The U.S. surplus lines market notched double-digit year-over-year (YoY) premium growth from 2018-2023, as wholesale brokers tapped this market with greater frequency to explore coverage solutions for businesses amid expanding risks.

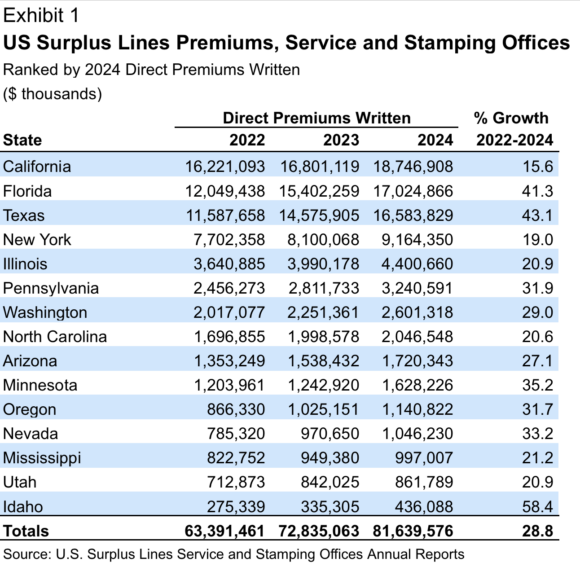

The magnitude of the YoY growth peaked at 30% in 2021, based on data compiled by AM Best. The U.S. surplus lines and stamping offices detailed the continuation of premium momentum, highlighting a 12.1% YoY premium increase in 2024 for surplus lines’ insurers reporting data to the 15 individual state service and stamping offices nationwide. Across the last full three years from 2022-2024, premiums produced by the service and stamping offices increased by 28.8%.

Several segments have been key in contributing to the growth in premiums generated by surplus lines—or non-admitted—insurers in the three-year period, including lines directly experiencing turbulence post-COVID from macroeconomic pressures.

Although personal lines coverage, specifically homeowners’ insurance, remains a relatively small part of the overall surplus lines market, increased writings in that segment have contributed to the consistent surplus lines premium growth. Many states, in addition to multiple lines of business, have been key contributors to this momentum.

Largest States Drive Premium Growth

Four states that consistently account for the largest share of U.S. surplus lines direct premium written (DPW) annually—California, Florida, Texas, and New York—also generate the majority of total property/casualty (P/C) insurance direct premium. The first three states referenced each generated over $16 billion in surplus lines premium for the year, with New York lagging behind, comparatively, at $9.1 billion (see Exhibit 1 below). In 2024, these states produced over 75% of total U.S. surplus lines DPW, based on the services and stamping offices data.

Even before the devastating California wildfires at the start of this year, extreme weather in 2023 and 2024, including heavy rains that subsequently yielded mudslides, created unfavorable results for homeowners’ and commercial property insurers offering coverage in the state, significantly affecting underwriting results in those years.

Subsequently, some admitted insurers reassessed their appetite for property business and pushed more of it into the surplus lines market. California’s property insurance market is likely to face more challenges in the near term, and surplus lines’ insurers could be called upon to fill supply gaps as more admitted insurers become increasingly judicious with their market capacity in specific areas of the state. If this occurs, it would be similar to market dynamics in Florida and Louisiana following the impact of elevated weather-related losses earlier this decade.

Troubled Coverage Lines Provide Opportunities

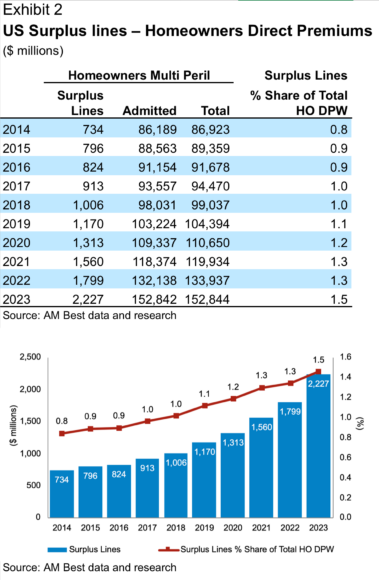

Volatility in the underwriting results for property insurers has led to the higher policy pricing for both commercial and personal lines property businesses. While surplus lines writers have not historically focused much on personal lines business, they generated 1.5% of U.S. homeowners’ DPW in 2023, reaching the highest level during the decade and surpassing the $2 billion mark for the first time (see Exhibit 2 below).

AM Best expects that once 2024 surplus lines data is fully aggregated, it will reveal a continuation of the trend. Surplus lines’ insurers have had the flexibility to meet demand during tough markets, which has led to surplus lines’ homeowners’ premium more than doubling during the last six years, from $1.0 billion in 2018 to $2.2 billion in 2023.

During this time, the P/C industry’s year-over-year homeowners market profitability has exhibited a higher-than-normal level of volatility. Line of business premium data serves as an indicator of the types of business being supplied in the surplus lines market during any given period.

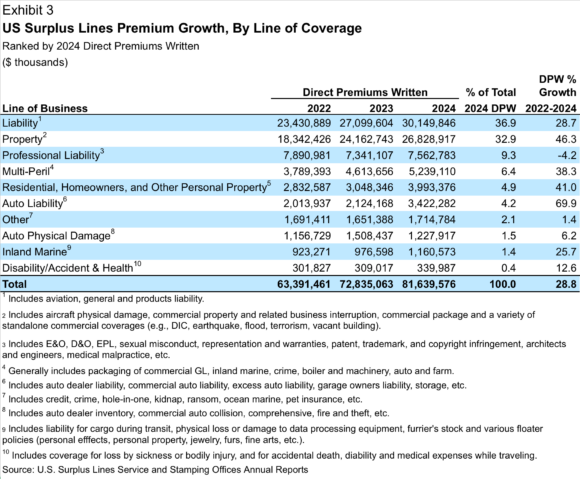

From 2022 through 2024, surplus lines service office data revealed that total surplus lines premium grew by 28.8% (see Exhibit 3 below).

Casualty lines of business include general liability, products liability, umbrella and excess liability coverage. AM Best has found that general liability coverages consistently combined to represent the largest portion of the surplus lines market from a DPW perspective.

Initial data aggregation for 2024 indicates an almost 10 percentage point deterioration in the P/C industry’s net incurred loss ratio for the other liability (occurrence) coverage line, which represents the larger of the two general liability coverage lines. The combination of general liability (36.9%) and commercial property (32.9%) coverage represented almost 70% of surplus lines market premium written through the service and stamping offices over the last three years.

Commercial property included business interruption coverage associated with commercial property policies, in addition to standalone coverages, including but not limited to difference in conditions, earthquake, flood and terrorism. No other coverage accounted for as much as 10% of the surplus lines market. The trend showing increasing premium growth underscores the surplus lines market’s ability to adapt to shifting demands, utilizing its freedom of rate and form to provide coverage for troubled risk classes and lines of coverage when admitted market carriers display reticence to do the same.

Selective Growth in Adversely Trending Lines

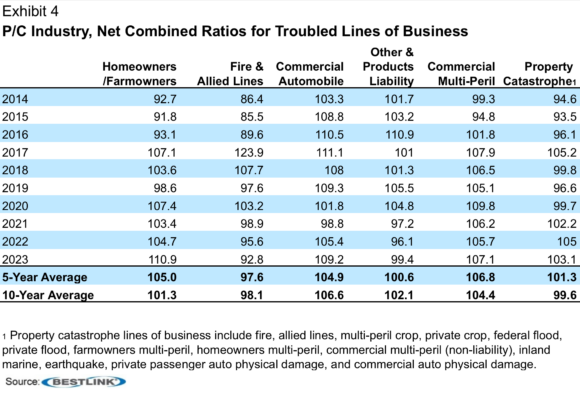

Surplus lines writers have collectively been providing a greater percentage of market coverage for some of the same lines that have generated unfavorable underwriting results for the overall P/C industry during the past decade. For most of these lines, industry underwriting results have been trending poorly and have exhibited notable volatility in recent years (see Exhibit 4 below).

The five-year average net combined ratios for the homeowners, commercial auto, and property catastrophe lines of insurance—which encompasses commercial property, and both homeowners and farmowners multi-peril lines of coverage, among others—all exceeded the breakeven combined ratio of 100. The commercial multi-peril line, which largely reflects coverage written for small- and medium-size commercial enterprises, posted the highest average combined ratio (106.8) during that five-year period and generated a combined ratio almost as high (104.4) over the last 10 years.

During the 2014-2023 period, changing climate-related risks led to more frequent weather-related events, and inflationary pressures on claim costs added to the challenges faced by insurers underwriting property, commercial auto, and general liability lines, which have been robust growth areas for surplus lines’ insurers. Many standard market insurers have reassessed their risk appetite and underwriting strategies for these coverage lines.

Surplus lines’ companies have proven adept at opportunistically selecting the risks they are willing to insure and using their freedom to develop bespoke policy provisions to produce unique products to meet the needs of policyholders.

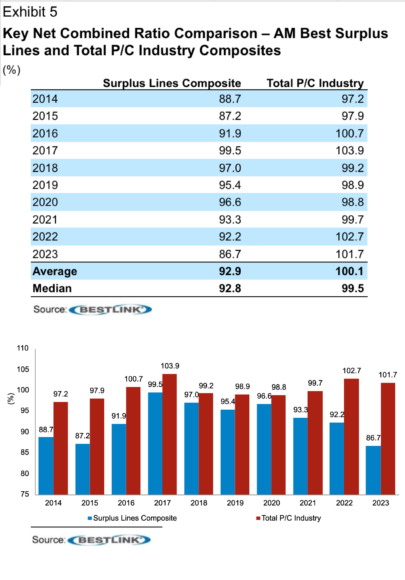

That effectiveness has resulted in surplus lines’ companies, in the aggregate, generating superior underwriting results compared to the results of the total P/C industry looking through the lens of AM Best’s surplus lines composite and its total P/C industry composite (see Exhibit 5 below). AM Best’s surplus lines composite reflects the results of companies for which more than 50% of their business is written on a non-admitted or surplus lines basis.

Developing Innovative Coverage Solutions

The surplus lines segment has successfully pivoted during challenging conditions by adjusting strategies, developing innovative coverage solutions and modifying enterprise risk management principles. These strengths have been vital to the market’s expansion and as carriers adopt practices that generally have led to short-term improvements during difficult periods, while seeking to establish long-term success.

As businesses continue integrating newer technologies such as generative artificial intelligence into daily operations and use new scientific discoveries and tools in their operations that present new risk exposures, AM Best believes the role of surplus lines’ insurers will continue to expand. These insurers will be critically important to insureds in manufacturing, engineering, construction, and other businesses that require nimble coverage solutions to protect their businesses.

Related:

- Increased Writings in Homeowners Adds to US Surplus Lines Growth

- US Excess & Surplus Lines Boost London Market Re/Insurers’ Topline Growth

- As E&S Market Growth Hits New Heights, Some Risk May Be There to Stay: AM Best

Topics Excess Surplus Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  Viewpoint: How P/C Carriers Can Win the Next Decade With Tech + Talent

Viewpoint: How P/C Carriers Can Win the Next Decade With Tech + Talent  Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers