Homeowners, Private Passenger Auto and Workers’ Compensation Lines Impact Premium Growth

Through the first quarter 2012, total direct premium written (DPW) for all property/casualty insurers is up 4 percent compared to first quarter 2011. This increase in DPW represents over $4.8 billion in premium growth, of which approximately $2.6 billion is attributed to the homeowners multi-peril, private passenger automobile liability and workers’ compensation lines of business.

The recent surge in first quarter workers’ compensation DPW growth has made it a driver of overall premium growth. Workers’ compensation writers increased DPW nearly 10 percent comparing the first quarter of 2012 and 2011, reversing the trend of declining DPW reported in 2010 and 2009. In examining the last five first quarters (2008-2012), DPW for workers’ compensation has increased an average of less than one half percent period over period.

Contrasting the workers’ compensation results, in examining the last five first quarters, homeowners’ multi-peril and private passenger automobile liability have been a more consistent driver of premium growth. With homeowners’ multi-peril DPW increasing an average of 4.6 percent and private passenger auto liability DPW increasing an average of 2.1 percent, both of these lines of business account for significant dollar volumes of premium growth.

Homeowners’ multi-peril has increased DPW an average of $628.8 million period over period from 2008 to 2012. Private passenger auto has increased DPW an average of $520.6 million period over period from 2008 to 2012. All other lines of business have decreased DPW an average of $237.2 million period over period from 2008 to 2012. This demonstrates the overall positive impact of homeowners multi-peril and private passenger automobile liability on overall premium growth since 2008.

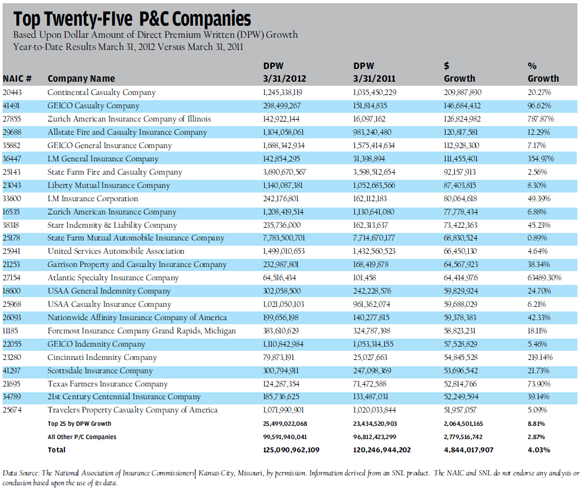

Top 25 Individual Companies by First Quarter DPW Growth

As of March 31, 2012, the Top 25 individual P/C insurers increased their direct premium written by 8.8 percent, approximately $2.1 billion, period over period. Consequently, the Top 25 accounted for almost 43 percent of the total DPW growth for the P/C insurance industry.

In contrast, the remainder of insurers that comprise the industry reported an increase in DPW growth of only approximately 2.9 percent, or $2.8 billion, period over period. As stated above, in total, direct premium written for the P/C industry grew more than $4.8 billion or approximately 4 percent.

If P/C insurers can continue to demonstrate the same rate of premium growth for the remainder of 2012, total DPW will exceed $500 billion. In fact, should P/C insurers experience premium growth of 4 percent, they would report total DPW of approximately $523 billion for 2012, the highest level of DPW ever reported by the P/C industry.

Topics Trends Workers' Compensation Pricing Trends Homeowners Property Casualty Market

Was this article valuable?

Here are more articles you may enjoy.

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears