Most U.S. homeowners don’t know the policy covering their home doesn’t cover flooding, a new survey shows.

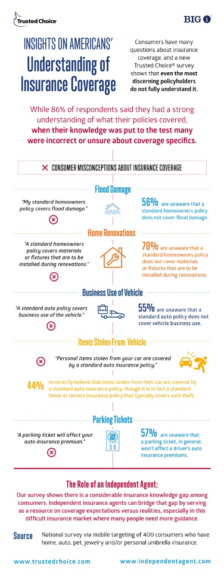

Respondents in a survey out this week from Trusted Choice, a group representing the members of the Independent Insurance Agents & Brokers of America (the Big “I”), also believed that have a strong understanding of what their policies covered. When they were tested on this knowledge, many of them were incorrect or were unsure about their coverage specifics.

Perhaps the biggest findings in the survey out this week shows that 56% of respondents were unaware that flood damage is excluded from a standard homeowners policy.

Perhaps the biggest findings in the survey out this week shows that 56% of respondents were unaware that flood damage is excluded from a standard homeowners policy.

Seven-out-of-10 of those polled were are unaware their policy does not cover materials or fixtures installed during renovations.

Nearly half (46%) didn’t have, or were unsure if they had, a home inventory of major household items to help them file a claim, the survey shows.

Other findings include:

- 44% incorrectly believed that personal items stolen from their car are covered by a standard auto insurance policy.

- 57% were unaware that a parking ticket won’t affect their auto insurance premiums.

- 55% were unaware that a standard auto policy does not cover business use of the vehicle.

The national survey was conducted via mobile devices. It targeted 400 consumers with home, auto, pet, jewelry and/or personal umbrella insurance.

Topics Trends Flood Homeowners

Was this article valuable?

Here are more articles you may enjoy.

US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs  Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’