The organization that keeps track of excess and surplus policies sold in Texas says the number of E&S flood insurance policies in place in the state’s coastal counties declined after Hurricane Harvey hit in August 2017.

In the months after Hurricane Harvey made landfall, the number of E&S flood policies in the 60 coastal counties impacted by the hurricane filed with the Surplus Lines Stamping Office of Texas (SLTX) fell, while the number of flood policies for the rest of the state of Texas increased, SLTX said.

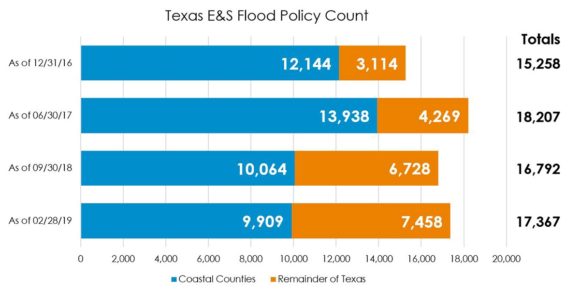

In evaluating policies in force as of June 30, 2017, SLTX found that 76.6% of E&S flood policies were located in the 60 impacted coastal counties included in an ongoing Harvey disaster declaration, with 13,938 of 18,207 total policies filed. About a year after Harvey, for policies in force as of Sept. 30, 2018, 59.9% of flood policies recorded were written in the affected counties, at 10,064 of 16,792 total.

However, while the number of flood policies in the counties included in the disaster declaration decreased between these two dates, the number of flood policies written in the remainder of the state increased over the same time. As of June 30, 2017, 4,269 E&S flood policies were in force for all other counties in Texas, and, as of Sept. 30, 2018, that number increased to 6,728, with another significant increase to 9,909 as of Feb. 28, 2019.

Counties outside of the disaster declaration experienced increases in both new and renewal policies at points in 2016 through 2019, while counties affected by Harvey saw a decrease in the amount of renewal policies in 2018. The number of new E&S policies in these 60 counties declined over this period, which may indicate that more consumers turned to the National Flood Insurance Program (NFIP) to purchase coverage on the coast.

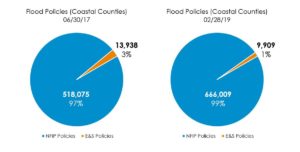

Information compiled by the Texas Department of Insurance (TDI) shows that the number of NFIP policies in the coastal counties impacted by Hurricane Harvey increased by 29% when comparing policies in force on June 30, 2017, and those in force as of Sept. 30, 2018, from 518,075 to 669,355. More than a year after Harvey, as of Feb. 28, 2019, NFIP policy count decreased in these counties to 666,009.

In an editorial published prior to the beginning of the 2019 hurricane season, Texas Insurance Commissioner Kent Sullivan urged consumers to remember historical trends, where flood insurance policies spike following a major catastrophe but decline in the months that follow.

With the passage of HB 1306, a bill that creates a diligent effort exception for surplus lines flood policies, it is possible that Texas will see an increase in private flood insurance policies. As the bill takes effect, SLTX will continue to monitor its impact on the industry and the flood insurance market for the state of Texas.

Source: SLTX

Topics Texas Excess Surplus Flood Hurricane

Was this article valuable?

Here are more articles you may enjoy.

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate