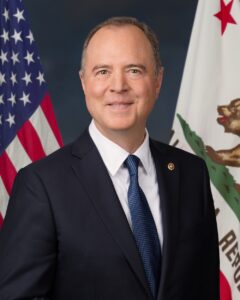

Sen. Adam Schiff recently reintroduced his Incorporating National Support for Unprecedented Risks and Emergencies (INSURE) Act to create a federal catastrophic reinsurance program.

The insurance industry promptly reintroduced their opposition.

“The INSURE Act may sound helpful on paper but would not work in practice,” said Sam Whitfield, senior vice president of federal government relations for the American Property Casualty Insurance Association (APCIA), in a statement. “The INSURE Act shifts insurance risk to the federal government and the American taxpayer without solving the core issues facing insurance markets across the U.S.”

Schiff, D-Calif., said a federal risk reinsurance pool would improve the affordability of insurance. The program would be capitalized by $50 billion in federal funds.

“All across America, in fire zones and flood plains and well beyond, the most valuable property a family may own is becoming uninsurable,” he said. “This must be addressed with urgency.”

The bill would establish the Federal Catastrophe Reinsurance Program to cap the liability of insurance companies above a to-be-determined threshold of loss. The threshold will not be more than 40% of the probably maximum loss of a participating insurer for each peril included in the program.

The federal backstop would require that insurers cover all natural disasters, as well as require investments in loss prevention and risk-mitigation partnerships with policyholders. Finally, the measure would use the Federal Insurance Office and Office of Financial Research in cooperation with state regulators to improve monitoring of the marketplace.

APCIA’s Whitfield said pooling disaster costs “would force Americans in low-risk states to subsidize higher-risk elsewhere, such as hurricanes, floods, tornados and hail in states across the country,” which would lead to higher premiums and federal bailouts.

“Importantly, the bill misses many reasons why insurance prices are rising—like growing demographic shifts, rising property values, inflation in the cost to repair and replace property, legal system abuse, delayed regulatory approval of rate filings, and mandated coverages,” Whitfield said.

The bill was first introduced by Schiff early in 2024. The proposal then was likewise met with criticism by APCIA.

Related: Federal Reinsurance Backstop for Catastrophes: APCIA Says No Thanks

The proposed legislation is co-sponsored by Sen. Mazie Hirono, D-Hawaii. There is also a companion bill in the House from California representatives Sydney Kamlager, Salud Carbajal, and Doris Matsui.

Amy Bach, executive director and co-founder of nonprofit consumer group United Policyholders, said, “We are in the grip of an unprecedented national insurance crisis. The marketplace has changed dramatically for the worse, and the INSURE ACT can be the national solution we need.”

Topics Reinsurance

Was this article valuable?

Here are more articles you may enjoy.

Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates

Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates  CRC Group CEO on Casualty: ‘It’s More About the Coverage’ Than Price

CRC Group CEO on Casualty: ‘It’s More About the Coverage’ Than Price  After Florida Charged People With Selling Insurance Licenses, 12 More Arrested

After Florida Charged People With Selling Insurance Licenses, 12 More Arrested  Miami Developer Indicted in Alleged $85M Fraud Scheme

Miami Developer Indicted in Alleged $85M Fraud Scheme