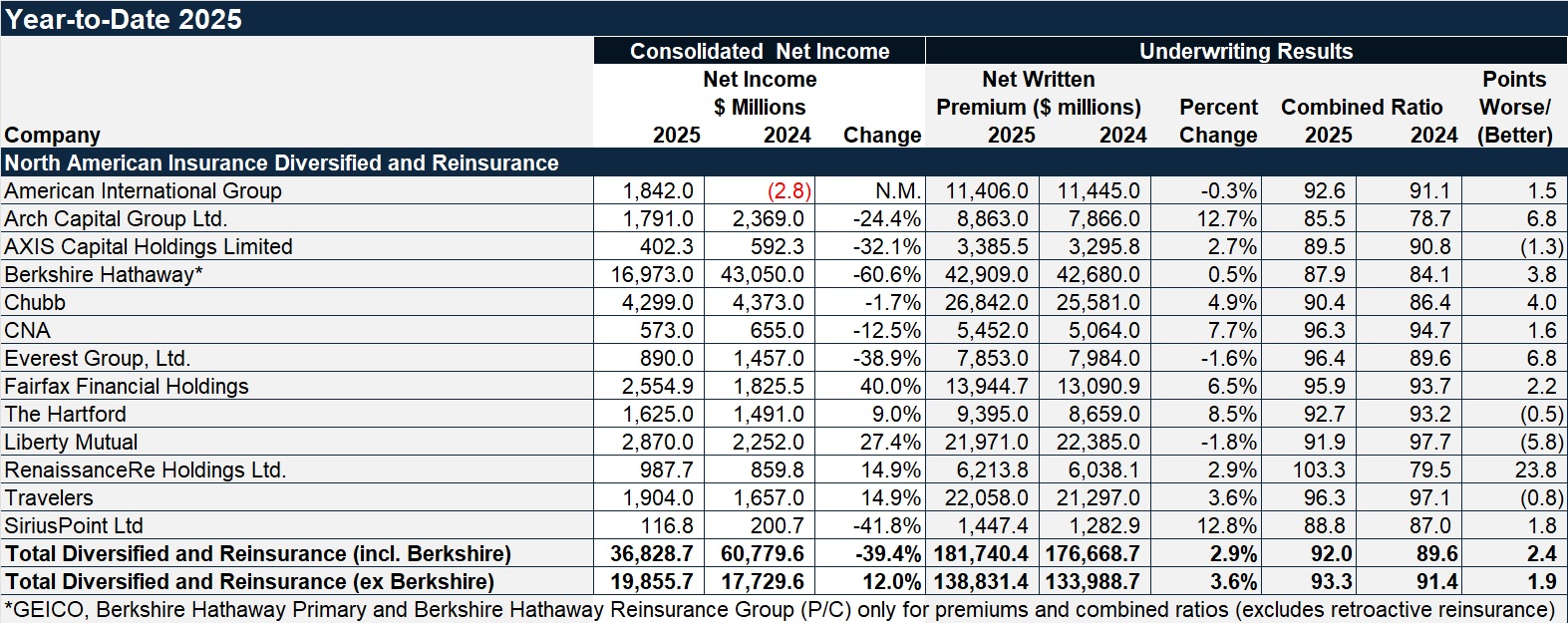

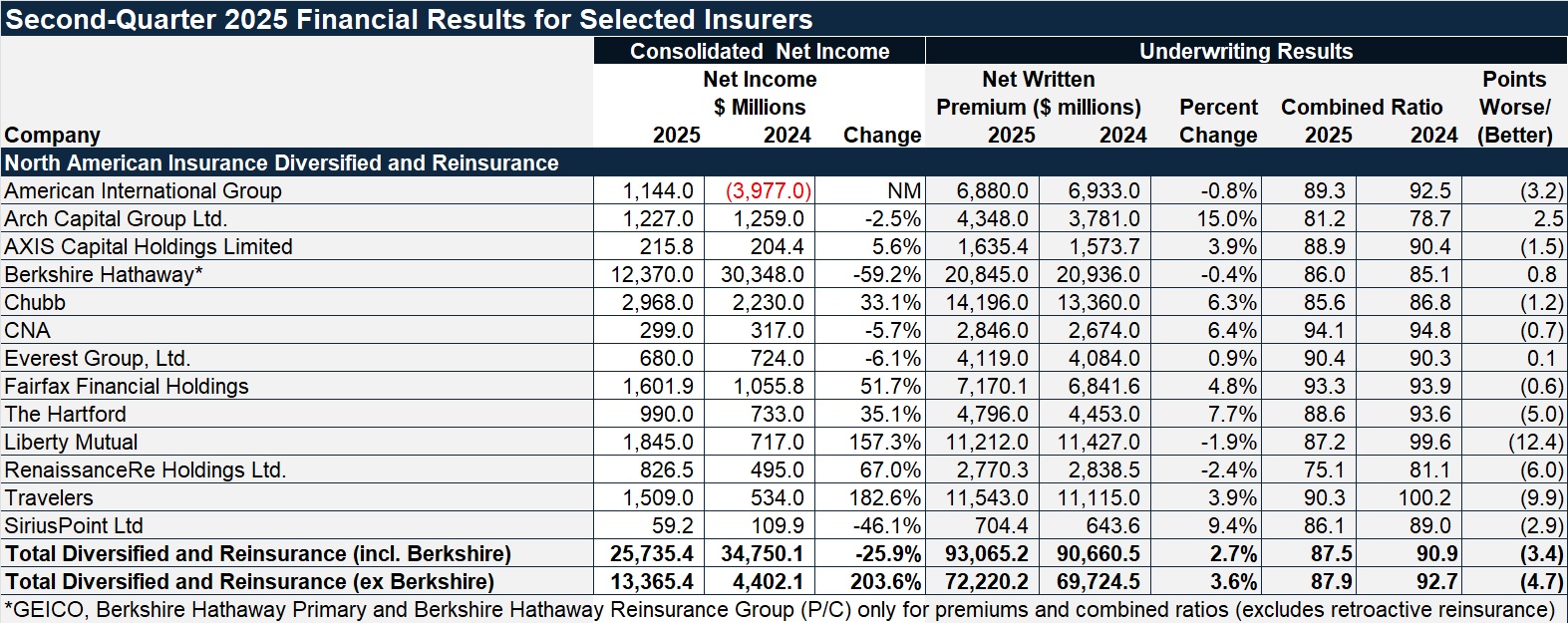

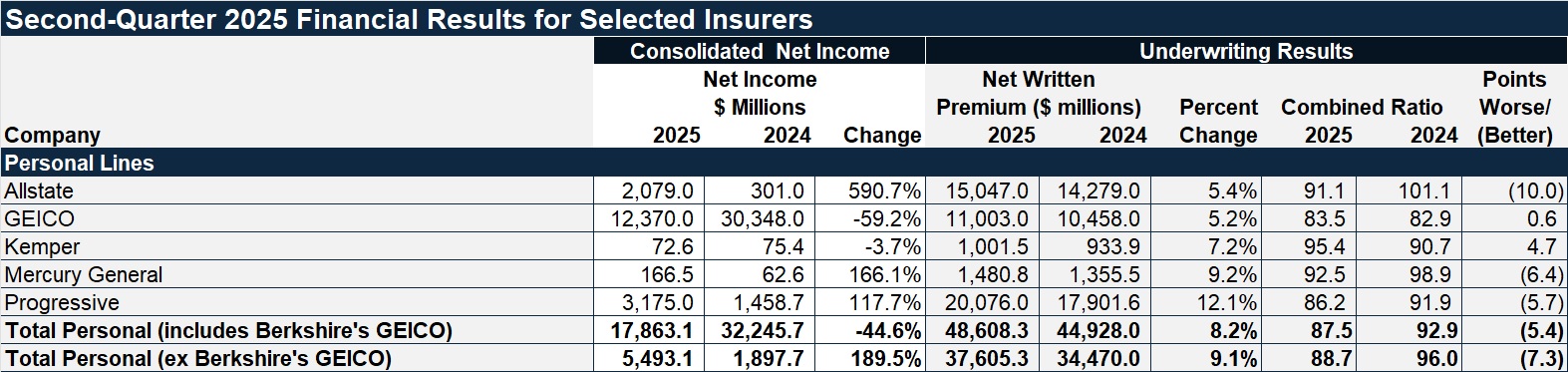

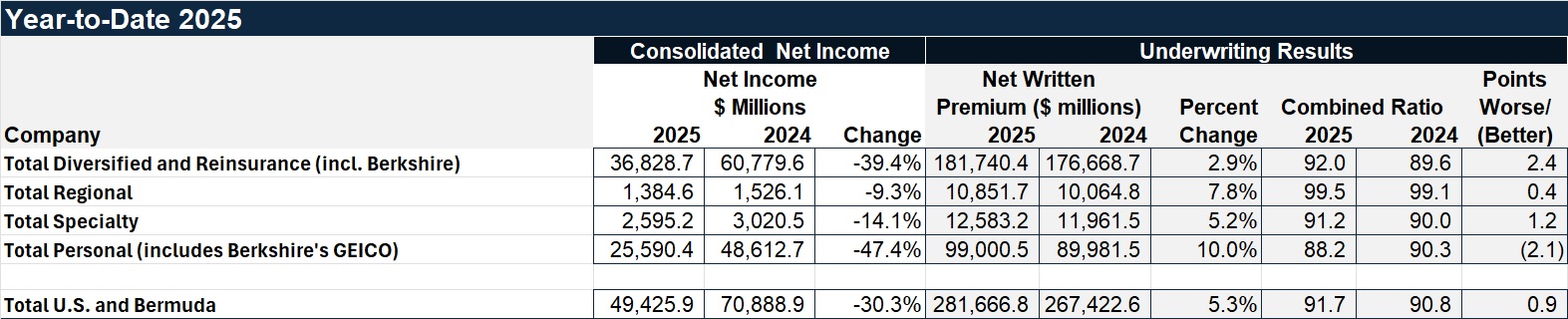

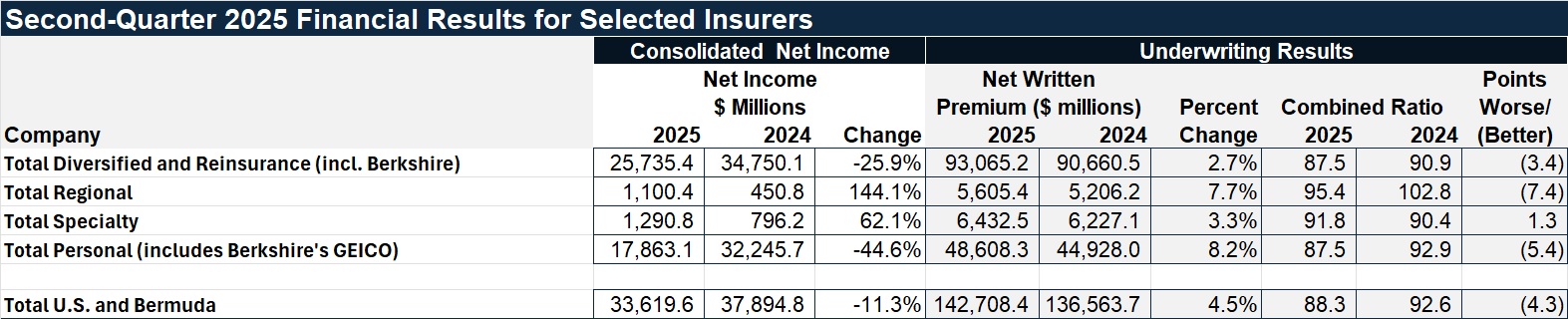

A Carrier Management summary of earnings metrics for the year so far reveals a second-quarter average combined ratio of roughly 88, and a year-to-date ratio of just under 92 for a cohort of 27 insurers.

Among the group, made up of carriers who reported their results publicly via press releases or conference calls, two-thirds had better combined ratios in second-quarter 2025 compared to second-quarter 2024. Year-to-date, only one-third had better combined ratios in 2025.

For both periods, Liberty Mutual’s underwriting results were the most improved among a collection of 13 North American diversified insurers and reinsurers that write nationally or globally—with its overall combined ratio dropping more than 12 points to 87.2 in the quarter and nearly six points to 91.9 for the first half.

This story was first published in Carrier Management, a sister publication of Insurance Journal.

Liberty Mutual saw the biggest combined ratio improvement among national carriers with diversified books of business. Arch Capital recorded the most growth, fueled by its $450 million acquisition of the MidCorp and Entertainment insurance businesses from Allianz Global Corporate & Specialty SE

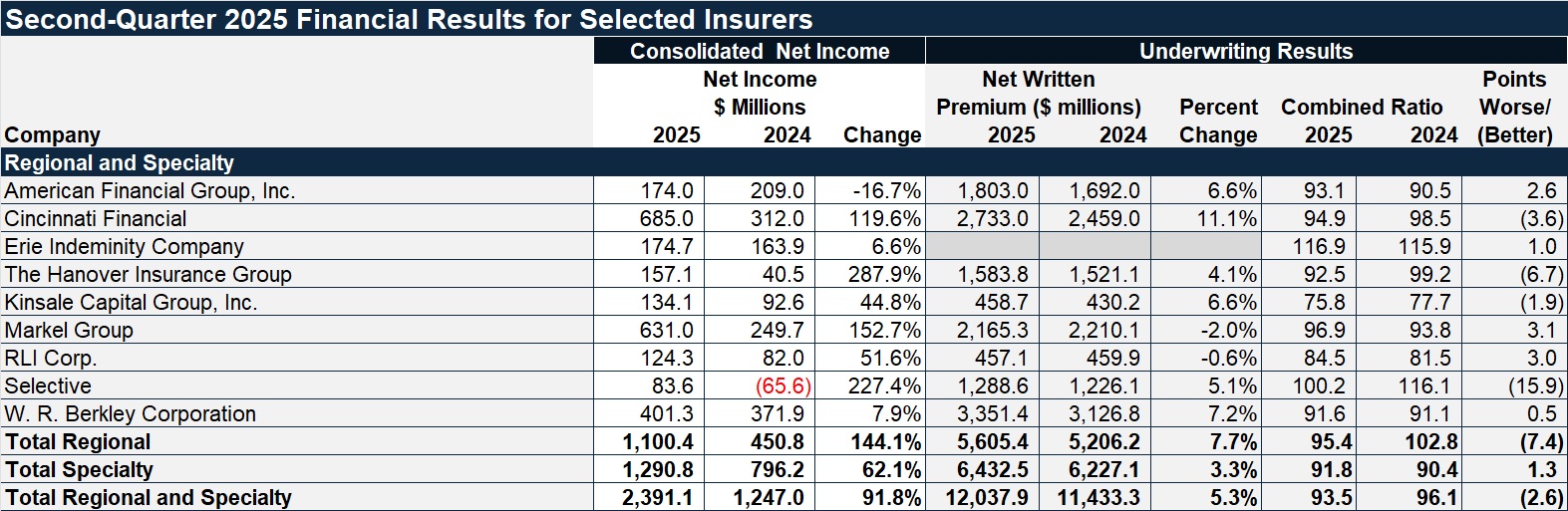

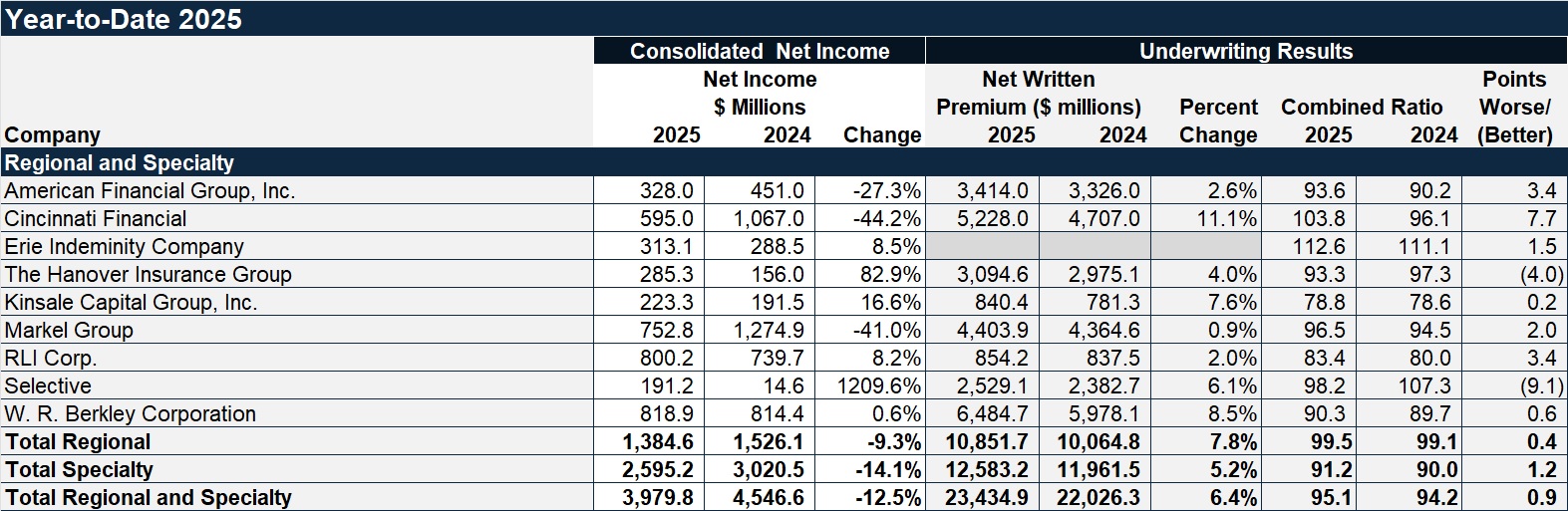

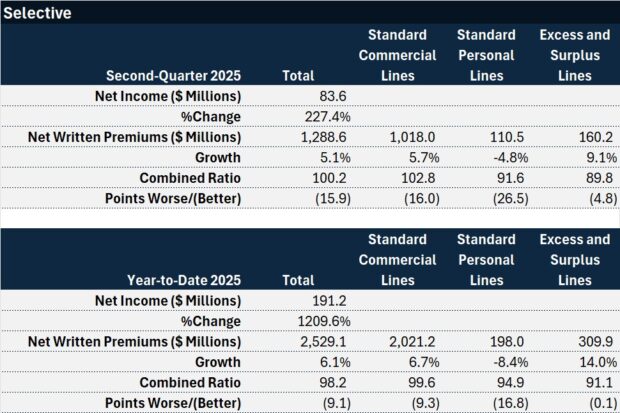

Selective’s combined ratios for both periods were the most improved among nine regional and specialty insurers.

Regionals grew more than specialty carriers in 2025 so far, but their underwriting profit margins were smaller. Specialty carrier Kinsale had the best first-half combined ratio of any of the more than two dozen carriers tracked by Carrier Management.

