Small businesses across the U.S. are increasingly satisfied with the products and services they receive from their commercial insurance providers.

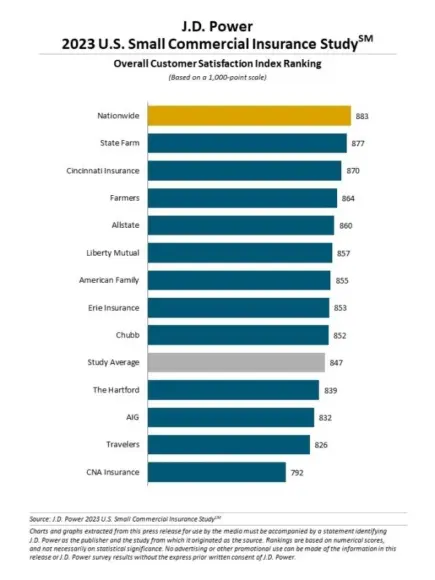

According to the 11th annual JD Power 2023 U.S. Small Commercial Insurance Study, overall customer satisfaction has reached an all-time high of 847 (on a 1,000-point scale) as customers note significant year-over-year improvement in three of five factors evaluated in the study. That figure is up 5 points from 2022 and 70 points from a decade ago.

“Contrary to what we’ve seen in personal lines insurance, small business customer satisfaction keeps rising even as premiums have continued to climb,” said Stephen Crewdson, senior director of global insurance intelligence at JD Power.

The study surveyed 2,472 small commercial insurance customers with 50 or fewer employees. Overall satisfaction comprises five factors: billing and payment; claims; interaction; policy offerings and price. The study was fielded from March through June 2023.

“While the overall satisfaction numbers are high, there are some important variations based on the size of the small business,” Crewdson said. “The trend is really being driven by businesses in the ranges of five to 10 employees and 11 to 50 employees, as opposed to the micro-businesses with fewer than five employees. That variation should inform more targeted small business strategies on the part of insurers.”

Nationwide ranks highest in overall customer satisfaction with a score of 883. State Farm (877) ranks second and Cincinnati Insurance (870) ranks third.

Other takeaways from the 2023 study include:

- Smallest small businesses feel less satisfied: Although overall customer satisfaction improves across all categories of businesses evaluated in the study, the micro category—which consists of businesses with fewer than five employees—has a lower overall satisfaction score (823) than medium-size (855) and larger (857) small businesses.

- Small businesses like proactive communication: When insurers proactively discuss price changes with small business customers and work with them to find ways to minimize that increase, overall customer satisfaction improves. Among the 36% of customers who made changes to their coverage to reduce a price increase, satisfaction with the price of their policy increased by 84 points. And of the 25% of customers who changed their business practices to reduce risk, price satisfaction rises 135 points.

- Social media plays a proactive role in communicating with small businesses: Small businesses are generally interested in receiving tips for reducing costs, new product information and information on state and federal regulation changes via social media. Overall satisfaction is 88 points higher among micro business customers who follow their insurer on social media than those who do not.

Was this article valuable?

Here are more articles you may enjoy.

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  Preparing for an AI Native Future

Preparing for an AI Native Future  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance