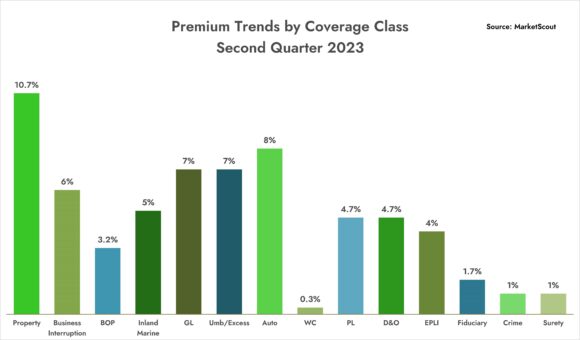

Like the first quarter of 2023, the composite rate for U.S. commercial property/casualty lines increased 5% in the second quarter, according to MarketScout’s Market Barometer.

The Dallas-based distribution and underwriting company, a division of Novatae, said most lines of coverage softened a bit but rates for commercial property, business interruption, general liability, and umbrella/excess increased. Commercial property was up 10.7%. The line was up 9.3% in the first quarter.

General liability rates were up 7% after softening somewhat in Q1, up 4.3%.

Cyber liability was up 13.3% in Q2 2023. The line saw rates increase 15.7% in Q1.

By industry class, transportation continued to lead with rate increases of 7.3%. Habitational was not far behind with rates up 7%.

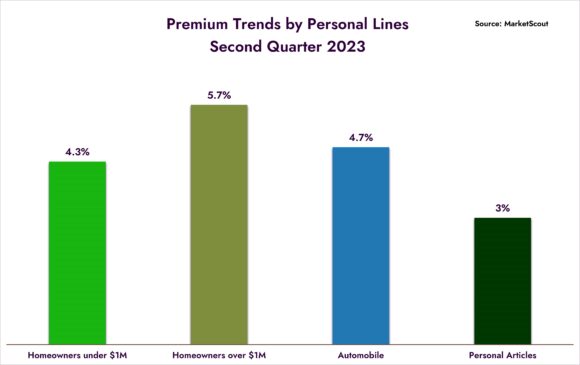

Meanwhile, the Market Barometer for personal lines revealed a slight decrease from a 5% increase in Q1 to 4.4% in Q2.

As he warned in the first quarter report, MarketScout and Navatae CEO Richard Kerr, said, “The real challenge will be to get through wind and wildfire seasons without catastrophic losses. We must all wait to see how things fare over the next four or five months.”

Topics Trends Commercial Lines Pricing Trends Liability Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

Insurers Begin Restricting Privacy Coverage in Response to Evolving Risk

Insurers Begin Restricting Privacy Coverage in Response to Evolving Risk  Buffett’s Berkshire Cash Hits $382 Billion, Earnings Soar

Buffett’s Berkshire Cash Hits $382 Billion, Earnings Soar  Florida Appeals Court Reverses $200M Jury Verdict in Maya Kowalski Case

Florida Appeals Court Reverses $200M Jury Verdict in Maya Kowalski Case  UBS Warns of Systemic Risk From Weak US Insurance Regulation

UBS Warns of Systemic Risk From Weak US Insurance Regulation