The Los Angeles Department of Water and Power is returning to the municipal bond market with a $1 billion offering, roughly three months after shelving a sale in the immediate wake of historic wildfires that began burning in Southern California on Jan 7.

The power system revenue bonds are set to price for retail investors on April 30, a day before institutional buyers. The department will use proceeds from the sale to ramp up its capital investment program and refinance some outstanding debt.

The issue is shaping up to be a major test of how muni investors view climate risk. The utility’s bonds used to trade better than AAA credits, though the wildfires raised the prospect it will be facing higher costs. The utility will likely need to increase infrastructure spending and it could owe billions in damages as the cause of the flames is still unknown. The department can’t rely on the safety net that investor-owned utilities have through California’s wildfire insurance fund, which would mean higher rates for customers and credit strains for bondholders.

Related: LA Municipal Utility Says No Evidence Energized Power Line Caused Fire

“I’m eager to see whether climate risk gets priced in,” said Tom Doe, founder and president of Municipal Market Analytics, an independent research firm. He said that the muni market tends to shake off climate risk, typically considering the likelihood of default instead. “Even with the recent volatility, we’ve had demand for California bonds because there’s such great demand from high net-worth investors.”

A spokesperson for the Los Angeles Department of Water and Power declined to comment on the upcoming bond sale.

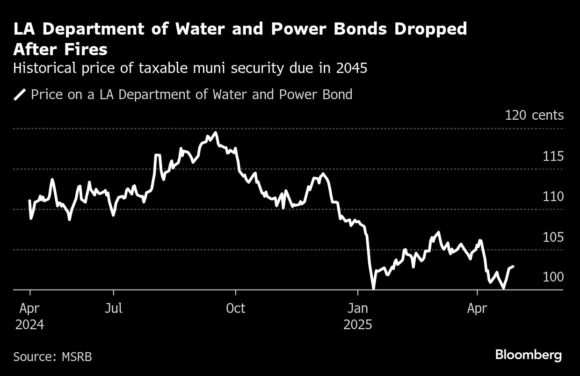

Following the wildfires, prices on power system bonds sold by the utility dropped, and their spreads widened, signaling investors were unloading the securities. Spreads have since tightened but the average gap between benchmark securities and LADWP debt due in 2045 is 137 basis points, up from as little as 95 basis points in December. The spread on an LADWP bond due in 2033 widened to an average of 87 basis points on Friday, compared to -18 on Jan. 2.

The fires also exposed vulnerabilities in LADWP infrastructure and opened up the utility to litigation stemming from its response to the disaster. LADWP faces at least a dozen lawsuits filed related to the Palisades Fire. Legal experts are suggesting the municipal utility may be held accountable under a legal argument called inverse condemnation, which could pave the way for property owners to collect damages from the utility for leaving fire crews without enough water.

Related: Lawsuit: Downed Municipal Power Lines May Have Caused LA’s Palisades Fire

S&P Global Ratings lowered its rating on municipal bonds sold by LADWP two notches to A from AA- in January, and warned that more downgrades may be ahead once litigation is complete. Fitch Ratings also downgraded LADWP’s water system revenue bonds to AA- from AA, citing increased liability risk tied to wildfires and limited financial headroom to absorb additional costs.

A Los Angeles Department of Water and Power sign instructs residents not to drink the water after the Palisades Fire in the Pacific Palisades area of Los Angeles, on Jan. 23.

The utility has a bevy of capital needs tied to a 2022 blueprint aimed at transitioning its power portfolio toward renewable energy, strengthening grid resilience, and adapting to climate-related threats.

“There hasn’t been any ‘turning point’ for climate risk in terms of significant price concessions so far,” said Dora Lee, director of research for Belle Haven Investments. “Not just for LADWP but for other climate prone areas as well. You see places devastated by hurricanes repeatedly that come to market with little change if anything.”

Lee says a web of safety nets have supported climate prone credits during recovery, warding off price concessions.

The new bonds are rated Aa2 by Moody’s Ratings and AA- by Fitch, according to bond documents. Both ratings carry negative outlooks, signaling the possibility of future downgrades.

The negative outlook reflects Fitch’s “view that wildfire credit pressures remain, including the potential for a rating downgrade if LADWP equipment is found to have ignited the Palisades wildfire or if LADWP’s protocols are found to have been a contributing factor,” analysts wrote in a April report.

Top photo: Workers with the LAFD inspect a burned hybrid vehicle marked for lithium-ion battery removal after the Palisades Fire in the Pacific Palisades area of Los Angeles, California, on Thursday, Jan. 30, 2025.

Was this article valuable?

Here are more articles you may enjoy.

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles