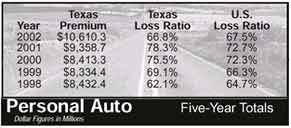

The 2002 premium and loss data for Texas provides hope for the future of Texas insurance markets. Here are the highlights in review:

• The aggregate loss ratio for all Texas companies for all lines of business was 78.4 percent (down from 96.9 percent in 2001), compared to the national loss ratio of 69 percent (down from 79.3 percent in 2001). Although this was the third year in a row that the Texas loss ratio exceeded the national loss ratio and was still not profitable, the dramatic reduction indicates that company pricing and underwriting initiatives are having the desired effect. It’s also a clear sign that Texas got lucky in 2002 with no extraordinary weather-related catastrophes.

• Texas independent agencies gained ground in the annual battle for personal lines market share, with increased market share in both auto and homeowners. The 24.7 percent market share in personal lines increased from 23.2 percent in 2001. It’s still not good enough compared to other states, but maybe it’s a sign of changing times. Texas independent agencies in 2002 captured 22.4 percent of the homeowners market (up from 17.3 percent in 2001) and 25.6 percent of the personal auto market (up from 25.3 percent).

• Loss ratios were down in all lines. Every line except homeowners had significant reductions, the lowest since 1998.

• Texas Mutual Insurance Company gained significant market share in workers’ compensation.

• Texas accounts for seven percent of the national premium volume, unchanged from 2001.

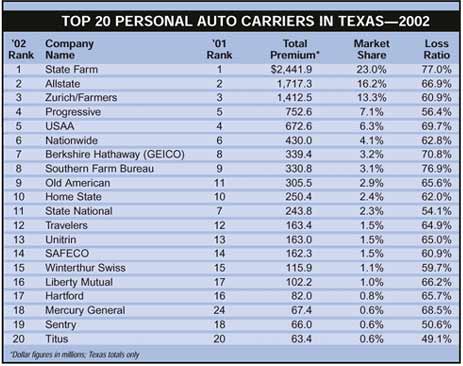

Personal Auto

The personal auto loss ratio at 66.8 percent was the lowest it’s been since 1997 and very close to profitable. Every company except State Farm had a loss ratio of less than 70 percent. The Texas loss ratio is better even than the national average loss ratio in personal auto.

With the homeowners line still in a state of crisis, it looks like the agency companies are targeting personal auto as a way to keep in the personal lines game. Independent agents gained a little market share in personal auto, from 25.3 percent in 2001 to 25.6 percent in 2002.

There was one significant change in the top 20 carriers in personal auto. CNA dropped off the list since their book was purchased by Allstate under the Encompass brand. In its place, Mercury General leapt into 18th place with strategic agency appointments and advertising around the state. Otherwise, there was little shuffling of company positions within the top 20.

County mutual insurance companies significantly increased their market share to 37 percent, compared to 28.2 percent in 2001, with a premium volume of $3.9 billion.

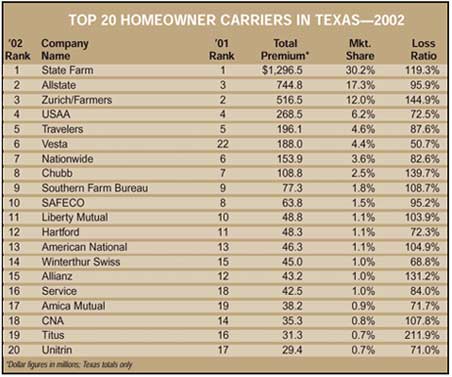

Homeowners

The homeowners line was still a disaster in 2002, although the loss ratio fell from 115.6 percent in 2001 to 108.3 percent in 2002. The Texas loss ratio was 42 points higher than the national average, a larger margin than in 2001. Texas Select (Vesta) and Republic (Winterthur Swiss) were the only companies in the top 20 with loss ratios of less than 70 percent. Other companies, however, realized significant improvements in their loss ratios, including Unitrin from 123.9 percent in 2001 to 71 percent in 2002.

The aggregate homeowners premium written in Texas increased 25.7 percent from 2001 to 2002, up to $4.3 billion.

The production moratoriums imposed by Farmers throughout 2002 translated to a significant loss in its market share—from 19.2 percent in 2001 to 12 percent in 2002. The slack was mostly picked up by independent agents, whose market share increased more than five points from 17.3 percent to 22.4 percent, the largest single-year jump in the history of the Independent Insurance Agents of Texas’ market share reports. Most of that increase was realized by a single company, Texas Select, which moved into the top 20 for the first time at number six with 4.4 percent market share and a loss ratio of 50.7 percent.

