Editor’s Note: This is the first article in a three-part series on the oil and gas industry. The second article will address new and emerging claims trends and the third article will address the emerging risks arising from new technologies, new labor/employee risks, and simultaneous operations.

The year 2015 was significant for the oil and gas industry:

- President Obama announced that the U.S. has become the number one producer of oil and gas in the world.

- The United States can now export oil and gas after a change in law in 2015 which opened up the U.S. to a global marketplace previously not accessible for 40 years.

- The United States broke production records for both oil and gas in 2015 despite the price drop on oil from a high of $105 a barrel in 2014 to a low of $35 a barrel in 2015.

- The drilling rig count went from a high of 1,609 in 2014 to a low of 698 drilling rigs in 2015 while during the same time period oil and gas production increased to record levels primarily due to hydraulic fracturing technology.

- Increases in oil and gas production in the U.S. are no longer dependent on new well drilling. Furthermore, the rig count is no longer an accurate measure of oil and gas production or a risk metric that can correctly measure oil and gas activity for insurers. In fact, the U.S. Department of Energy has developed a new model to try to estimate U.S. oil and gas production because using the rig count alone is no longer a viable metric.

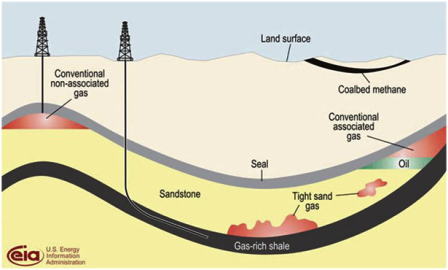

- Hydraulic fracking is a well completion and well stimulation operation that is done independent of drilling operations and after the drilling rig is removed from the well. Fracking can be done years after the well has been drilled. The drilled shale well is not capable of commercial oil and gas production until it is completed using hydraulic fracturing technology.

- There will be many more wells hydraulically fractured in 2016 than wells drilled. As fracking technology evolves, wells previously drilled with old fracking technology are now becoming candidates to be re-fracked to improve production performance. Older conventional wells are also being fracked to improve production performance.

- The risks involved with wells that are completed using hydraulic fracturing are significantly higher and different than conventional wells. Also, a well drilled in one policy period, where coverage for the well completion was paid for, may not be completed via fracking until several years later, and possibly with a different carrier, potentially causing issues for brokers and clients alike. Fracking risks have evolved to the point where the idea of creating a separate insurance coverage for hydraulic fracking and separating it from drilling exposures has come up.

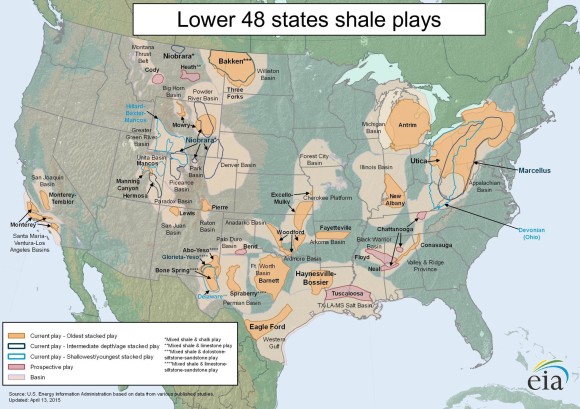

All of the above points are possible due to the fact that oil and gas are now technically recoverable from the vast shale resources held in the United States. The pairing of horizontal drilling and hydraulic fracturing technologies allows us to create manmade reservoirs that can be produced in the dense shale that has kept oil and gas hydrocarbons trapped for millions of years and previously not obtainable.

While this new technology has created many new issues for the insurance industry, this particular article is centered on risks that exist with the 4.3 million existing wells in the U.S. that have already been drilled and completed since the first commercial oil well was drilled in Pennsylvania in 1859.

Non-Infinite Life Span

Oil and gas wells do not have an infinite life span. With thousands of wells across the nation now over 150 years old, the evolving risks that come from aging oil and gas wells failing are becoming more apparent. A well can “blowout” in any phase of its life, even when it is producing, shut-in, or plugged and abandoned. As the casing and cementing on older wells deteriorate, the risk of failure increases. At some point in the future, well failures from these older wells may become more commonplace and could have a major impact on the insurance industry.

Oil and gas wells are known to pollute ground water, air and surface areas, as long as we have been drilling wells. Even with millions of wells safely drilled, hazardous pollutants can escape during a blowout, as the Gulf of Mexico blowout in 2010 substantiated.

Well integrity is critical for the reliability and longevity of a well. The well casing and cementing are the front line defense to keep unwanted substances from migrating outside of the well and possibly making it into the groundwater, or reaching the surface, causing a cratering event. Pollution arising from oil and gas wells mostly involve surface events, such as spills or other surface-related occurrences, but these events also can involve underground crossflows of water and/or hydrocarbons between sub-surface strata. When a sub-surface event arising directly from a well does occur, one of the major causes of this is the failure of the well casing and cement that seals it in place.

In October 2015, a natural gas storage facility well blowout occurred in Los Angeles in an area known as Porter Ranch. The well went into operation in 1954 and was converted into a gas storage well in 1973. The cause of loss was predicted to be a casing failure possibly due to corrosion, but no one knows for certain at this time. This blowout is ongoing and expected to be brought under control in late February or March 2016 via relief wells being drilled.

The Porter Ranch blowout is unique as it is developing into what may be one of the largest evacuations due to a well blowout in U.S. history. Several thousand people evacuated the area and more are considering evacuation from this populated area of 30,000. Evacuation expenses from this will be significant.

Proximity of well operations to populations of people is an often overlooked exposure, and evacuation costs need to be factored into the decision on how much insurance coverage, in terms of limits of insurance, a client should purchase. Defense costs are another significant and often overlooked exposure that need to be quantified and defined in clear language on the policy.

The Porter Ranch blowout is attracting media’s attention, several class action lawsuits have been filed, and celebrities and activists are getting involved. Public opinion may have an effect on jury verdicts arising from the lawsuits, which may significantly increase exposure to insurers.

As risks in the oil patch evolve, so should the insurance program of clients in this business.

Was this article valuable?

Here are more articles you may enjoy.

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance