Respondents of a recent survey reported lower premium increases for all lines of business except umbrella during the third quarter.

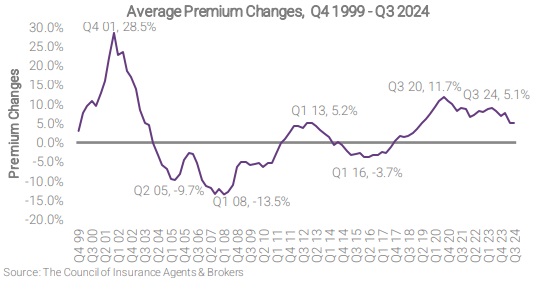

According to The Council of Insurance Agents & Brokers (CIAB) quarterly survey, commercial property/casualty premiums across all account sizes rose by 5.1% in the third quarter—about the same as the second quarter when CIAB said there were signs of softening market conditions.

The third quarter marked the 28th consecutive quarter of premium increases across all account sizes.

Premiums for the umbrella line of business increased by 8.6%, the highest out of all lines, according to CIAB’s Q3 survey results.

Premiums for the umbrella line of business increased by 8.6%, the highest out of all lines, according to CIAB’s Q3 survey results.

“Industry experts agree that social inflation, manifesting in extended litigation and nuclear verdicts, was one of the main drivers behind the umbrella increases,” CIAB said. As a result, survey takers said there has been more scrutiny from carriers on umbrella risks, as well as reduced limits and capacity.

Other than umbrella, all lines had premium increases lower than the previous quarter. Directors & officers premiums dropped nearly 2% — the most among the lines where premiums decreased in Q3.

“Survey respondents pointed to much more competition for the line among carriers, which likely led to downward pressure on premiums,” CIAB commented.

Meanwhile, cyber premiums were down 1.5% and workers compensation fell 1.4%.

Topics Trends Commercial Lines Business Insurance Pricing Trends

Was this article valuable?

Here are more articles you may enjoy.

Georgia Appeals Court Reverses $345M Judgment Against Insurers in School Sex Abuse

Georgia Appeals Court Reverses $345M Judgment Against Insurers in School Sex Abuse  Asia’s Rich Having Second Thoughts on Dubai as War Rages

Asia’s Rich Having Second Thoughts on Dubai as War Rages  Florida House Gives Final Approval to Much-Debated Citizens Clearinghouse Bill

Florida House Gives Final Approval to Much-Debated Citizens Clearinghouse Bill  Georgia Teacher Killed When Toilet Paper Prank by Students Goes Wrong

Georgia Teacher Killed When Toilet Paper Prank by Students Goes Wrong