The U.S. excess and surplus lines market isn’t growing at the rate it has been, with the premium growth through September 2025 lower than the prior year.

According to a new report from insurance industry rating agency AM Best, years of consistent growth in the E&S space continues but “has shown signs of tapering off.”

Premium growth in the E&S market increased by 9.7% through the third quarter of 2025, compared with 13.5% for the same prior year period, thanks to competitive market pressures on certain lines of coverage such as cyber, commercial property, and directors and officers liability.

AM Best said surplus line market premium is expected to flatten over the near term but continue to handle a greater number of risks better suited for E&S.

“These changes have influenced both distribution and product strategies,” said David Blades, associate director, AM Best. “One such example is capacity for catastrophe-exposed property coverage, an area in which surplus lines carriers have been able to offer flexibility and customization for those kinds of risks that no longer fit standard underwriting frameworks.”

Newer market entrants, especially fronting companies, have driven much of the E&S market growth in recent years. However, some of these entities may fall victim to adverse development in accident years 2021 through 2024, where fronting companies have reportedly been concentrated.

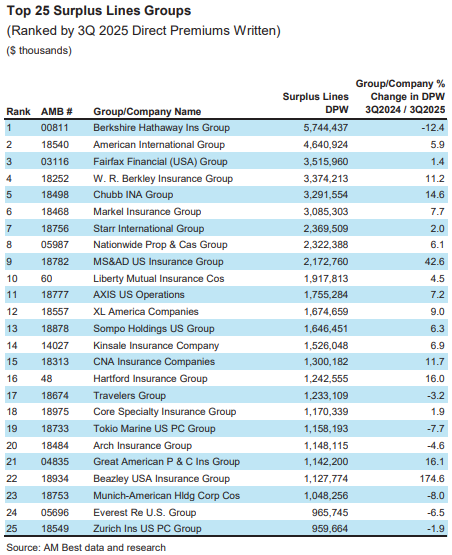

Nine of the top 10 E&S market participants grew direct premiums written, except for Berkshire Hathaway, who decreased DPW by 12.4% in Q3 2025 compared to the same quarter the prior year.

Topics Trends Excess Surplus Pricing Trends

Was this article valuable?

Here are more articles you may enjoy.

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  Preparing for an AI Native Future

Preparing for an AI Native Future