Last month’s sprawling winter storm from Texas to New England was one of the first multi-grid tests in the US for big batteries. They passed.

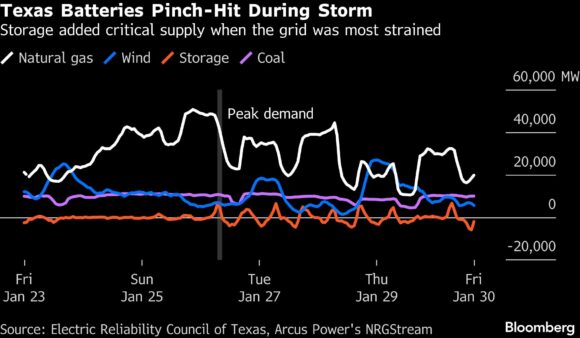

Texas in particular benefited from energy storage, which helped cushion the state’s grid during the storm. Texas has nearly 17 gigawatts of installed battery capacity now, up from less than 0.5 gigawatts in 2021, according to data from Electric Reliability Council of Texas, the state grid operator, and Wood Mackenzie. The state is expected to hit 25 gigawatts in 2029, per an annual assessment released last month by the North American Electric Reliability Corporation.

“The batteries were the savior this time,” said Barbara Clemenhagen, executive director of the Gulf Coast Power Association and energy consultant, adding that they likely could’ve helped Texas avoid the severe blackouts it experienced when a days-long freeze paralyzed the grid in early 2021.

Grid operators are racing to fortify aging grids strained by extreme weather and surging power demand from data centers, new factories and electric cars. The Trump administration is keen to keep old coal-fired plants alive and build new natural gas and nuclear plants. Renewable advocates, meanwhile, say solar farms are cheap and quick to build.

Batteries are also seen as a key tool — they help minimize the intermittency of wind and solar power and can provide short bursts of energy when demand is peaking, especially when gas plants or wind farms are sidelined during intense storms. Batteries are often paired with solar generation and are increasingly being installed next to gas plants, according to battery developer Elevate Renewables. Storage is more common in Texas than New England today.

But even as battery capacity is swelling in Texas, power demand is also soaring, as the state’s population grows and as it attracts data centers and crypto mining. So, the grid may face further tests from extreme temperatures — and batteries, which today usually can store four hours of energy, may only be able to do so much.

The Electric Reliability Council of Texas, the state’s grid operator, put in place new software that can cap prices by summoning more efficient supplies first. This new system, which allows it to use batteries more readily when needed, has improved grid flexibility and stability, spokeswoman Trudi Webster said in an email.

Last month, the risk of blackouts in Texas during the tightest hour of the morning — 7 to 8 a.m., when people were turning on their heat, lights and appliances before going to work — was only 1%, down from 7% a year earlier, according to Ercot. Just before 8 a.m. on Jan. 26, batteries delivered more than 7 gigawatts of power, equivalent to around 9% of the overall power on the grid at that time, according to Wood Mackenzie. (One gigawatt is equivalent to the capacity of one traditional nuclear reactor.)

Texas’ electricity market design results in volatile prices, which has incentivized developers to add batteries to the grid because they can buy energy when it’s cheap and then sell it when prices are high, says BloombergNEF analyst Isshu Kikuma.

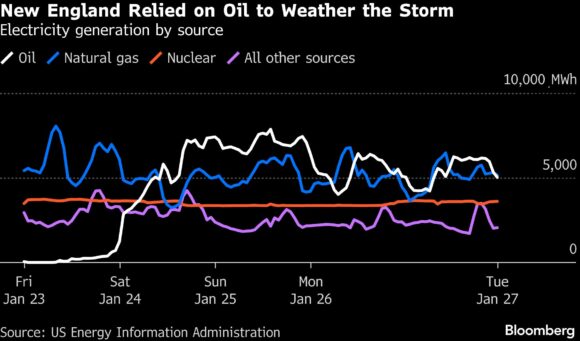

New England on the other hand has less battery capacity because its market structure doesn’t result in price volatility, so developers are less inclined to add storage capacity there, Kikuma said. At the same time, the region has supply problems for natural gas because it is at the end of the US’s natural gas pipeline and relies on imports of liquefied natural gas to help fill potential shortfalls as demand surges in winter, which resulted in a spike in natural gas prices during the storm.

So instead of a boost from batteries, New England had to rely on oil.

Starting during the earliest hours of the morning on Jan. 24, the grid’s use of the fuel shot up from less than 1 gigawatt-hour to nearly 8 gigawatt-hours, surpassing natural gas. Oil plants usually provide zero energy to the grid in New England, and operators only turn them on when necessary, like during a storm.

Oil is much dirtier than other forms of energy. In 2023, petroleum-fired power plants in the US emitted about 2.46 pounds of CO₂ per kWh generated — higher than coal or natural gas on a per-kWh of generation basis, according to the US Energy Information Administration.

In order to weather future storms, US energy grids are going to need a collection of solutions. While the Texas grid used natural gas the most during last month’s winter storm, solar provided the most energy to the grid the following weekend, despite continuing low temperatures — around 50% of total power for much of the day on Feb. 1, according to data from Ercot. Big power users, such as data centers and bitcoin miners, also curtailed their use of power to help the grid.

“When you think about the needs of the grid, there is no silver bullet; it’s an all of the above approach in which you have different types of technologies and resources to drive resiliency and affordability,” said Joshua Rogol, chief executive officer of Elevate Renewables, a portfolio company of infrastructure investor ArcLight Capital Partners.

Topics Texas

Was this article valuable?

Here are more articles you may enjoy.

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Carmakers Push Toward ‘Eyes-Off’ Driving, Raising Questions of Safety, Liability

Carmakers Push Toward ‘Eyes-Off’ Driving, Raising Questions of Safety, Liability  Judge Upholds $243M Verdict Against Tesla Over Fatal Autopilot Crash

Judge Upholds $243M Verdict Against Tesla Over Fatal Autopilot Crash  Sompo Receives Regulatory Approvals to Acquire Aspen Insurance in $3.5B Deal

Sompo Receives Regulatory Approvals to Acquire Aspen Insurance in $3.5B Deal