Market share for the five leading carriers dropped from 77.2 percent in 2001 to 70.3 percent in 2002.

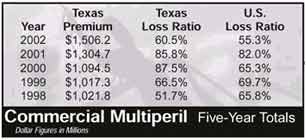

Commercial Multiperil

The commercial multiperil loss ratio of 60.5 percent was profitable for the first time since it was 51.7 percent in 1998. The national loss ratio for this line was even better at 55.3 percent.

The top 20 includes two new carriers. ACE-INA moved back into the top 20 from 22nd to 16th, while W.R. Berkley moved from 21st to 20th, replacing last year’s 18th-ranked carrier Old Republic and 19th-ranked GE Global.

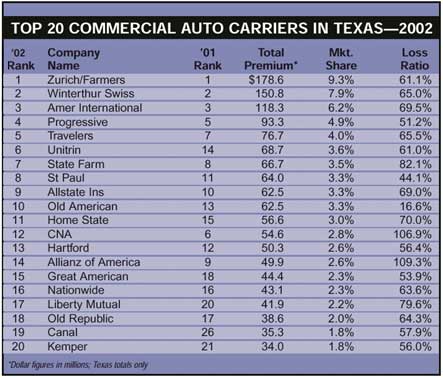

Commercial Auto

Profitability in commercial auto finally became a reality for the first time since 1997, with a 66.7 percent loss ratio compared to 79.3 percent in 2001.

There always seems to be a stable available market for this line, although it does appear that county mutuals are the ones providing that market. County mutuals increased their market share in commercial auto from 29.9 percent ($497.6 million) in 2001 to 31 percent ($590.7 million) in 2002.

Canal and Kemper entered the top 20 in 2002, replacing State National and Safeco. State National operates State and County Mutual as a fronting company for various MGA programs. According to a company official, its drop from number four out of the top 20 was caused by a loss of some key MGA programs and a single large account.

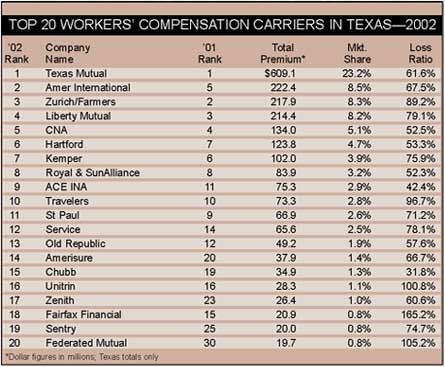

Workers’ Compensation

Workers’ compensation took a giant leap back towards profitability in 2002, with a loss ratio of 74.1 percent (down from 89.5 percent in 2001). The Texas loss ratio was better than the national average of 77.7 percent.

Texas Mutual Insurance Company continues to dominate the Texas market. It took a giant 44 percent leap in written premium from 2001 to 2002 and the result was a significant increase in market share—from 17.7 percent to 23.2 percent. It also maintained a loss ratio that was more than 12 points better than the statewide average.

There was some change in the top 20 carriers from 2001 to 2002, with three carriers out (Swiss Re, White Mountains and Atlantic American) and three carriers in (Zenith, Sentry and Federated Mutual). Service Group is now in the 12th position, thanks in part to IIAT members’ participation in the CompConnection program.

The 2003 Outlook

The insurance industry in Texas is holding its collective breath as the Texas Department of Insurance sorts through and implements the rate and policy form reforms passed by the legislature in 2003. Significant coverage reductions for water damage and mold should finally have a positive (and we hope dramatic) impact on homeowners results, although April hailstorms in North Texas and Hurricane Claudette in July will certainly affect the bottom line and demonstrate once again how volatile Texas weather exposures can be.

After three consecutive unprofitable years, we believe 2003 is the come-back year. Premiums are up (significantly in some lines), loss ratios should be down, and companies can look forward to virtual personal lines rate and form freedom in 2004.

David Surles is director of Professional Liability and Regina Anderson is manager of Technical Services for the Independent Insurance Agents of Texas.

Topics Texas Carriers Agencies Auto Profit Loss Workers' Compensation Personal Auto Homeowners Independent Agencies

Was this article valuable?

Here are more articles you may enjoy.

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer  The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets

The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets  Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples

Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples  Zurich Reveals Beazley Stake After UK Insurer Spurns Bid

Zurich Reveals Beazley Stake After UK Insurer Spurns Bid