Increases for commercial property/casualty insurance rates in the United States were again about 5 percent during June, the fourth straight month at that pace.

According to the latest composite index from MarketScout, all coverages, industry groups and account sizes held within a plus 1 to minus 1 percent range compared to last month.

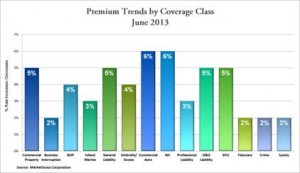

By coverage classification, commercial auto had the highest rate increases at plus 6 percent. Property, general liability, directors and officers and employment practices liability (EPLI) followed at plus 5 percent. EPLI has made the most significant upward rate adjustment in the last four months.

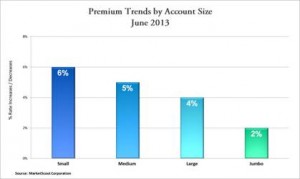

Small accounts (under $25,000 premium) were assessed the largest rate increases at plus 6 percent. Jumbo accounts (those over $1,000,000 premium) enjoyed the best composite rates at plus 2 percent.

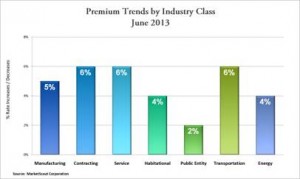

Contracting and service segments were the largest increases by industry class at plus 6 percent.

“The market is steady right now,” said MarketScout CEO Richard Kerr in a statement accompanying the report. “There were no big surprises in July 1 treaty renewals and even the impact of Superstorm Sandy seems to have been forgotten by most property insurers.”

The National Alliance for Insurance Education and Research conducts the pricing surveys that are used in MarketScout’s analysis.

A summary of the June 2013 rates by coverage, industry class and account size is set forth below.

Topics Trends Commercial Lines Business Insurance Pricing Trends

Was this article valuable?

Here are more articles you may enjoy.

Preparing for an AI Native Future

Preparing for an AI Native Future  Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  Trump’s EPA Rollbacks Will Reverberate for ‘Decades’

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’  Gun Accessory Company to Pay $1.75 Million to Buffalo Supermarket Shooting Victims

Gun Accessory Company to Pay $1.75 Million to Buffalo Supermarket Shooting Victims