Hurricane Ian is going to affect commercial and personal property rates “significantly” – not just in Florida, predicted MarketScout.

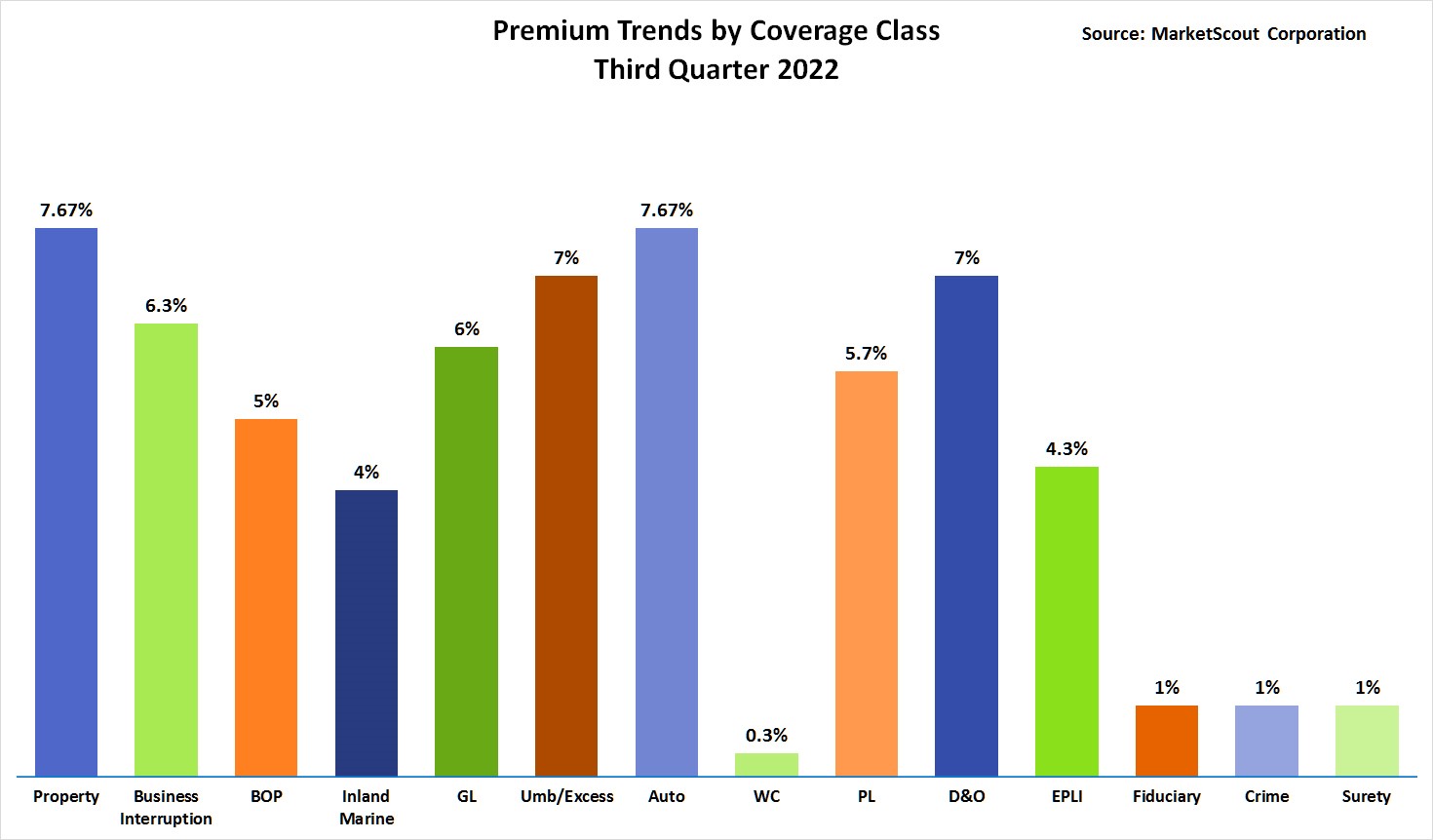

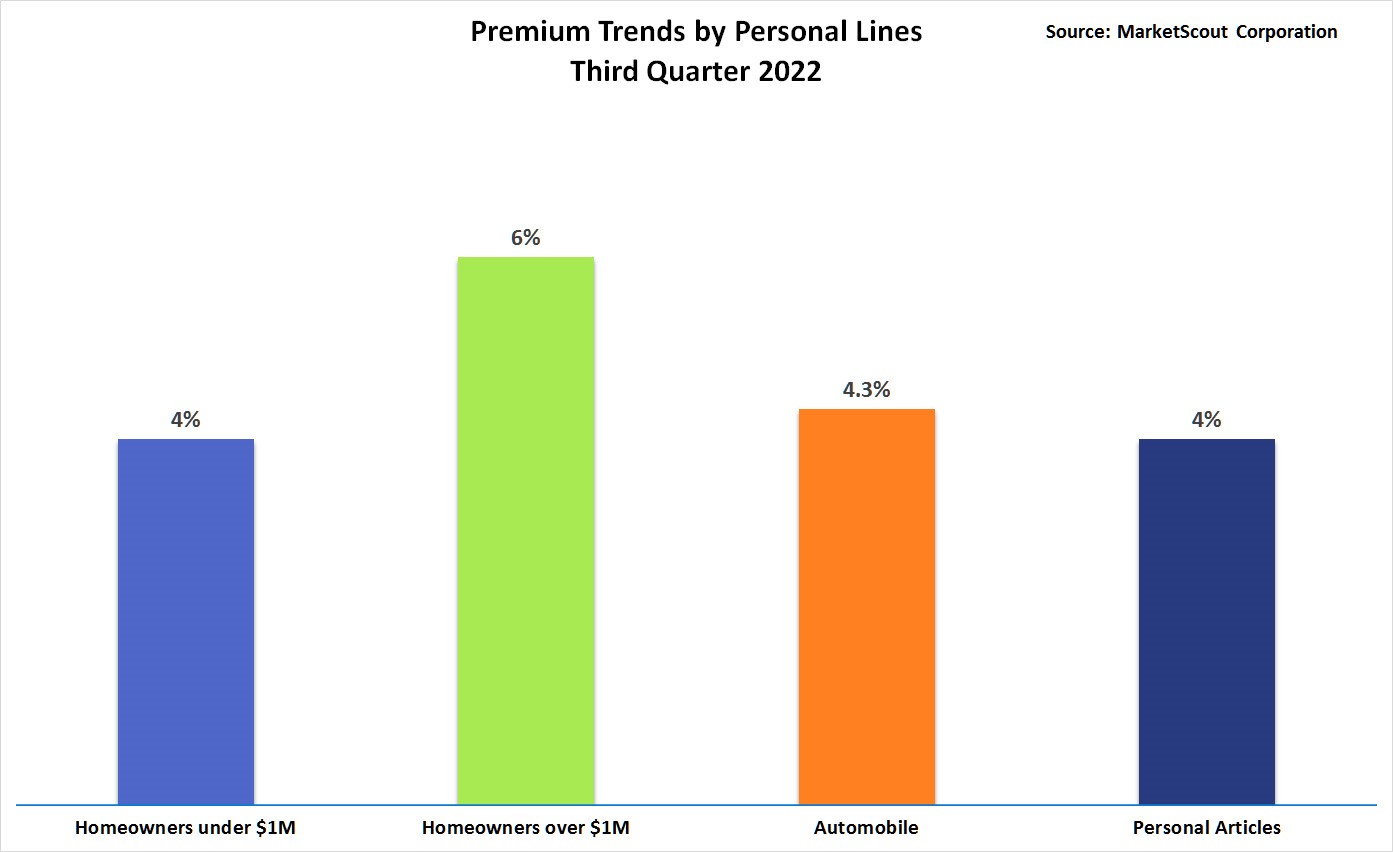

The Dallas-based insurance distribution and underwriting company released its quarterly Market Barometer of rate conditions in personal and commercial insurance lines. Overall, MarketScout reported an uptick of about 5.3% in the commercial market composite rate during the third quarter 2022, and an increase of about 4.6% for personal lines during the same period.

In the second quarter, MarketScout said commercial rates increased just over 5.9%, virtually matching the rate increases of the first quarter.

Q2 Rate Increases Hold Steady: MarketScout

The focus of both reports was Hurricane Ian. MarketScout CEO Richard Kerr said the storm will “be a huge loss for insurers covering properties in Florida.”

“Rates will be up dramatically in Florida for the foreseeable future,” he added in the personal lines Market Barometer. For commercial, Kerr said, “Losses from Hurricane Ian will significantly impact [property] rates in Florida and other wind exposed coastal states.”

Commercial property rates were up nearly 7.7% in Q3. Rates for homeowners insurance in Q3 were up 4% for home under $1 million in value and 6% for home over $1 million. Kerr said high-value homes were already seeing more aggressive in Q3 because they are typically located in catastrophe-prone areas.

Elsewhere in commercial lines, Kerr said MarketScout is seeing a softening in D&O and professional lines, but cyber insurance rates are “still increasing significantly” – up 23% in Q3.

All account sizes are hovering at or around 6% increases for Q3. By industry, transportation saw the highest Q3 increase at 8%.

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions. These surveys help to further corroborate MarketScout’s actual findings, mathematically driven by new and renewal placements across the United States.

Topics Property

Was this article valuable?

Here are more articles you may enjoy.

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows