Insurers are not keeping up with rising customer expectations and will need to offer more innovative products and ally with some nontraditional partners to catch up and to keep more digital-savvy firms from stealing their business, a report from consulting firm Accenture says.

According to the report, carriers face a stark choice: embrace a holistic digital business strategy with a customer (as opposed to product) focus; move out of distribution to focus on a manufacturing role; or stay as they are. The last of these is the least likely to succeed, while the first is a route to the agility required to compete, Accenture advises.

The Accenture Strategy report, “Capturing the Insurance Customer of Tomorrow,” found that less than one-third (29 percent) of insurance customers are satisfied with their current providers. At the same time, the number of customers who believe that most insurance carriers are the same in terms of their products and services jumped 50 percent in the last year, to 21 percent in this year’s survey from 14 percent in a similar survey last year.

Furthermore, less than one in six customers (16 percent) said they would definitely buy more products from their current insurance provider. In addition, only one in four (27 percent) has a high estimation of their insurance providers’ trustworthiness, and nearly one in four (23 percent) said they would consider buying insurance from online service providers, including technology giants.

“Today’s insurance customer is more empowered, more social and has higher expectations of his/her providers,” said John Cusano, senior managing director of Accenture’s global Insurance practice.

Cusano said the study data indicates that insurers are not keeping up with rising customer expectations, which is leading to increased customer dissatisfaction and the so-called “switching economy.”

The report says that the “big question” is: who will be the winners in the switching economy? The authors’ answer: “As digital technologies continue to evolve, the companies that are most successful at exploiting them are likely to have the advantage.”

Nearly half (47 percent) of the survey respondents said they want more online interactions with their insurers. In the past six months, half (49 percent) of P/C consumers purchased a policy online, with two in five (41 percent) using a mobile phone to make the purchase.

The percentages are even higher for customers in emerging markets, with 57 percent of P/C consumers there purchasing a policy online, and more than two-thirds (69 percent) of those using a mobile phone to make that purchase.

While many consumers globally are using online tools to purchase insurance products, only 15 percent said they are satisfied with their insurers’ digital experience.

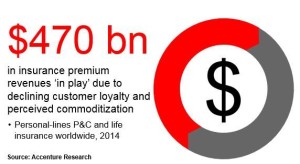

The declining customer loyalty and the perceptions that all insurers are the same mean that as much as $470 billion in property/casualty and life insurance premiums are up for grabs, the report says.

“Leading insurers realize the need to offer a broader range of innovative products and services and create a differentiated customer experience, which will likely require partnering with non-traditional players,” added Jean-Francois Gasc, managing director, Insurance, Accenture Strategy, Europe, Africa and Latin America. These non-traditional partners are most likely outside of the insurance sector, the authors say.

The goal is for the insurer to be part of– either in a lead or supporting role– a digital “ecosystem” that gives customers a broader selection of products and services including adjacent non-insurance products. The report cites examples of State Farm offering smart home risk management services and AXA in Europe offering free ridesharing coverage to its customers who are members of BlaBlaCar.

The report is based on Accenture’s Global Consumer Pulse Research, which included more than 13,000 P/C and life insurance customers in 33 countries.

Topics Trends InsurTech Carriers Tech Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

Preparing for an AI Native Future

Preparing for an AI Native Future  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs