If there is anything that exists in the insurance distribution industry, its ego. This is why agency performance benchmarking is so important. The industry is also fortunate to have a level playing field. Most independently held and bank-owned insurance agencies operate and are built with similar business models, organizational charts, and expense models. Quality benchmarking that provides an “apples to apples” comparison is readily available.

Agency scorecards are valuable in setting goals for firms who employ strong, competitive leadership teams. These leadership teams use benchmark reports to enhance their business model and to ensure they are peak performers (the best of the best).

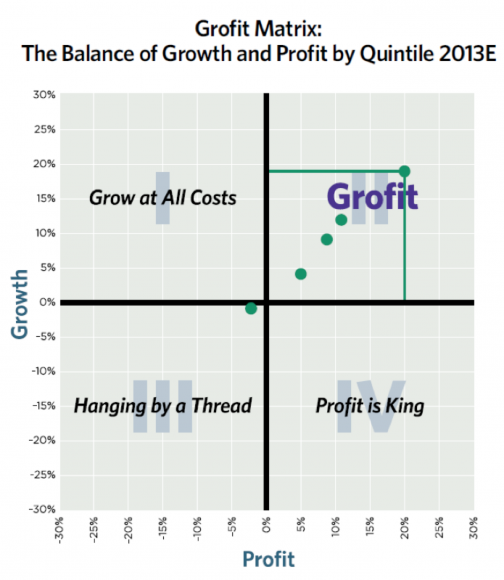

Sifting through all of the metrics available to industry leaders to gauge an agency’s performance is simple. Top-line revenue growth and agency profitability are two of the most simplistic, and important, measures of performance. Building long-term value requires a balance between the two metrics.

Given that investing in growth can hurt short-term profitability and a heavy margin can hinder future growth, maximizing agency value (performance) is comparable to riding a teeter totter. The best firms can maximize both growth and profitability without sacrificing the balance.

Where do you stack up against the best, most balanced firms in the business?

Source: MarshBerry proprietary financial management system Perspectives for High Performance (PHP); MarshBerry 2013 Market & Financial Outlook.

Topics Profit Loss

Was this article valuable?

Here are more articles you may enjoy.

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Two-Thirds of Independent Agencies Plan to Increase AI Use This Year, Survey Says

Two-Thirds of Independent Agencies Plan to Increase AI Use This Year, Survey Says  Palantir Decamps to Miami Co-Working Space in Surprise Move

Palantir Decamps to Miami Co-Working Space in Surprise Move