The average rate increase for U.S. personal lines coverages was about 7.6% in the second quarter, up from about 4.8% for the first three months of the year, according to MarketScout.

Dallas-based MarketScout, a division of Novatae Risk Group, said rates for home valued below $1 million were up 8%. Home valued at more than $1 million saw rates up 9% in the second quarter.

Auto rates increased 8.7%, according to the insurance distribution and underwriting company.

“Some homeowners insurers are increasing rates because they feel the exposure reported is less than the replacement cost, thereby resulting in generally higher claims than anticipated. Building materials are more expensive due to inflationary pressures, so claim payments are larger than anticipated,” said Richard Kerr, CEO of Novatae Risk Group. “Auto insurance rates are up because of increased repair costs and higher-than-expected liability claims,” said Kerr.

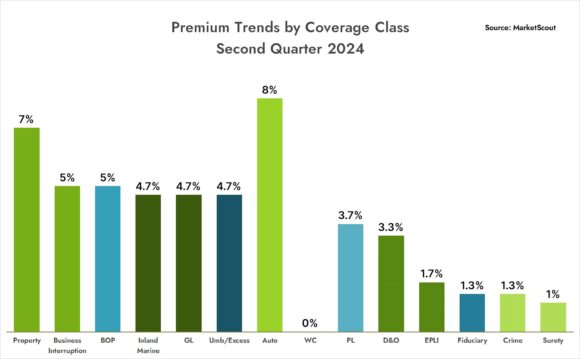

Meanwhile, commercial rates during Q2 2024 were up about 4.4% compared to 3.9% in Q1 2024.

Commercial auto was up 8% and property was up 7%, said MarketScout, based on pricing surveys by the National Alliance for Insurance Education and Research.

Kerr said insurers are “comfortable with their pricing” so there wasn’t much movement in any lines of business.

Topics Trends Pricing Trends

Was this article valuable?

Here are more articles you may enjoy.

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows