The wreckage caused by Hurricane Melissa in Jamaica is expected to cost insurers $1 billion to $3 billion, according to...

Reinsurers News

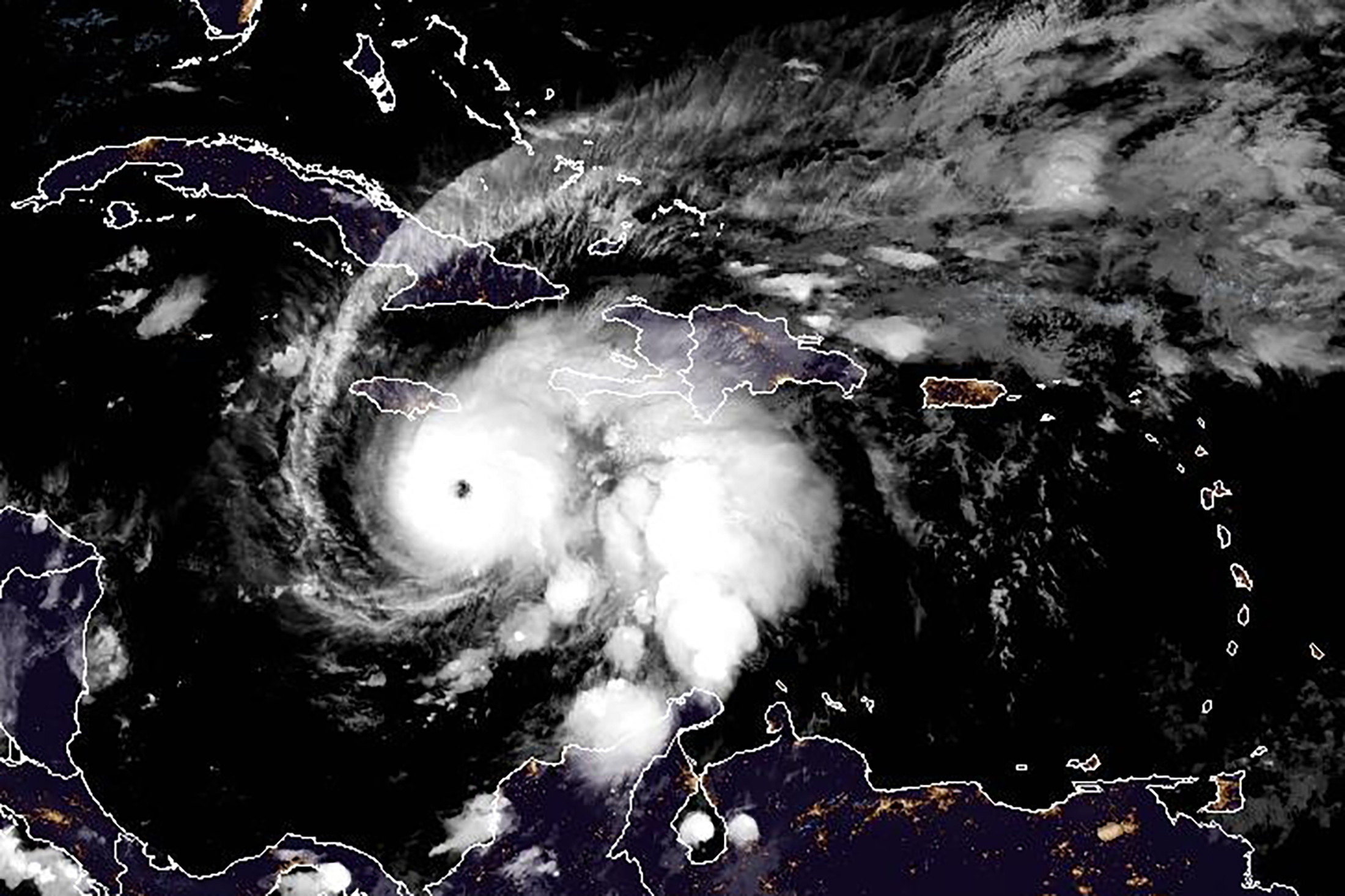

As Hurricane Melissa sweeps past Bermuda, new satellite data of Jamaica has revealed devastation for tourist center Montego Bay and...

The devastation from Hurricane Melissa came into focus after the record-setting storm moved past Jamaica, Haiti and Cuba with at...

Hurricane Melissa made landfall in Jamaica as a powerful category 5 storm – a record for the Caribbean island nation...

The seemingly unstoppable rise of catastrophe bonds may now be eroding the market share of reinsurers. After years of raising...

During the upcoming renewals, S&P Global Ratings expects a moderate decline in pricing for short-tail lines but that global reinsurers...

Pricing and returns in the reinsurance market are expected to gradually come off recent highs, with the market facing moderately...

Swiss Re tops the list of the world’s 40 largest reinsurers in 2025, followed by Munich Re and Hannover Re,...

As natural catastrophes become more frequent and destructive, a key backstop intended to help cover losses has gotten harder to...

Sound risk management, strategic use of technology and a maturing partnership with alternative capital have subdued the cyclical nature of...