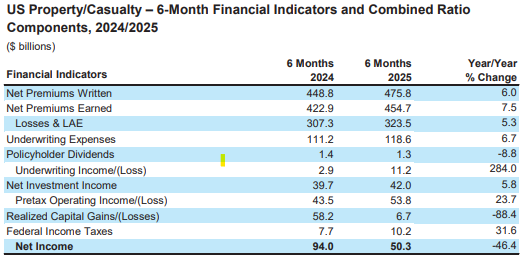

An early look by AM Best at the financial results of the U.S. property/casualty industry revealed insurers recorded an estimated $11.2 billion in net underwriting income in the first half of 2025.

Last year after the first six months, the P/C industry booked $2.9 billion, according to a report from the rating agency.

AM Best added that the P/C industry’s combined ratio improved to 96.4 in first-half 2025 from 97.8 in the same period of 2024. Catastrophe losses accounted for 10.9 points on the six-month 2025 combined ratio, up from an estimated 8.8 points in the previous year.

However, excluding prior-year reserve development of nearly $13 billion, the combined ratio was 99.2, said AM Best.

Growth of 7.5% in net earned premiums in the six-month period offset increases in incurred losses and loss adjustment expenses (LAE), largely attributable to the January wildfires in California, and other underwriting expenses. Plus, an increase in net investment income aided the underwriting gain.

A substantial reduction in net realized capital gains, driven primarily by a $47.5 billion decline at Berkshire Hathaway’s National Indemnity Company, contributed to the industry’s net income being cut nearly in half from the same prior-year period to $50.3 billion.

Topics USA Profit Loss Underwriting AM Best Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’