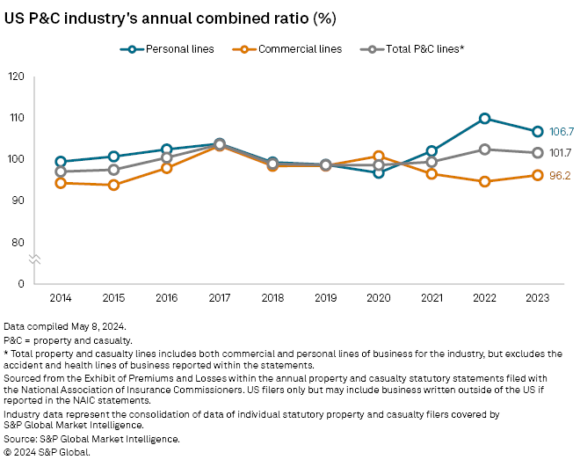

The U.S. property/casualty industry’s net combined ratio improved in 2023 to 101.7 from 102.5 the prior year, according to S&P Global Market Intelligence.

The combined ratio for the industry’s personal business lines came in at 106.7%—about 3.2 points better than the year before. The combined ratio for commercial worsened 1.5 points to a still profitable 96.2.

Looking closer at the industry’s results, there were some concerning trends, according to S&P Global Market Intelligence. For instance, homeowners insurers collectively posted a combined ratio of nearly 110—the worst result in at least a decade. The U.S. had 21 billion-dollar insured loss events due to convective storms, accounting for $58 billion in insured losses.

Meanwhile, auto insurers posted a less-than-desirable combined ratio of 104.9, but the result was about 7 points better than in the historically bad year of 2022.

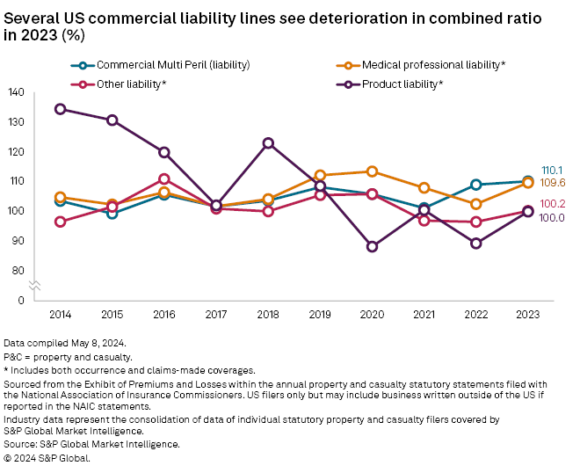

Turning to commercial lines, S&P said four lines of business posted worse combined ratios than in 2022, led by a product liability’s 100 compared to 89.3 in 2022. Commercial multiperil and medical professional liability lines each recorded 2023 combined ratios of about 110.

Topics USA Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears