Arch Capital’s first-quarter profit fell 49.2% as catastrophe losses from the California wildfires weighed on its underwriting performance and investment...

Arch Capital News

While writing primary casualty insurance is more appealing than writing casualty reinsurance, the chief executive of Arch Capital said casualty...

Executives of two property/casualty insurance organizations—Kinsale Insurance and the U.S. P/C operations of Arch Capital—shared their recipes for success with...

Ryan Specialty, the Chicago-based international specialty insurance firm, announced it has completed the acquisition of Castel Underwriting Agencies from Arch...

Ryan Specialty, the Chicago-based specialty insurance firm, announced it has signed a definitive agreement to acquire Castel Underwriting Agencies Ltd....

Drawing analogies to an epic tennis match and the hands of a clock, the leader of Bermuda-based Arch Capital declared...

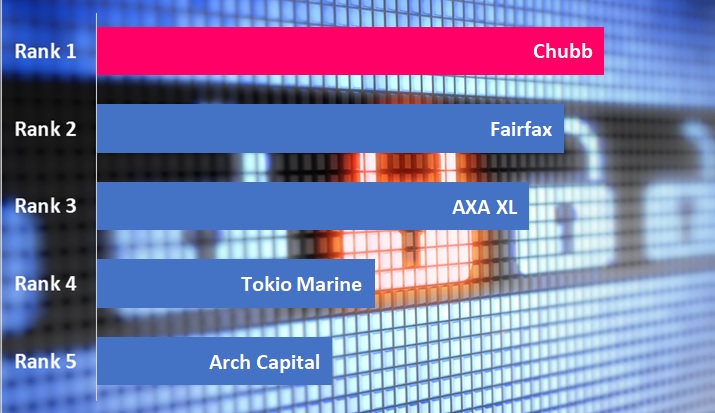

In a year when cyber insurers notched the third-lowest industrywide loss ratio since 2015, and cyber premiums vaulted to $7.2...

Full-year 2022 financial results, reported by a handful of international groups that write reinsurance, show mixed results in a market...

U.S. and Bermuda reinsurers reported strong operating performance for the first six months of 2022, supported by continued pricing increases...

Arch Capital Group Ltd. estimated a range of pretax catastrophe losses of $180 million to $190 million for the first...