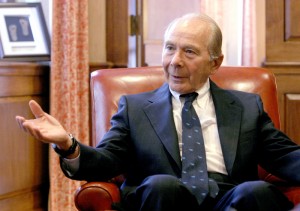

Maurice “Hank” Greenberg said that his partial victory in a lawsuit tied to American International Group Inc.’s bailout isn’t enough, and that he’s seeking financial damages to hold the government accountable.

“Our Constitution is a sacred document,” the former chief executive officer of AIG said Thursday in an interview. “Without the Constitution, what are we? What’s the future of the country if the government can overstep its bounds?”

Greenberg is appealing a federal court ruling that his Starr International Co. isn’t entitled to compensation tied to the 2008 bailout of AIG. U.S. Court of Claims Judge Thomas Wheeler ruled June 15 that the terms of the rescue were illegally onerous, a victory for Greenberg and Starr’s lead lawyer, David Boies.

Starr, an AIG investor, sued the U.S. in November 2011, claiming the government violated the Constitution by insisting on 80 percent of the insurer’s stock. Greenberg had sought as much as $40 billion in damages for shareholders.

AIG repaid the bailout in 2012, leaving the U.S. with a profit of about $22.7 billion.

“The one who overstepped their bounds got rewarded,” Greenberg said of the government. “The shareholders, who were the victim of that, did not.”

Wheeler ruled that Greenberg shouldn’t get damages because AIG would have probably filed for bankruptcy if not for the rescue, leaving shareholders worse off.

“To suggest that you know what a bankruptcy court would do, and what the outcome would be, is a little puzzling,” Greenberg said. “How do you know now what the bankruptcy court would do? AIG didn’t have a solvency problem. They had about $80 billion of net worth at the time. That’s a lot of net worth.”

Collateral Damage

AIG was unable at the time of its rescue to meet its obligations to banks on derivatives tied to subprime mortgages. Had the insurer been in bankruptcy, it could have resisted demands from counterparties on the contracts, especially since banks had sold AIG securities that were deceptively pitched as safe investments, he said.

“So why would we respond to a collateral call?” he asked.

The class action suit was for about 275,000 AIG shareholders, with Starr entitled to about 10 percent to 12 percent of the funds in an award, according to Greenberg. That’s about the size of the AIG stake that he controlled before the bailout, which swelled to $182.3 billion.

Greenberg said he’s seeking to recover legal fees and that proceeds from a victory would be used for charitable purposes and investments by Starr International.

–With assistance from Selina Wang in New York.

Was this article valuable?

Here are more articles you may enjoy.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears