The recent upticks in the frequency and severity of weather events has also affected insurance premiums for rental properties.

According to S&P Global Ratings, insurance is an increasing percentage of total expenses for rental properties and the trend is expected to persist.

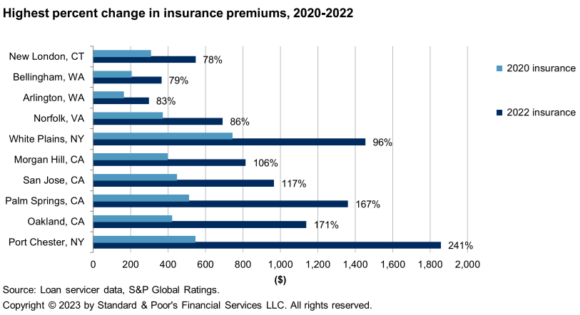

The weighted average for property insurance was about $590.30 in 2022, compared with about $473.60 the year before and about $386.90 in 2020. S&P Global Ratings analyzed 2020-2022 expense trends on 60 loans on U.S. affordable housing properties receiving low-income housing tax credits. The properties contain over 6,500 units.

“We expect property and casualty insurance premiums for commercial properties, including multifamily, will keep rising through 2023,” S&P Global Ratings said. “This is in part due to the material increases in insurance claims resulting from both the greater frequency of weather-related damages and the inflation-affected cost of repairs.”

Properties with the largest increases in insurance expenses are located in the following markets:

Topics Trends

Was this article valuable?

Here are more articles you may enjoy.

Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer