Florida may have had some of the highest property and auto insurance rates in the country in recent years, but so far this year, the largest auto insurers have filed for rate decreases averaging about 6%, regulators said.

“We are seeing steady signs of auto insurance rates dropping in Florida. Thanks again to effective legislative reforms, Florida’s auto insurance market continues to improve,” Insurance Commissioner Michael Yaworsky said in a statement Tuesday.

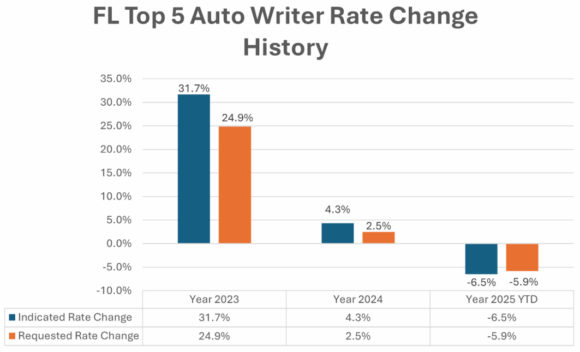

The top 5 auto insurers in Florida, covering 78% of the market, have all filed for rate decreases in 2025. The indicated average rate decrease for the carriers is 6.5%, but the requested rate cut is 5.9%, OIR said in a bulletin.

The decreases follow a 25% average increase in 2023 for the top 5 carriers and a 2.5% requested increase last year, the office indicated. Yaworsky said the Florida market saw a big improvement in the loss ratio for personal auto liability insurers – this year at an average of 53%, which is the lowest in the nation.

Legislative tort reforms approved in recent years should help further reduce litigation and damage costs going forward, said consultant and former Deputy Florida Insurance Commissioner Lisa Miller. That’s because statutes now require juries to be told of the actual medical costs, not speculative estimates on future expenses, she said.

The news on rates comes after several years of reports showing Florida has some of the highest auto insurance rates in the country. Bankrate.com reported early this year that the average annual cost for full coverage was above $4,000, well above the national average. Insurify pegged the average cost at about $3,100. The firm blamed heavy insurer losses in 2022 and the state’s no-fault auto insurance system for the higher costs, according to a report in USA Today.

Topics Carriers Auto Florida Pricing Trends

Was this article valuable?

Here are more articles you may enjoy.

Westchester Close to Settling on Hurricane Sally Condo Claim That Topped $230M

Westchester Close to Settling on Hurricane Sally Condo Claim That Topped $230M  Marsh, Aon in Talks With US on Insuring Tankers in Hormuz

Marsh, Aon in Talks With US on Insuring Tankers in Hormuz  Death and Destruction at Orlando I-4 Project But Punitive Damages Not Allowed

Death and Destruction at Orlando I-4 Project But Punitive Damages Not Allowed  Zurich Insurance and Beazley Agree to $10.9B Cash Acquisition

Zurich Insurance and Beazley Agree to $10.9B Cash Acquisition