The nation’s top securities regulator is planning to make it easier for small companies to go public by cutting mandatory disclosures and scaling back requirements based on the size of the firm.

Such a move could increase the initial public offering pipeline and revive the roster of listed companies, Securities and Exchange Commission Chairman Paul Atkins said in prepared remarks for a Tuesday event at the New York Stock Exchange.

The revisions include giving companies an “on-ramp” of at least two years rather than just one to gradually comply with the rules for going public, such as phasing in disclosures and other reports to investors. The agency is also revisiting what counts as a small company to reduce their burden. The last major tweak to the definitions of large and small firms was two decades ago, said Atkins, who has lamented that there are about half as many publicly traded companies than there were three decades ago.

“Our regulatory framework should provide companies in all stages of their growth and from all industries with the opportunity for an IPO,” he said, noting that the costs of complying “may have a disproportionate impact on some companies.”

More Changes

Other planned revisions include executive compensation rules, an issue Atkins had the SEC take up earlier this year through a listening session with pension funds, institutional investors, public companies and other market participants. He also asked the SEC staff to tackle measures “de-politicizing shareholder meetings” to focus on director elections.

The reference is likely a nod to the Trump administration’s opposition to shareholder initiatives focused on environmental, social and governance measures that current officials contend gained too much prominence during the Biden administration. Exxon Mobil Corp., notably, saw some of its board members forced out in 2021 by an activist hedge fund and other investors due to opposition to the energy giant’s climate risk strategy.

Atkins said the agency would move to “reform the litigation landscape” to better shield companies from “frivolous” securities lawsuits.

The SEC has already moved to recalibrate the balance of power between shareholders and boards during Atkins’ tenure. A prominent change in September bolstered companies’ ability to force shareholders into mandatory arbitration.

Atkins said on CNBC that the SEC would begin rolling out the proposals in early 2026 and release a so-called innovation exemption for digital asset firms as soon as January. In a November speech, Atkins said this framework, which is expected to exempt crypto firms from some securities requirements, would try to help digital asset firms raise capital while also ensuring investor protections.

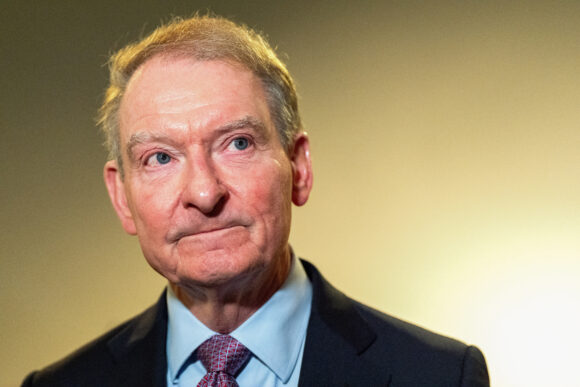

Photo: Paul Atkins/Bloomberg

Was this article valuable?

Here are more articles you may enjoy.

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  Preparing for an AI Native Future

Preparing for an AI Native Future  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’