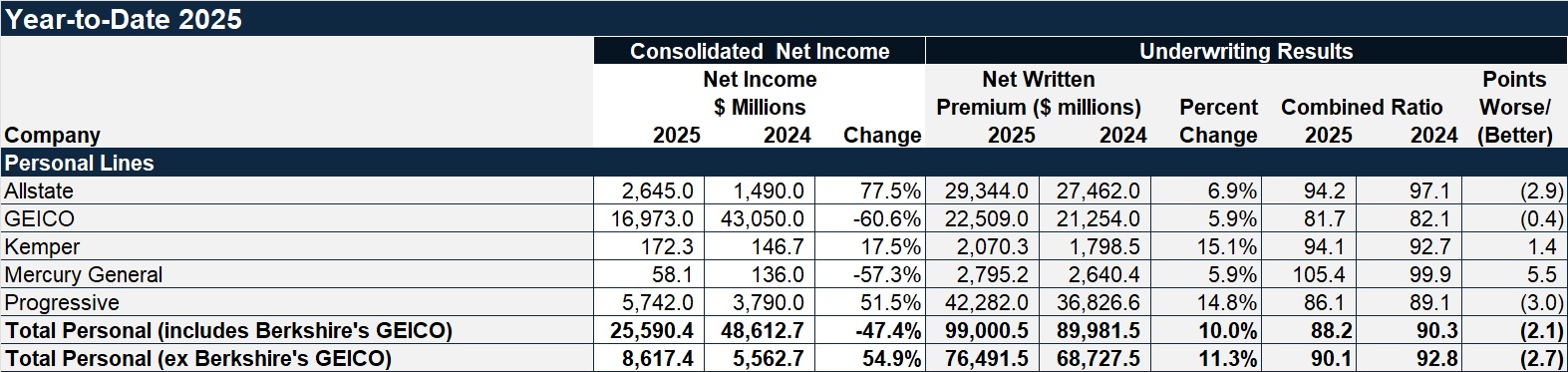

Allstate’s 10-point combined ratio improvement for the second quarter led the pack of personal lines insurers tracked by Carrier Management, while Kemper and Mercury General were the only personal lines insurers that reported higher year-to-date combined ratios in 2025 than 2024.

Personal lines insurers continued to record the biggest premium jumps and most improved combined ratios in 2025 through six months.

Personal lines writers, as a group, reported improved underwriting results through six months, with the year-to-date average combined ratio for five insurers writing predominately personal lines improving by more than 2 points over the first six months of 2024. With the best segment combined ratio for the year so far—roughly 88—personal lines insurers were also the only segment to report double-digit growth in the first half, among those analyzed by Carrier Management.

For carriers writing commercial lines, even the most improved carriers flashed warnings for the industry overall, as executives spoke about results during second-quarter earnings conference calls.

Neeti Bhalla Johnson, president of Global Risk Solutions (GRS), which houses large commercial, specialty and reinsurance businesses at Liberty Mutual, said, “While we’re better positioned than ever to navigate…heightened external complexity and uncertainty, we’re also seeing mounting pressures across the industry. A rapidly softening market in key lines and regions is occurring against the backdrop of persistent legal system abuse, seven consecutive years of $100 billion-plus in global insured cat losses and continued geopolitical and economic uncertainty.”

“No doubt, the industry’s resilience and discipline will be tested,” she said.

Still, Liberty’s GRS grew 5.6% through six months, while its personal lines and small commercial insurance segment, U.S. Retail Markets (USRM), shrank during the first half and second quarter. (“This reduction was driven by strategic rate, underwriting and new business actions executed in prior years,” according to Hamid Talal Mirza, USRM president.)

Referring to pressures on commercial lines insurers, Bhalla Johnson said, “Legal system abuse continues to drive a disproportionate share of these pressures, particularly in U.S. casualty lines. …”

“Across most geographies and lines, pricing increases have continued to decelerate even as loss cost uncertainty remains elevated,” she said, noting that overall pricing was up less than 2.0 percent year-to-date for GRS business (excluding the sharing economy segment).

