Many in the insurance industry may think of the Federal Home Loan Bank as an agency that facilitates affordable mortgages for homes.

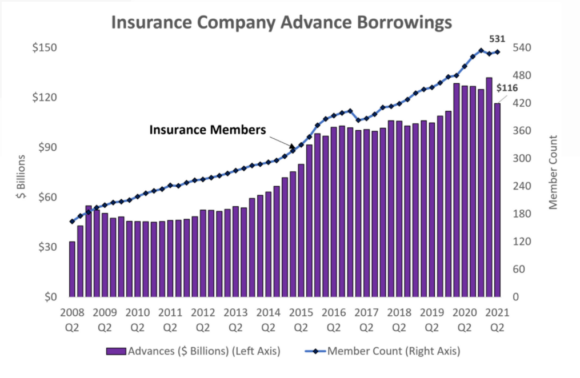

The system, founded in the waning days of the Herbert Hoover administration to support community investment, is that. But it also lends to member insurance companies that may need help with liquidity or can’t find such low rates in the commercial lending market. More than 500 U.S. insurers now participate in the program – more than double the number of just a decade ago, the FHLB has reported.

And, if bills now pending in several state legislatures become law, more insurers are likely to consider becoming members and enjoy even better terms on commercial loans. FHLB officials this year have been quietly going state-to-state, urging lawmakers to approve measures that would guarantee that the Home Loan Banks would have first priority on collateral pledged by insurers.

With that, the FHLB system would no longer have to require that member insurers pay a premium charge on loans, potentially saving the carriers considerable amounts, explained Melissa Dallas, first vice president and corporate counsel for the Home Loan Bank of Cincinnati, one of 11 regional banks in the system.

Kentucky’s House of Representatives last month became the first chamber this year to approve the FHLB-backed bill. Some 21 other states have adopted similar measures in recent years.

“This bill will allow Kentucky-domiciled insurance companies to borrow from the Federal Home Loan Bank on the same terms as Kentucky banks and credit unions do,” Rep. Joe Fischer, R-Fort Thomas, said at a Jan. 19 meeting of the House Banking and Insurance Committee.

Those rates can be as low 1.6% on three-year notes, according to the FHLB.

The nuts and bolts of HB 171 read: “A federal home loan bank shall not be stayed or otherwise prohibited by a court from exercising its rights regarding collateral pledged by an insurer member for more than 10 days following the date a temporary restraining order, preliminary injunction, or permanent injunction is issued by the court…”

A FHL bank must take action on collateral within seven days of receiving a redemption request from an insurer, and may repurchase any of the insurer’s outstanding capital in excess of the amount the insurer must hold as a minimum investment. In cases of receivership, the bank should establish procedures for the release of collateral, and shall provide options for restructuring the loan, the bill notes.

At the committee meeting, Kentucky Rep. Susan Westrom, D-Lexington, asked Fischer if the legislation had been recommended by the National Council of Insurance Legislators. He said it had not.

“Well, you’re brilliant, then,” Westrom said.

The full Kentucky House approved the bill by a vote of 89-0 late last month. It now awaits action in the state Senate. Similar measures are pending in at least four other states where lawmakers are now in session, including Florida, New Jersey, New York and Virginia.

The Cincinnati bank vice president said that liquidation is rare among member insurers in the three-state Cincinnati region, which includes Kentucky, Tennessee and Ohio. Florida, though, where a number of property and casualty insurers have gone insolvent in the last two years and several more may soon be in need of low-cost capital, may be one of the states in which the legislation could have a bigger impact.

The Cincinnati bank vice president said that liquidation is rare among member insurers in the three-state Cincinnati region, which includes Kentucky, Tennessee and Ohio. Florida, though, where a number of property and casualty insurers have gone insolvent in the last two years and several more may soon be in need of low-cost capital, may be one of the states in which the legislation could have a bigger impact.

But Florida Senate Bill 1888 and its twin, House Bill 1405, have seen little movement in the 2022 session, which began Jan. 11 and concludes in mid-March.

Only eight Florida-based insurers, all property/casualty carriers, are members of the FHLB system. A lobbyist for one of those companies said the bills were not on the carriers’ radar this year. A spokesman for the Florida Department of Financial Services, which houses the state Office of Insurance Regulation, said only that the department is monitoring the bills.

It’s unclear exactly how the state-level effort to put insurers on equal footing with banks began. Dallas, the Cincinnati vice president, said that a state regulator had pointed out to the FHLB in recent years that banks are federally regulated and backed, at least to some degree, which automatically gives the Home Loan Banks first priority on collateral when banks run into trouble.

But insurers are mostly regulated by states, so the FHLB, governed by Federal Housing Finance Agency (FHFA), hit upon the state-by-state approach to remedy the discrepancy.

The push likely has something to do with the federal law that governs the Home Loan Banks, explained Cornelius Hurley, an adjunct law professor at Boston University and a former director of the FHLB’s New England regional bank. The law prohibits discrimination against members, but allows discretion based on the credit worthiness and collateral that is pledged.

Hurley noted that the move to lobby legislatures raises questions, however, about whether states have the authority to pass laws that regulate a federal system. And he wondered why the FHLB itself had not publicized the effort. No mention of the state bills can be found on the FHLB website and a spokeswoman said no information had been published about the bills.

Hurley argued that, really, the Kentucky-type legislation should be only a starting point for the FHLB, which now is at a critical juncture in its history. He said that the FHLB has lost relevance and borrowers have turned to commercial lenders during the recent era of ultra-low interest rates, and that the system has been hamstrung by allowing only mortgages or mortgage-backed securities as collateral.

While the number of insurer members has risen steadily in the last decade, the amount of lending to insurers dropped sharply last year. Lending to insurer members topped $130 billion in 2020 but plunged to $116 billion in 2021, an FHLB report shows.

FHLB should be finding ways to provide credit to more insurers with different types of collateral, Hurley said.

“A lot of insurance companies don’t have mortgage-backed collateral,” Hurley said.

The system also should join the modern age and rapidly open the door to other types of members, including fintech companies and other types of organizations that now make loans and can impact communities. In a recent piece in American Banker magazine, Hurley wrote: “With regard to the system’s mission, why not expand it beyond housing finance to include financing initiatives in the arenas of climate change, infrastructure development and economic equity?”

This new focus on the FHLB and its member insurers could be well-timed: The U.S. Senate is now considering the nomination of Sandra Thompson as President Biden’s pick to head the Federal Housing Finance Agency, overseer of the Home Loan Banks. She has pledged to undertake a number of reforms.

In an open letter to Thompson posted Monday, Hurley and a former chair of the Federal Deposit Insurance Corp. urged her to launch a strategic review of the system and consider repurposing the FHLB “to meet the needs of the modern era.”

Chart: Lending to member insurers by the Federal Home Loan Banks. Source: FHLB

Topics Carriers

Was this article valuable?

Here are more articles you may enjoy.

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Preparing for an AI Native Future

Preparing for an AI Native Future