A new report from Aon Benfield, a reinsurance intermediary and capital advisor of Aon plc, says U.S. homeowners insurance is showing significant growth opportunities.

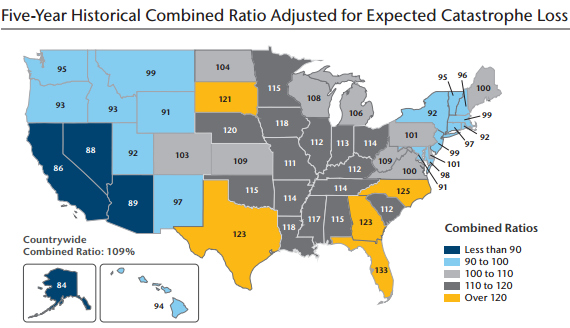

The report, titled “Homeowners ROE Outlook: 2013 Update,” reviews the industry aggregate state level statutory financial filing information along with rate filings and supporting actuarial information for the 20 top homeowners insurance groups by state. It concludes that insurers’ prospective after-tax return-on-equity (ROE) for homeowners insurance is 4.6 percent on a countrywide average.

The countrywide ROE outlook is essentially flat relative to last year’s 4.7 percent estimate. But Aon Benfield says that at the state level, positive rate momentum is improving the outlook for many states. Excluding Florida, the industry’s prospective ROE is 8 percent, with 36 states having prospective ROE outlooks better than this average, and 28 states with prospective ROE outlooks 12 percent or greater.

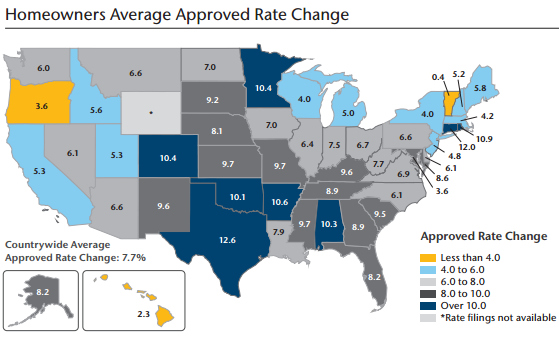

The report says positive rate momentum has been evident — as approved rate changes in homeowners lines have averaged a 7.7 percent increase across the U.S. over the past 18 months. The report also points to advancements in ratemaking methodology associated with capturing the cost of catastrophe risk. Recovering the cost of capital required to support retained catastrophe risk has seen widespread acceptance by state regulators and by-peril rating is becoming more widespread, according to the report.

Gulf states achieved some of the highest average rate increases, particularly Texas, where rates increased 12.6 percent, while the hurricane-exposed state of Florida average rate increase was 8.2 percent.

Although rate adequacy still remains elusive in the gulf and south-eastern states, positive rate and underwriting actions have put the outlook of rate adequacy within reach for states outside these regions, according to Aon Benfield.

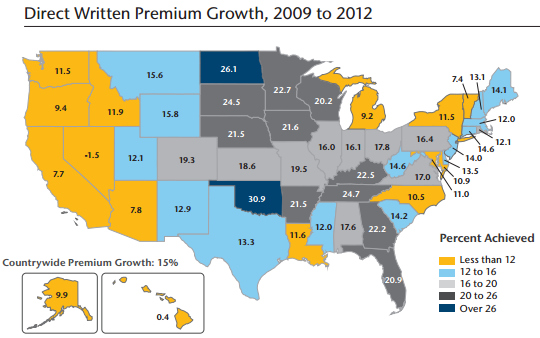

Furthermore, the study says that in an industry desperate for growth as auto premium volumes have stagnated, homeowners continues to be a growth opportunity for personal lines carriers. The study shows strong growth in the homeowners line between 2009 and 2012, with direct written premiums increasing 15 percent countrywide. Only Nevada saw a decline in premium volumes, as written premiums decreased by 1.5 percent during the period. At the same time, personal auto direct written premium growth was only 6.5 percent.

The study says that in order to maximize the growth opportunities available from the homeowners line of business, more granular pricing of catastrophe costs beyond state level indications is a necessity.

It also says accurate segmentation of reinsurance and capital costs at the territory level and refining territory definitions more granularly to better match rates to cost variations is essential to achieving overall rate adequacy without jeopardizing an insurer’s ability to grow in areas that will diversify its catastrophe risk.

“Overall, the homeowners line of business is still not producing adequate returns for the industry, but given the recent rate and underwriting actions, for the first time we are seeing an improving outlook for many states, especially in non-coastal regions,” said Parr Schoolman, Aon Benfield’s global risk and capital strategy team leader.

“Although more can still be done in terms of pricing segmentation, capturing the cost of catastrophe risk in rate filings is becoming a more widespread practice within the industry, which is positive for the long term prospects in this line of business,” Schoolman said.

Topics USA Homeowners Aon

Was this article valuable?

Here are more articles you may enjoy.

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  AIG Underwriting Income Up 48% in Q4 on North America Commercial

AIG Underwriting Income Up 48% in Q4 on North America Commercial  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call