The coronavirus pandemic has led to a greater emphasis on employee benefits that help people plan for unexpected life events and provide financial protection, according to a study by The Hartford.

The Hartford’s Future of Benefits Study found that 40% of U.S. workers say they will consider purchasing life insurance during their next open enrollment as a result of COVID-19.

“The pandemic is shining new light on the benefit programs offered to employees through their workplace, revealing features they might have been overlooking,” said Jonathan Bennett, head of Group Benefits at The Hartford. “People are facing challenging circumstances – whether it is the shattering experience of losing a loved one or becoming sick themselves – and are now recognizing the value of financial protection provided by life insurance and other benefit options.”

In particular, the survey uncovered a shift in attitudes among younger workers.

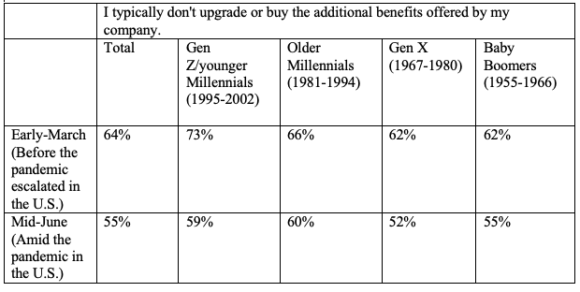

Bennett said the insurer has been conducting research about Millennials’ preferences for many years and has found that the youngest generation typically has the lowest participation rates in company-sponsored benefits so a shift in their thinking is encouraging. This latest study found that employees in their early twenties (generally considered Gen Z and younger Millennials) are now more likely to upgrade or buy additional benefits offered by their company than they were before the pandemic began.

While more workers overall showed interest in upgrading or purchasing additional benefits, the youngest workers indicated the most notable shifts in attitudes.

The study, which polled U.S. workers and human resource benefit decision makers before the COVID-19 outbreak in the U.S. in early March 2020 and again in mid-June, found that employees say they would consider purchasing the following benefits during their next open enrollment because of COVID-19:

- Life insurance: 40%

- Short-term disability insurance: 30%

- Long-term disability insurance: 29%

- Critical illness insurance: 27%

- Hospital indemnity insurance: 23%

The study’s first wave was fielded from Feb. 27 – March 13, 2020, just before the pandemic escalated in the U.S., and included 761 employers and 1,503 employees. The second wave was fielded from June 15 – June 30, 2020 and included 567 employers and 1,038 employees. The employers surveyed were HR human resource professionals who manage/decide employee benefits and employees surveyed were actively employed. The margin of error is employer +/- 4% and employee +/-3% at a 95% confidence level.

Was this article valuable?

Here are more articles you may enjoy.

Fla. Regulators’ Effort to Remove Insurer Execs May Not Pass Constitutional Muster

Fla. Regulators’ Effort to Remove Insurer Execs May Not Pass Constitutional Muster  ‘Buffett Got it Wrong’ on California Fire Risk: PG&E CEO

‘Buffett Got it Wrong’ on California Fire Risk: PG&E CEO  Growing Progressive Set to Hire 10,000+ in Claims, IT, Other Roles

Growing Progressive Set to Hire 10,000+ in Claims, IT, Other Roles  Aon Completes $13B Acquisition of Middle-Market Broker NFP

Aon Completes $13B Acquisition of Middle-Market Broker NFP