During the upcoming renewals, S&P Global Ratings expects a moderate decline in pricing for short-tail lines but that global reinsurers will hold firm on terms and conditions.

Risks arising from geopolitical tensions could affect both sides of global reinsurers’ balance sheets, while significant losses from natural catastrophes highlight the need for reinsurers to maintain a strong portfolio and manage their risk appetites.

In addition, the rising cost of claims in U.S. casualty lines could prompt reinsurers to further strengthen their reserves over the next 12 months.

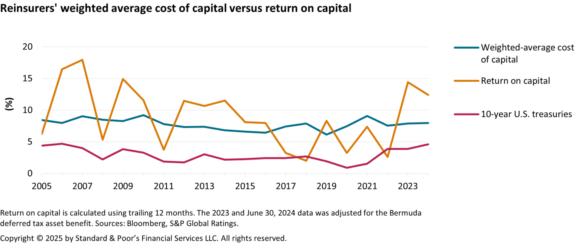

Nevertheless, we view the global reinsurance sector as stable, supported by reinsurers’ strong capital, sound underwriting margins, robust investment returns, and still-favorable earnings prospects above the sector’s cost of capital.

Operating Performance

Reinsurance pricing has passed its peak, which will likely temper earnings prospects for global reinsurers over 2025-2026. However, the sector’s operating performance is forecast to remain strong through 2026, continuing a trend started in 2023. Even though natural catastrophe events weighed on the 2025 half-year results, the sector is also on track to meet its cost of capital for the year, and we anticipate that it will do so again in 2026.

Under our base-case earnings forecast for 2025-2026, we assume an undiscounted combined (loss and expense) ratio of 94-96 in 2025 and 95-98 in 2026, and a return on equity (ROE) of 12-14% in 2025 and 11-13% in 2026. The sector’s conservative asset portfolios support our assumption that overall investment returns will be robust at 3.5-4.0%. Players with exposure to life reinsurance are forecast to benefit from an ROE for these lines of 10-12%.

Pricing and Terms and Conditions

Prices for short-tail lines are projected to fall by about 5%, albeit with significant variation across regions and business lines. That said, we expect reinsurers to take a generally disciplined approach to terms and conditions and to maintain their focus on risk management despite pressure to broaden coverage and reduce attachment points.

Capitalization

Capital adequacy has consistently been one of the sector’s key strengths. Reinsurers maintain large capital buffers so they can manage severe events. In this respect, the largest risks stem from natural catastrophes and reserving volatility, both of which have the potential to exhaust a reinsurer’s capital buffer if not carefully managed.

Most of our top 19 global reinsurers took advantage of their sound earnings to further strengthen their capitalization in 2024; as a result, redundancy at the 99.99% confidence level rose to 11% from 6% in 2023.

The reinsurance capital available to cedents increased because reinsurers were keen to take advantage of favorable conditions. Over the same period, strong demand for catastrophe bonds bolstered the availability of alternative capital, especially in the retrocession market.

U.S. Casualty

Reserve calculations present increasing risks to reinsurers as the cost of claims in certain lines soars. U.S. casualty, in particular, has seen a spike in costs in recent years, creating reserving volatility and causing our top 19 global reinsurers to strengthen their combined reserves by about $6 billion in 2024. So far, positive performance in short-tail lines has overshadowed the need to strengthen reserves in certain long-tail lines and, in aggregate, our top 19 global reinsurers have continued to release reserves from prior years.

However, the size of the positive runoff has been shrinking since 2018, mainly because of unfavorable reserve developments related to U.S. casualty business.

Geopolitical Tensions

We see potential for geopolitical tensions and macroeconomic uncertainty to further affect investment returns and underwriting performance. On the underwriting side, geopolitical tensions can directly affect lines of business such as trade credit, political risk or aviation. Other lines can be indirectly affected, via muted economic growth and because there are smaller sums at risk.

Reinsurers exposed to aviation lines have already suffered losses due to the Russia-Ukraine conflict, and the U.S. tariff announcements created significant capital market volatility during 2025.

Natural Catastrophe Risk

Urbanization, climate change and inflation continue to elevate natural catastrophes losses. Insured losses in the first half of 2025 were about $80 billion, the second-highest level recorded during the first half of a year. Reinsurers saw significant losses, mainly from the wildfires in California and, to a lesser extent, from the earthquakes in Myanmar and Taiwan and the convective storms in the U.S.

The annual catastrophe budget amounts to about $21 billion, of which we estimate that about 50% had been consumed by end-June 2025. In a severe natural catastrophe stress scenario, capital could be hit if losses exceed the annual catastrophe budget plus the expected profits before tax.

For the top 19 global reinsurers, we estimate a combined buffer for 2025 of about $72 billion. Absolute exposure to natural catastrophe risk increased at most of the reinsurers in our top 19 global cohort, but typically the increase was in line with general portfolio growth and the level of capital at risk was similar.

Navigating the Road Ahead

The global reinsurance sector remains on course to post strong results and meet its cost of capital for the third year in a row. The industry’s sound underwriting margins and robust investment returns should help it ride out the changes as the market softens. As always, short-term success depends on whether catastrophe losses remain within the annual budget.

We consider strict underwriting, portfolio management and strong risk controls key to preserving the current favorable conditions, given the elevated natural catastrophe losses, geopolitical uncertainty and significant exposure to U.S. casualty lines. That said, the sector’s key to success remains its approach to maintaining discipline. We expect reinsurers to resist the pressure to broaden terms and conditions in 2026.

This article first was published in Insurance Journal’s sister publication, Carrier Management.

Topics Reinsurance

Was this article valuable?

Here are more articles you may enjoy.

Former Broker, Co-Defendant Sentenced to 20 Years in Fraudulent ACA Sign-Ups

Former Broker, Co-Defendant Sentenced to 20 Years in Fraudulent ACA Sign-Ups  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan