Workers’ compensation remained a healthy and profitable line in 2024 but claims severity grew with an increase of 6% for medical claim severity and 6% for indemnity claim severity.

That’s according to the National Council on Compensation Insurance (NCCI)’s annual 2025 State of the Line report which found that in 2024, U.S. workers’ compensation net premium decreased 3% from 2023, with a combined ratio of 86, the same as in 2023.

Net written premium in the U.S. workers’ compensation insurance market grew by 1% from 2022 to 2023.

This marks the eighth consecutive year that the workers’ comp line held a combined ratio below 90, according NCCI, an organization that provides analysis and recommendations on workers’ comp loss costs and rates in 38 states.

Workers’ compensation had the only premium decrease of all property/casualty lines—driven by decreases in rates that exceeded the pace of payroll growth in 2024.

Related: What’s Next For Workers’ Comp?

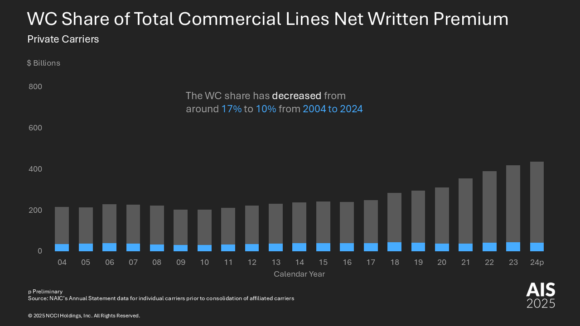

NCCI said that in general, the workers’ comp line makes up a small share of the total net written premium for all commercial lines and continues to shrink in share size. As premiums in other commercial lines have increased over the last 20 years, the workers’ compensation line share has decreased from 17% in 2004 to 10% in 2024.

“The workers’ compensation system continues an era of exceptional performance with strong results and a financially healthy line,” said NCCI Chief Actuary Donna Glenn. “And while there are early indications of potential headwinds on the horizon, the industry is positioned well to navigate these challenges.”

Other key highlights from the report:

- The workers’ comp accident year 2024 combined ratio is 99 with prior years continuing to experience a downward reserved development.

- NCCI estimates a redundant industry reserve position of $16 billion.

- Lost-time claim frequency declined by 5% in 2024, a faster pace of decline than the long-term average decline.

- Severity grew in 2024 with increases of 6% for medical claim severity and 6% for indemnity claim severity.

NCCI said that while overall claims frequency has been in a decades-long decline, there are trends that made 2024 different than years’ past.

The shift to remote work since 2020 has led to a decline in claim frequency among office workers and claims trends remain low for those who have continued to work remotely.

When it comes to the leisure & hospitality industry, claim frequency for restaurants declined in both 2022 and 2023, while frequency for other sub-sectors has remained flat.

The report also noted that despite the pandemic disruption, healthcare claim frequency (excluding COVID-19 claims) generally declined from 2015 to 2023, driven by a nearly 30% reduction in strain-related injuries. But when it came to the private education industry, frequency rose, primarily driven by “struck or injured by” injuries, potentially resulting from workplace violence in the industry.

“While the overall frequency of workers’ compensation claims continues its long-term decline, industry-specific patterns present a varied picture,” Glenn said. “Workers and workplaces are safer today than ever yet understanding the nuances at an industry-level can uncover both opportunities and challenges within the system.”

Was this article valuable?

Here are more articles you may enjoy.

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles