The latest culprit for cooling U.S. inflation: safer driving.

A measure of underlying price pressures watched closely by policy makers continued to moderate in February, missing forecasts, according to data published Tuesday by the Labor Department.

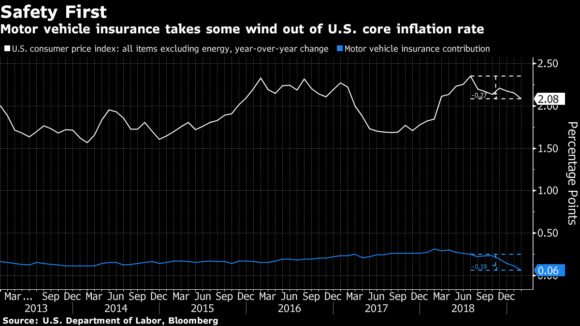

The gauge of consumer prices excluding food and energy rose to a nearly 10-year high in July. But since then, it’s fallen almost three tenths of a percentage point, and a single category accounts for most of the decline: motor vehicle insurance.

The category comprises just 3 percent of the basket of goods and services used to calculate so-called core inflation, but over the last three years, a surge in premiums has given it outsize importance. The pace of motor vehicle insurance inflation slumped to 2 percent in February from a three-decade high of 9.7 percent a year earlier.

That surge in premiums was caused by an uptick in auto accidents in 2015 and 2016, according to Allstate Corp.

“We had to respond pretty aggressively to a spike up in auto accident frequency,” Mario Rizzo, the insurer’s chief financial officer, said at a recent investor conference. “We took prices up, as did a number of our competitors, and others have kind of, may have started a little bit later but are effectively through that cycle now.”

Topics Auto

Was this article valuable?

Here are more articles you may enjoy.

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Viewpoint: How P/C Carriers Can Win the Next Decade With Tech + Talent

Viewpoint: How P/C Carriers Can Win the Next Decade With Tech + Talent  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup