This week’s Lowdown highlights the concerns of insurance CEOs, as reported by PwC in their 21st CEO Survey. According to the study, there remains a great deal of angst around technology but industry leaders joined in a huge sigh of relief that InsurTech hasn’t “materialized to the extent that was feared.” The following is a snapshot of the findings, which can be found for download in Research & Trends.

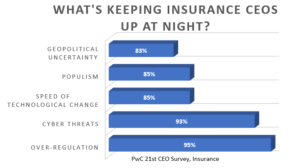

Page 8: PwC surveyed CEOs about threats to their organizational growth and found top concerns to include regulation, cyber threats, speed of technological change, populism and geopolitical uncertainty.

Page 8: PwC surveyed CEOs about threats to their organizational growth and found top concerns to include regulation, cyber threats, speed of technological change, populism and geopolitical uncertainty.

Page 10: 49% of insurance CEOs are planning a new strategic alliance or joint venture to drive profitability and growth over the next 12 months.

Page 12: +50% of insurance CEOs are clear about how robotics and artificial intelligence can improve customer service.

Page 18: 81% of insurance CEOs are concerned about shortage of digital skills within the industry and 86% believe their organizations need to strengthen employees’ soft skills as well as digital skills.

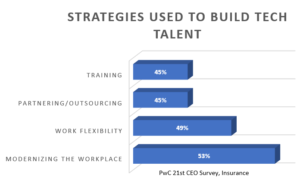

Page 19: PwC asked insurance CEOs to what strategies were being utilized to attract and develop digital skills. Top strategies include modernizing the workplace, providing greater workplace flexibility, implementing training, and partnering/outsourcing. (for the full 10 top strategies, see the download)

Page 19: PwC asked insurance CEOs to what strategies were being utilized to attract and develop digital skills. Top strategies include modernizing the workplace, providing greater workplace flexibility, implementing training, and partnering/outsourcing. (for the full 10 top strategies, see the download)

Page 20: 66% of insurance CEOs report increasing pressure on their organizations to deliver business results under shorter timelines.

PwC recommends partnerships with external vendors as critical to the success in “clearing away the barriers to growth and accelerating transformation.” Where concerns remain highest around technology, digitization and losing advantage to InsurTech, CEOs must look to “partnerships with new entrants, rather than rivalry.” Geoffrey Moore reminds us of the importance of transformation in his April 2nd blog on operational excellence, “You are not just giving away cost advantages to next-generation competitors who are leveraging automation to accomplish what you are doing manually. You are also silently disappointing your customers who increasingly expect to meet their everyday needs digitally through self-service rather than call centers or store associates.”

Be sure to sign up for our weekly Research & Trends e-newsletter to receive the latest additions to our library of webinars and whitepapers on subjects ranging from secure policyholder engagement to weather predictions, digitization and automation.

As always – happy reading!

Topics InsurTech

Was this article valuable?

Here are more articles you may enjoy.

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’  Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions