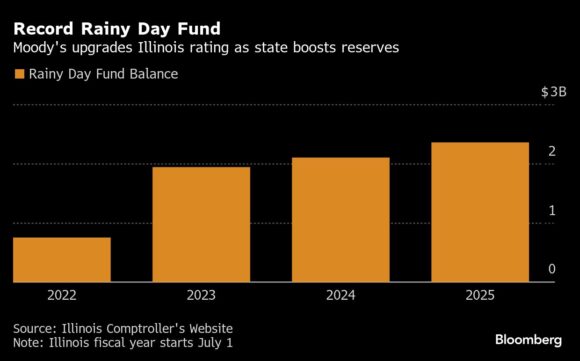

As part of efforts to mitigate risks to federal funding, Pritzker in recent weeks told state agencies to cut costs to put up to 4% of their budgets into reserves. In past years, Illinois held very little cash in reserves. For example, the state had only $3.6 million in its rainy day fund in 2019. Since then, officials built up the rainy day fund to a record $2.4 billion this year, though it still holds among the smallest levels of any state, according to a report released by the governor’s office of management and budget earlier this month.

Even with recent improvements, the state’s underfunded pensions, which are short about $144 billion, are a drag on its finances.

“Illinois remains an outlier among states for exposure to unfunded pension obligations that contribute to high leverage and fixed costs,” according to Moody’s.

Topics Illinois

Was this article valuable?

Here are more articles you may enjoy.

US Offers $20 Billion Reinsurance Plan to Spur Gulf Oil Flow

US Offers $20 Billion Reinsurance Plan to Spur Gulf Oil Flow  Georgia Insurance Law Is About to Get an Upgrade With Multiple Changes

Georgia Insurance Law Is About to Get an Upgrade With Multiple Changes  How State Farm, USAA Boost Customer Retention: Historic Dividends

How State Farm, USAA Boost Customer Retention: Historic Dividends  Marsh, Aon in Talks With US on Insuring Tankers in Hormuz

Marsh, Aon in Talks With US on Insuring Tankers in Hormuz