“We see meaningful softening in property, most notably in U.S. shared and layered market. And in specialty lines, particularly in cyber and D&O, where competition has remained intense,” she said.

She noted that even though auto, umbrella and excess lines demonstrated strong mid-double-digit rate increases throughout the quarter, “excess and umbrella rate in our estimation is not keeping pace with loss trends due to the amplified effects of legal system abuse…”

“In addition to pricing actions, therefore, we are also adjusting our risk appetite. Our growth will be disciplined and focused on places delivering appropriate risk-adjusted returns with decisive measures underway in portfolio segments where returns fall short,” she said.

Noting that Liberty Mutual is “deeply engaged on the topic of legal system abuse,” she said the company is educating clients and partnering closely with broker partners and trade associations “to advocate for meaningful tort reform as long-term change is required.”

Much of the discussion on the earnings conference call for Selective Insurance Group was about the impacts of the litigation environment on U.S. standard casualty business—the bulk of the carrier’s business. John Marchioni, president and chief executive officer, used the term social inflation rather than legal system abuse as he outlined actions the carrier has been taking internally, apart from industry advocacy for tort reform.

One key action—shoring up loss reserves—pulled the carrier’s overall and commercial lines combined ratios for the second quarter above breakeven.

“Contractors is our largest industry segment and has a higher mix of general liability and commercial auto exposure,” he noted at one point—a fact that may explain the heavy social inflation impact on Selective’s results.

Still, reserve additions for prior accident years added just 3.8 points to Selective’s second-quarter 2025 combined ratio, compared to 16.3 points in the comparable period last year.

“We tend to respond early to loss emergence even for relatively immature accident years for longer tail lines,” Marchioni told analysts on the earnings call who worried about continued charges nonetheless.

“Focusing on the more mature 2015 to 2019 accident years, as of year-end 2024, we increased our other liability occurrence ultimate losses by 5.5% from our initial picks compared to an average 14% increase for the industry. In the 2021 to 2023 accident years, we increased our ultimate losses by 13% compared to the industry’s 5%,” he observed, suggesting there may be more to come for the rest of the industry on the more recent accident years.

Beyond that, Marchioni outlined pricing, underwriting and claims management strategies at Selective aimed at addressing the social inflation challenge to casualty insurers.

He said the company’s pricing and underwriting actions include:

- Seeking and achieving overall renewal pure price increases above expected loss trend.

- Tightening underwriting guidelines for select liability exposures, including certain contractors’ coverage offerings.

- Managing limits in challenging jurisdictions.

- Reducing the number of new umbrella lines with a particular focus on reducing limits greater than $5 million.

- Increasing minimum premiums in general liability and umbrella.

- Trimming underperforming classes or risks with emerging exposures.

- Prioritizing new business in better performing segments.

- Diversifying the business mix and geographic footprint with E&S business and business from the personal lines mass affluent market.

On the claims side, he said, “Our adjusters specialize by claim type, size and jurisdiction. For example, we have a limited number of adjusters assigned to Georgia bodily injury or New York labor law cases, to drive greater insight into best practices in analyzing these higher risk claims and defending related litigation.”

Marchioni also talked about increased review of cases going to trial—”boosting the use of second opinions, engaging jury consultants, conducting mock trials, and using roundtables to gain further insights about potential outcomes”—and about efforts to develop models to quickly identify which claimants are likely to seek representation.

“Our focus here is making sure we’re responding appropriately to what we think is an industry-wide societal shift driving social inflation, but also recognizing there are things in our control that we have to have a continuous improvement mindset around, [and] making sure that individual risk selection decisions, individual claim decisions are getting to the right outcome on a regular basis,” he said.

Was this article valuable?

Here are more articles you may enjoy.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup