E&S property insurance market conditions were a recurring talking point on two recent earnings conference calls, but the leaders of specialty insurers offering commentary were not perfectly in lockstep in their assessments of the competitive landscape.

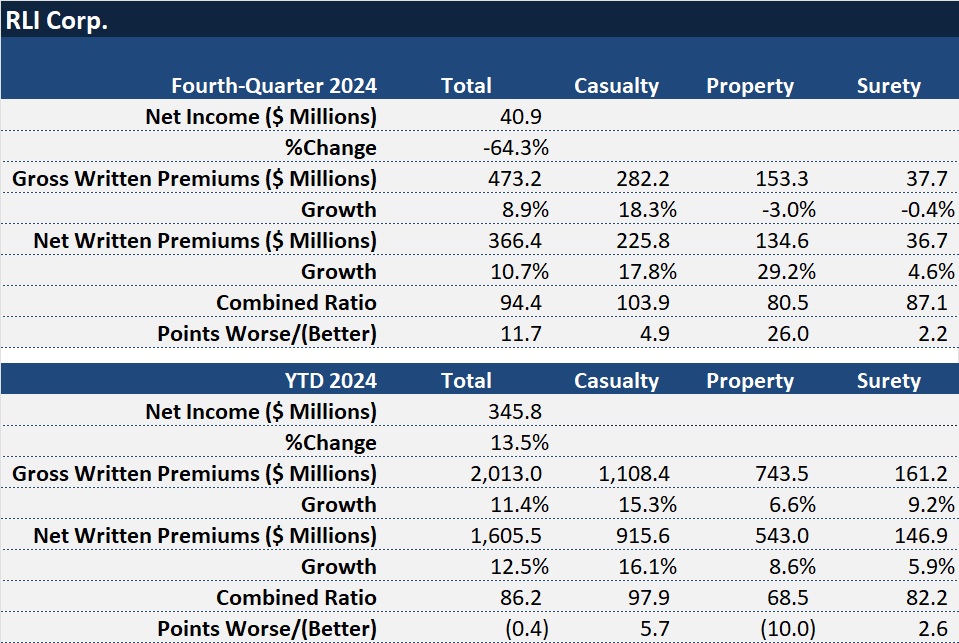

At RLI Corp., property was the only segment of the company for which fourth-quarter premiums dropped. And for the full year, RLI recorded premium growth just under 7% to $0.7 billion on a gross basis—less than half of the 15% jump for casualty (and also below the 9% for surety, it’s third reporting segment).

“We have leaned into the E&S property market for several years, and we knew the day would come when market conditions became more challenging,” said Jen Klobnak, RLI’s chief operating officer, during her prepared remarks on RLI’s earnings call. “Our talented team will continue to find opportunity in all of our property businesses to grow profitably over the long term.”

During the Q&A part of the call, Klobnak explained that E&S property is one of several parts of RLI’s property business, which also includes marine, earthquake and Hawaii homeowners business. “The part that’s most pressured is our E&S property part,” she said.

At RLI, Hawaii homeowners premiums grew 49% in the quarter, with rates up 18%. COO Jen Klobnak views that as an ongoing opportunity for the company as other carriers have exited or pulled back from that market.

“We’re doing battle every day in the trenches where we’re looking at what opportunity is presented to us and how it compares to what used to [be],” she said. She noted that while RLI’s property underwriters try to hold onto renewals, sometimes by giving up some rate, they’re slower to move off terms and conditions. “Those matter in the event of an actual claim, and I think that’s underappreciated by some folks in the industry,” she said.

“We tend to favor keeping our policy forms intact,” she said.

She went on to describe the higher degree of competition that RLI faces on new business, with competitors putting out much larger limits—”eliminating whole layers that were available before.”

Competitors are “back to $50 million of limit when just a couple years ago [they] were putting out $2.5-$5 million.” Now, it “takes a lot less players” to complete a coverage tower. “So, some opportunities are leaving that space.”

She continued: “We want to compete, …but if the pricing is well below what we think we need to achieve a proper return, then we can’t do it. We’re very bottom-line focused there, and our team has the support to look at it in that fashion,” Klobnak stated, summing up her assessment of new business opportunities.

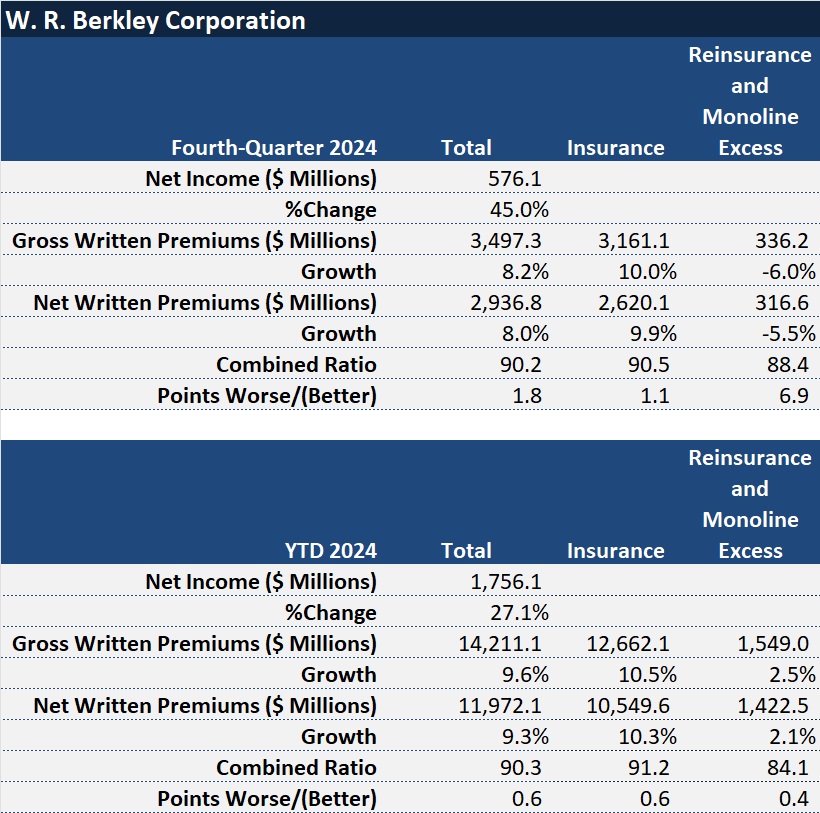

At W.R. Berkley, where overall net insurance premiums of $10.5 billion grew around 10% last year, the property book within the insurance segment grew 16% to $2.3 billion.

President and CEO W. Robert Berkley Jr. isn’t seeing quite the same picture as Klobnak.

“For the moment [in] property insurance, there is still a tailwind, but it is slowing,” Berkley said, drawing a contrast between primary property and the property reinsurance and retro markets where prices are dropping. In reinsurance, “at 1/1, there was no tailwind to be found. In fact, it was quite to the contrary. There was a growing headwind,” he said, offering the example of W.R. Berkley’s property-cat renewal, which cost “15 percent-ish” less this year.

RLI Chief Executive Officer Craig Kliethermes elaborated on the primary insurance pricing situation in the E&S property space. “Our underwriters have benchmark pricing available to them as they price every account… Even though the market generally is still above that benchmark, it’s dropping relatively fast—faster on some accounts than others. But we don’t tend to lose business by 10 or 15%.”

“The underwriters [are] walking away from business when someone is undercutting the price by 30 or 40%.”

“Our underwriters are not willing to go there. They’re constantly evaluating the tradeoff between margins and growth in underwriting profit dollars… That’s how they’re compensated at the end of the day anyway,” he said.

“I can tell you very rarely have we ever seen that that tradeoff works—that you can trade margin and you can write a lot more business. Usually you’re losing business by much more than the 5 or 10% that causes your margin just to slip a little bit. The amounts that we would hear back from our underwriters is you’ve got to cut rates 25 to 40% to start really growing again. And then you get below benchmark pricing… It doesn’t make a lot of sense,” Kliethermes said.

Klobnak noted that RLI’s property segment premium was down 3 percent in the fourth quarter “after 28 straight quarters of top-line growth,” pointing to “undisciplined competitors” in the E&S property space who are impacting market conditions. “MGAs, in particular, are increasing limits offers, reducing rates and deductibles, and starting to erode other terms and conditions. History has shown that rapidly backtracking on term and conditions does not turn out well, and generally results in capital withdrawing their support,” she said.

Klobnak also reported that higher submission flow, up 13% in the fourth quarter, marked three straight years of double-digit submission increases at RLI.

During the W.R. Berkley call, analysts asked CEO Berkley directly to address the commentary on the RLI call, referring to RLI as a smaller specialty company that flagged the behavior of MGAs and the Lloyd’s market. “How is price adequacy in property within the insurance business? Is that still a place that you can grow [with] your targeted profitability?” the analyst asked.

“We think that there is still an opportunity, generally speaking, in property,” Berkley stated. “That having been said, it’s reasonably evident that there is a bit more competition today than there was yesterday in certain pockets,” he said. “We’ll have to see what the impact is of the California fires, whether that changes the appetite of some,” he added. “But yes, as I tried to articulate earlier, I think for property insurance, there is still a tailwind but it is clearly diminished from what it was yesterday. It has not become a headwind [and isn’t] eroding to the extent that the reinsurance market has on the property front,” he said.

(Editor’s note: Berkley was asked specifically about pricing adequacy for commercial E&S property, and not the erosion in terms and conditions that the RLI executives spoke about.)

Early last year, during fourth-quarter 2023 conference calls, Berkley and RLI expressed similar views of the E&S commercial property market.

Klobnak said RLI still continues to lean into areas of opportunity in the property market—and noted that while she expects rate decreases to continue in the competitive catastrophe space, in the wake of the January 2025 wildfires in Southern California, there could be some uptick in demand for coverage of other non-wildfire catastrophe perils. RLI writes hurricane and earthquake coverage.

“Sometimes those perils seem to bleed over into why people want to buy or what they think, and then sometimes it seems like they don’t. It’s very hard to predict” human behavior, she said.

“From a non-cat perspective, we have seen more opportunities from different regions where people have pulled back from tornado and other types of activity,” she said, noting that RLI has grown in those area and achieved rate increases for the business.

“Even in Florida, for example, writing non-wind, or having a sublimit for wind and writing some fire there, can be very attractive depending on construction and different aspects of that location,” she said, concluding that “the opportunity, away from cat business, will remain healthy.”

While the two specialty companies recorded different growth trajectories for the property segment overall, both reported double-digit jumps in net income and underwriting profits across their entire books that broke records.

For RLI, the record was an unbroken streak of underwriting profit, with the 86.2 combined ratio marking the 29th consecutive year of underwriting profit for company.

At W.R. Berkley, full-year underwriting income for 2024 was $1.1 billion—a record for the company, translating to a combined ratio of 90.3. Underwriting and investment results together resulted in a $1.8 billion in net income—a 27 percent jump from 2023 bottom—yielding a return on equity of roughly 24 percent, according to CFO Rich Baio.

Topics Excess Surplus Property

Was this article valuable?

Here are more articles you may enjoy.

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs