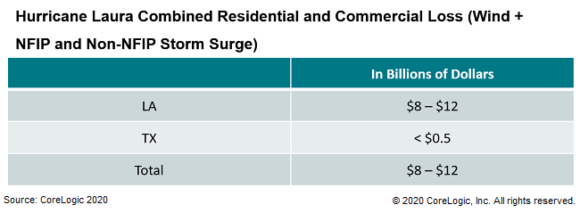

Property information, analytics and data provider, CoreLogic, has estimated residential and commercial insured losses from Hurricane Laura in Louisiana and Texas will come in at between $8 billion and $12 billion.

That estimate includes losses from storm surge and wind, with losses from storm surge contributing less than $0.5 billion to that amount. CoreLogic’s analysis includes losses impacting residential homes and commercial properties, including contents and business interruption, but does not include broader economic loss from the storm.

Category 4 Storm

Packing winds of up to 150 mph, Hurricane Laura made landfall near Cameron, Louisiana, around 1 am on Aug. 27. The storm had quickly intensified from a Cat 1 storm into a Cat 4 throughout the day on Aug. 26 as it progressed at a rapid pace northward through the Gulf of Mexico after having pummeled the Dominican Republic and Haiti, and to a lesser extent, Cuba.

Initial advisories from the National Hurricane Center in advance of Laura’s landfall near the border of Louisiana and Texas had warned of an “unsurvivable” storm surge of up to 20 feet. A storm surge of that intensity did not materialize, however. In an online presentation on Aug. 28 hosted by CoreLogic, experts discussed the possibility that Laura’s high winds and rapid intensification combined to limit storm surge development.

CoreLogic pointed out that center of Hurricane Laura struck more relatively populated area of the Louisiana and Texas coast.

“There is never a good place for a hurricane to make landfall. But this was the best possible outcome because it spared the major population centers of Houston and New Orleans,” said Curtis McDonald, meteorologist and senior product manager of CoreLogic, in a prepared statement.

Hurricane Laura weakened as it moved over land, which kept some metropolitan areas from receiving the full impact of a Category 4 hurricane, CoreLogic said.

Laura quickly downgraded into tropical storm after making landfall, but it left six people dead, buildings destroyed, trees uprooted and hundreds of thousands without power in Louisiana as it swept northward with drenching rains into Arkansas.

Related:

Topics Catastrophe Natural Disasters Texas Profit Loss Louisiana Hurricane State Farm

Was this article valuable?

Here are more articles you may enjoy.

Georgia Insurance Law Is About to Get an Upgrade With Multiple Changes

Georgia Insurance Law Is About to Get an Upgrade With Multiple Changes  Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates

Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates  Travelers Stranded by War Learn Insurance Won’t Cover Flight Cancellations

Travelers Stranded by War Learn Insurance Won’t Cover Flight Cancellations  Lloyd’s Market Engaging With US Government Over Gulf Maritime Plan, Officials Say

Lloyd’s Market Engaging With US Government Over Gulf Maritime Plan, Officials Say