For independent agents, errors and omissions (E&O) allegations can surface any day or week but the risk is heightened in the days following natural catastrophes.

“After the storm passes over and the claims start to come in, the risk for the insurance agent rises,” according Insurance Journal’s Academy of Insurance Director Patrick Wraight.

After the winds die down and rains subside, the claims questions and denials begin and agents can find themselves thrust into uncomfortable situations between their customers and their carriers.

“That’s when the agent’s errors and omissions insurance kicks in,” Wraight said recently in an Academy webinar on agency E&O exposures following Hurricanes Harvey and Irma.

The leading cause of agency E&O claims for years has been an agency’s failure to procure coverage. E&O insurers fully expect to see an uptick in such claims given this year’s highly active hurricane season.

“In 2017, given the number of hurricanes, some errors and omissions carriers will see a spike in this issue, especially around flood and windstorm coverage,” Mark R. Angelucci, resident senior vice president and E&O segment leader for Utica National Insurance Group, told Insurance Journal.

“We do expect to see an increase in claims against agents after hurricanes Harvey and Irma,” agrees Robin LaFollette, head of financial and professional claims in North America for Swiss Re Corporate Solutions. “Even before a natural disaster is over, clients contact their agents to begin the process of filing a claim and to ask questions about what their policies will and will not cover.”

E&O is not the main agency concern during a disaster, of course. But having a proper disaster plan helps assure that there are procedures in place to properly serve clients and minimize mistakes during a stressful time for everyone.

LaFollette notes that agents must have a plan for mitigating the impact of natural disasters on their own operations and providing services to their clients in a post-catastrophe environment.

“Just like their clients, agents are at risk of sustaining damage to their operations in a natural disaster,” she said. For instance, after Katrina many agents lost all paper files and computers to flooding. “Agents should make sure they have critical documents in electronic form backed up on a remote server or in the cloud so that they can be accessed after a flood.”

Disaster Risk Management

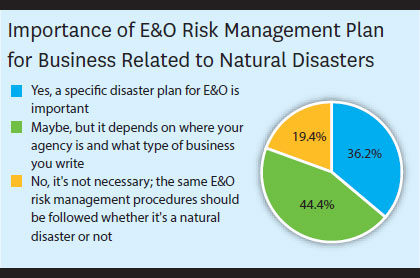

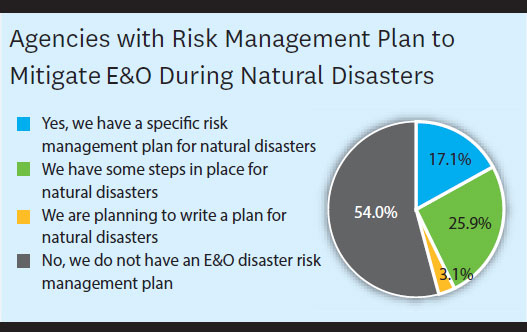

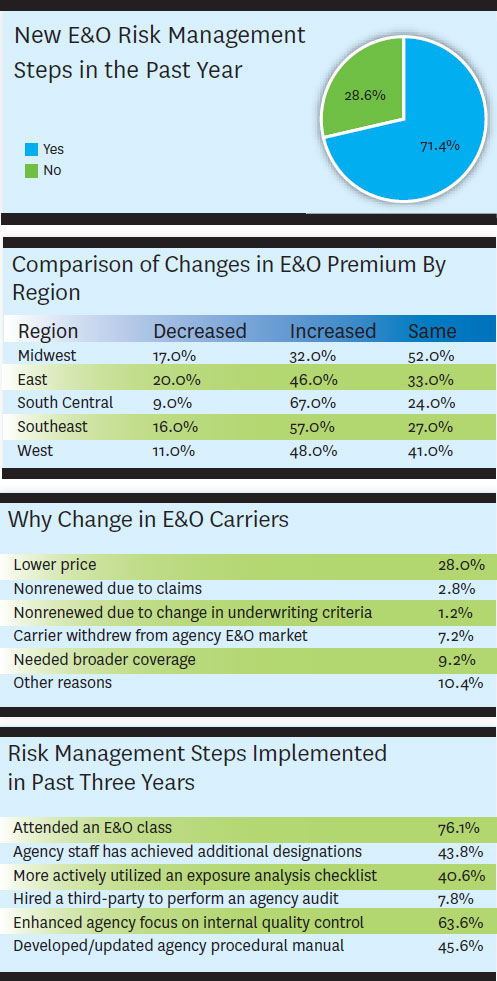

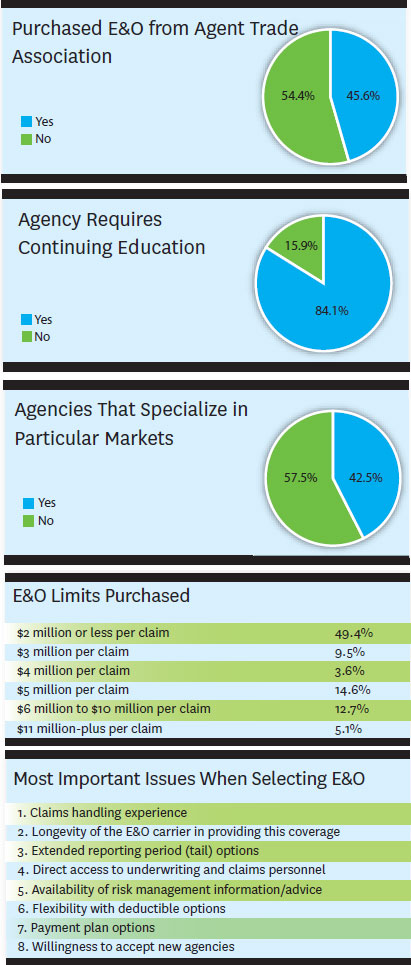

According to Insurance Journal’s 2017 Agency E&O survey, 36.2 percent of respondents believe it’s important to have an errors and omissions risk management plan specific to handling business related to natural disasters but only 17.1 percent reported actually having such a risk management plan in place.

Swiss Re’s LaFollette says that every agency should have a contingency plan for how it will provide critical services if its office is without power or, worse yet, cannot be accessed at all.

“It’s wise for agents to consider ahead of time whether they should purchase a generator to provide power,” she said. They should also have a contingency plan for temporary office space and temporary employees to help with the high volume of claims that their clients will report after large natural disasters such as Hurricanes Harvey and Irma.

Agents should also check their E&O policies to see if they have catastrophe extra expense coverage that will reimburse them for some of these expenses, LaFollette said.

“Agencies must have their own disaster recovery plans because they are in the unique position of needing to operate their businesses post-catastrophe,” Utica’s Angelucci told Insurance Journal. “That is exactly the time that many of their customers need them the most.”

Angelucci recommends that every agency address at least three areas.

First, a plan should include a complete list of customers and carriers’ claim-reporting phone numbers as well as backup locations if their offices are unable to be used, Angelucci said. (Utica National recently developed a tool to assist agents in developing this list.)

The second piece involves documentation of the pre-catastrophe binding restrictions of the agency’s carriers. This, he said, includes “knowing and documenting the submission status of risks needing coverage that were submitted pre-catastrophe so that there is no confusion about whether coverage was in-force or not.” This can include payment requirements and knowledge of coverage afforded by wind pools or by the National Flood Insurance Program. For example, some states’ wind pools only provide building, not contents coverage.

The third piece involves documentation of customer procedures. “If you are writing risks in hurricane-prone areas, each risk should be advised about the availability – or lack thereof – of flood coverage, the flood limits, and the deductible if the coverage is written,” he said. “For homeowners policies, if a carrier offers different hurricane deductibles or limits roof coverage, this must be explained to the insured, and his or her decision about deductibles, limits, etc., must be memorialized back to the insured via a letter or email.” These coverage areas seem to drive the most frequent post-catastrophe E&O claims, according to Angelucci.

Coverage Offers

According to LaFollette, many post-hurricane E&O claims involve nonexistent or inadequate flood or wind coverage, a lack of contingent business interruption coverage, or off-site power failure coverage.

“Agents can reduce their exposure to these claims by offering their clients policies that cover the kinds of damage we see after a hurricane,” she said. “It is very important that the agent document his file with evidence that he offered the policy together with the client’s response, especially if the offer was rejected. This is the most powerful defense to an E&O claim.”

Angelucci agrees that it is important for agencies to effectively communicate the outcome of discussions on coverages offered, limits available and coverages declined.

“Email and work-processing systems make this process as easy as it has ever been,” Angelucci said. “It is also the most effective way to do business. Policyholders need to understand what they are buying does for them, and conversely, what it doesn’t.”

Quality E&O Product

Whether before or after a storm, agency owners never expect to have an E&O claim.

“We don’t want to have them, we don’t expect to have them, but we have them,” said Angela Schroder, president of U.S. E&O Brokers, a retail insurance brokerage based in Houston that exclusively markets E&O policies nationwide for insurance agents and brokers.

Insurance agents E&O protects agencies, the owners, their families and their employees from financial harm. “It is their lifeline for what they do every day,” said Schroder.

“You could have a catastrophe at any time in the United States, not just a hurricane,” she said. “It could be something else and that’s why coverage is important every day, not once a year.”

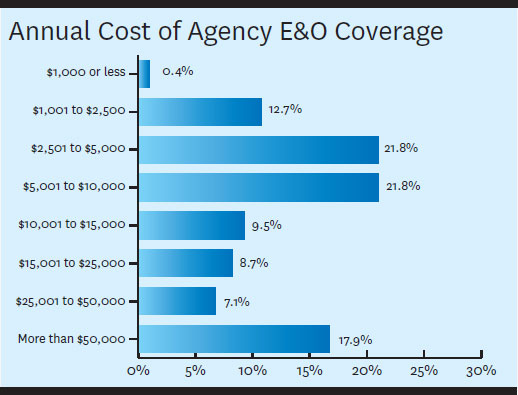

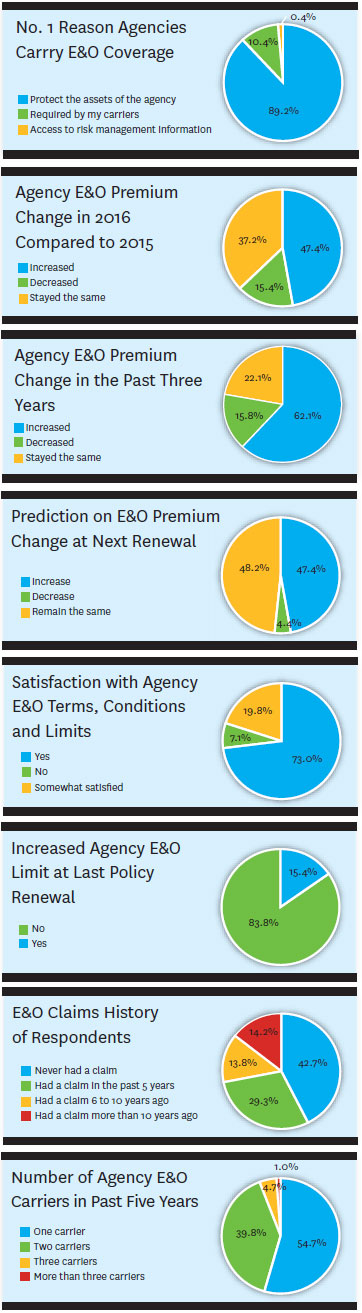

Agents get it. According to Insurance Journal’s 2017 Agency E&O Survey, the vast majority of agency owners (89.2 percent) purchase E&O coverage. That was up from 83.5 percent in IJ’s 2016 survey.

Agency owners, too, need to understand the E&O coverage they buy and understand that right after a disaster may not be the best time to shop around for a new policy.

Right now, the agency E&O market is stable and competitive, with good availability of markets for quality accounts, according to Schroder. This scenario drives some agents to shop around, which Schroder says is not always a good idea in a post-catastrophe environment.

Schroder said she has seen agents shopping their E&O in storm-hit locations. “They should just be happy with the policy they have. If they’re not happy with the policy they have, they shouldn’t have bought it last year!”

She worries about agents in Texas, Louisiana and Florida. “If your E&O comes up in the next two or three months, I’m not sure you really should be changing carriers. You just had a hurricane,” she said.

Schroder admits that even agency owners don’t always read their policies and what’s covered.

“They’re not reading the endorsements. They’re not reading what lines of business are covered or not covered. Or that there’s no punitive damage coverage or that certain perils are excluded,” she said.

In some cases, agencies may be purchasing lower cost E&O coverage that doesn’t even meet the financial responsibility of the state they’re licensed in, according to Schroder.

“If you have a corporation and that’s how you are doing business, that corporation needs to be the named insured,” she said. “There are quite a few policies that will only list the agent and not their entity, and that may not meet the financial responsibility requirements.”

What’s most important is buying an E&O product that covers the agency’s exposures, she said.

“Are they buying a quality product? Or are they just buying a product that, at the end of the year, they might save $500 or $600 or $1,000? Or did they actually buy an E&O product that will cover them in the event that they have a lawsuit against them or a suit against their company?”

Policy forms vary, according to Schroder. “These policy forms do matter,” she said. “You have to read what’s covered. A lot of times, we’ll say, ‘You got a quote and it’s $500 less.’ Great. ‘But did you read the policy? Did you read the exclusions?'” she said.

While many agencies are lucky enough to avoid E&O claims, many others will find themselves facing an E&O allegation at some point. According to Insurance Journal’s 2017 Agency E&O survey, nearly half of the survey respondents (43.1 percent) have had an E&O claim in the past 10 years. Another 14.3 percent had an E&O more than 10 years ago, while 42.7 percent reported never having an E&O claim.

Insurance Journal’s Agency E&O Survey collected more than 300 responses from agency owners nationwide via an online survey in September 2017. Demotech Inc., Insurance Journal’s official research partner, assisted with analysis of this year’s survey results. For more information, contact Andrea Wells at: awells@insurancejournal.com.

Was this article valuable?

Here are more articles you may enjoy.

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds  Viewpoint: How P/C Carriers Can Win the Next Decade With Tech + Talent

Viewpoint: How P/C Carriers Can Win the Next Decade With Tech + Talent  Trump’s EPA Rollbacks Will Reverberate for ‘Decades’

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’