Developments in drone technology are often heralded as having the potential to change the landscape of business operations, most prominently in the consumer goods shipping sector. Yet, the development of federal regulation and guidance on the commercial use of drones lags behind the pace of innovation. Meanwhile, litigation highlighting the common law tort risks inherent in drone operations has been percolating in jurisdictions around the country. It is no surprise, then, that users of the technology face major uncertainty in terms of their exposure to liabilities, both known and unknown. In this article, we discuss the expansion of these potential new uses and liabilities and the role that commercial insurance may play as both an enabler and as a means to fill the gap between innovation and exposure to liabilities.

Drone Usage Across Different Sectors

Drone technology has increasingly been used across various industries as a tool to augment existing services. For example, architecture firms and contractors have already begun to embrace drone technology for monitoring construction and gathering site data. Specifically, drones rigged with high-resolution cameras enable construction professionals to gather valuable project data through the entire life cycle of a project including the survey, design and construction phases. Drones may survey sites, inspect construction quality and photograph completed structures. The benefits of leveraging drone technology, as opposed to following traditional methods, are substantial: Drones offer the unique ability to navigate and ascend to viewing points that would be otherwise inaccessible without such technology. In addition, drone usage could also reduce site-related injury and property damage by reducing the risks associated with placing personnel and equipment in potentially precarious situations.

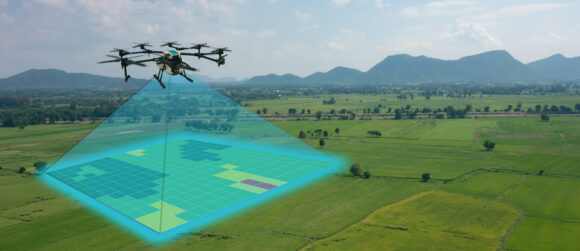

Drones are also poised to become an integral part of supply chains across the country, and their proliferation is likely to increase as federal agencies develop new guidelines and regulations paving the way for expanded uses. Many anticipate that drones are likely to dominate the consumer delivery arena. Indeed, the Federal Aviation Administration (FAA) has already issued key certificates declaring drone delivery services such as Amazon Prime Air, Alphabet’s Wing Aviation and UPS Flight Forward to be “air carriers” in the eyes of the law. However, behind the scenes, drones also offer significant value across less visible links in the supply chain as well. For example, raw materials industries such as farming and mining have embraced drones as tools to expedite monitoring and management of large swaths of land at a fraction of the cost otherwise required.

New Liabilities Emerge

As with any emerging technology, early drone adopters face considerable uncertainty in terms of potential areas of liability. Although federal regulations traditionally have barred the flight of drones over people or moving vehicles, there has been no shortage of tort lawsuits filed in courts around the country concerning personal injuries and property damage caused by drone collisions. In order to strike a balance between expanding commercial drone use while mitigating these kind of traditional tort liabilities, the FAA recently enacted new regulations permitting drone flights over people and vehicles, provided certain safety measures are met. These measures include, for example, a prohibition on exposed rotating parts that could cause lacerations and a weight limit of 55 pounds. In rolling out these regulations, the FAA has not only sanctioned an entirely new class of drone operations, but has provided compliant drone operators with a strong legal basis to defend these kinds of traditional tort claims related to personal injuries or property damage.

Regulatory bodies have been less quick to act on more nuanced areas of potential liability that may arise from drone use, such as the violations of privacy rights that may occur when drones fly over or onto private property. To date, the FAA has largely taken a hands-off approach to the regulation of drone use and privacy concerns, focusing instead on safety and operational issues. Recently however, the FAA enacted its remote identification regulation, which requires drones to broadcast information about their identity, location, altitude and control station or takeoff location to federal regulators. This regulation does little, however, to address the privacy concerns of land owners or other parties who may face potential intrusions by drone flight.

Until the FAA acts on these emerging privacy concerns, some nongovernmental bodies have stepped in to shape thought around the development of future regulations. For example, in 2019, the Uniform Law Commission drafted the Uniform Tort Law Relating to Drones Act, which defines, among other things, the torts of aerial trespass by unmanned aircraft and proposes to extend existing state privacy statutes to drone operations as well. Similarly, in early 2020, the American Bar Association’s House of Delegates passed Resolution 111, which advocates for a robust enforcement of traditional state trespass and privacy laws in connection with drone operations.

Nonetheless, until the FAA or other federal bodies provide guidance on privacy issues, drone operators will face uncertainty about areas of potential liability. This is especially the case for operators who may seek to fly across state lines and, as a result, may be subject to a patchwork of differing state privacy laws.

Still more potential liabilities loom on the horizon as companies begin to integrate artificial intelligence, machine learning and autonomous piloting technology into their drones as well. The onset of machine learning algorithms has given rise to the “black box problem” — a term coined to describe the phenomena whereby an algorithm becomes so complex that it is impossible to discern how it derives an output from any particular inputs. In other words, even an algorithm’s creators very frequently cannot explain how the algorithm reached a given decision or prediction.

The black box problem raises novel legal questions about who is responsible when an algorithm may cause a drone to fail, resulting in some harm to a third party. The European Union has sought to tackle the black box problem by way of its General Data Protection Regulation (GDPR), which provides a so-called right to know clause, providing that data subjects have a right to obtain an explanation about how a particular algorithmic decision was reached. The contours and practical effect of the right to know provision are still the subject of heated debate, and, to date, the U.S. has not adopted any equivalent regulatory scheme.

Insurance as a Potential Solution

Most traditional forms of third-party liability insurance contain carveouts that exclude coverage for liability that arises from drone usage. Specifically, many commercial general liability policies exclude coverage for bodily injury or property damage “arising out of the ownership, maintenance, use or entrustment to others of any aircraft owned or operated by or rented or loaned to any insured.”

For example, in Essex Ins. Co. v. City of Bakersfield (2007), the court stated that the aircraft exclusion is designed to limit coverage for risks normally covered by other insurance, and, “to cover these risks, the insured must purchase separate insurance.” And it is typical for errors and omissions policies to contain an exclusion for claims arising from property damage and bodily injury.

As alluded to above, this means that a drone operator seeking to cover some of the risks noted above must look beyond the “traditional” forms of third-party liability insurance.

Multiple insurance carriers have issued drone liability coverage endorsements as add-ons to their existing architects and engineers professional liability insurance policies. These amendatory endorsements generally provide coverage for a drone liability claim against the insured that is typically defined as any claim against the insured for bodily injury, property damage, including construction project delays, and invasion of privacy. Generally, the claim must arise out of the insured’s operation of a drone in the performance of professional services, including any privacy breach arising therefrom. These endorsements generally exclude, among other things, non-certified drone operation based on, or arising out of, any drone operated by an individual who does not have a remote pilot certificate with a small unmanned aircraft system.

But note that as one prerequisite for coverage under these drone liability coverage endorsements, the insured’s drone operation must be done in the performance of its professional services, a defined term in the policy. This is an important limitation.

For example, if a policy defines “professional services” to mean architecture and engineering, these endorsements likely would not cover the insured for, say, capturing drone footage of a completed project for use in the building owner’s marketing materials. Thus, as always with errors and omissions insurance, underwriters and insureds must take into account the particular scenarios that could arise when negotiating the scope of their insurance policy’s coverages.

Perhaps in the future, delivery carriers deploying fleets of autonomous drones and their insurance brokers will seek to negotiate to obtain forms of insurance similar to the above-noted drone liability coverage endorsement. We can speculate that such an insuring agreement might be tied to, say, a “technology error or omission,” which could be defined to include hardware failures on an individual drone, software malfunctions across entire fleets of drones or either.

Similar to the insurance described above, delivery carriers likely will also seek insurance to protect them from invasion of privacy claims that are almost certain to result from the incidental gathering of potentially sensitive video data, as LiDAR- and camera-equipped drones begin to carry packages to the personal dwellings of delivery recipients. As alluded to above, however, early adopters of technology face considerable uncertainty in terms of potential areas of liability, and insurance carriers will undoubtedly be careful when wading into these areas of risk.

We expect policies that cover these risks to carry high deductibles and premiums, specific sublimits of liability and will possibly involve shared risk pools among various insurers or underwriting syndicates.

Conclusion

Drone technology is advancing much faster than the surrounding legal and regulatory framework. Although this gap, and the uncertainty it creates, may have a chilling effect on more risk-adverse businesses, those who are willing to embrace new technology may benefit by turning to insurance as a tool to mitigate that risk.

Likewise, as the uses of drone technologies expand and operators are confronted with new forms of liability, the interests of these large-scale commercial drone operators may intersect with those of private insurance carriers that wish to underwrite risks and charge premiums in return. As shown by the drone insurance written for architects and engineers, it is certainly possible for new third-party liability insurance products to crop up as a result of these novel commercial use cases.

The next few years will be a critical turning point in the expansion of commercial drone use, and drone users would be prudent to work with their insurance carriers to develop practical policies to provide protection from emerging liabilities.

Benon is a trial lawyer at Duane Morris, focusing on insurance coverage issues involving cyber, media, and technology liability policies, and professional liability policies. Decker is a trial attorney at Duane Morris, practicing in the areas of commercial, consumer class action, products liability and mass tort litigation.

Was this article valuable?

Here are more articles you may enjoy.

Marsh Awarded Injunction Against Former Employees Now With Howden US

Marsh Awarded Injunction Against Former Employees Now With Howden US  State Farm Inked $1.5B Underwriting Profit for 2025 but HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025 but HO Loss Persists  Zurich Insurance Said to Near Beazley Deal Funded by Equity Sale

Zurich Insurance Said to Near Beazley Deal Funded by Equity Sale  Resilience: Cyber Risk Shifts From Disruption to Long-Tail Losses

Resilience: Cyber Risk Shifts From Disruption to Long-Tail Losses