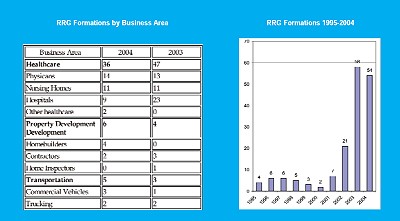

Risk retention groups have maintained their record rate of formations, with 54 RRGs formed this year as compared to 58 formed in 2003–a year that set an all time record. The high number of RRGs formed in 2004 continues to reflect the unavailability and unaffordability of liability insurance that commercial insureds face in the traditional marketplace.

Healthcare leads as the business area with the greatest number of RRG formations, accounting for 66 percent of total formations. There were more RRGs formed this year to insure physicians than formed last year–14 in 2004 vs. 13 in 2003. Eleven RRGs were formed this year to insure nursing home owners/operators, which is the exact same number as formed last year. However, there were fewer RRGs formed this year to insure hospitals and affiliates. Nine RRGs were formed in 2004 for hospitals and affiliates as compared to 23 formations in 2003.

While healthcare dominates RRG formations, other business areas are also showing signs of gains.

Property development recorded a formation of six RRGs in 2004 to insure contractors and homebuilders compared to only four in 2003. Transportation recorded the formation of five RRGs in 2004 to insure commercial vehicles and trucking operations compared to only three new RRGs formed in 2003.

The bar graph below highlights the growth of RRG formations in 2004 and the table compares the business areas in which the greatest number of RRGs have formed in the last two years.

Karen Cutts is managing editor and publisher of the Risk Retention Reporter, the authoritative information source for the risk retention and purchasing group marketplace. www.rrr.com.

Was this article valuable?

Here are more articles you may enjoy.

Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples

Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators  Trump Demands $1 Billion From Harvard as Prolonged Standoff Appears to Deepen

Trump Demands $1 Billion From Harvard as Prolonged Standoff Appears to Deepen