Platforms are having a moment. Should insurance companies care?

Increasingly more firms from different industries say they offer platforms. Technology firms with which your insurance carrier or agency works, manufacturers making smartphones or tablets, payment solution firms like PayPal, and retail companies such as Amazon and Walmart say they offer platforms.

None of these firms provide a description or definition of what they mean by the term platforms but why get picky? It is the go-to-market topic du jour.

To be fair, I believe that each of these firms are correct in the narrow sense that their platforms offer services to companies.

However, corporate users of these platforms are passive. They consume value rather than being able to also create different types of value for themselves and for others who use the platform.

Commerce Platforms

A commerce platform is an interactive solution enabling participating corporate users to create value rather than merely consuming value. More specifically, a commerce platform is a mobile, digital, web-accessible, cloud-enabled set of technology applications that brings together many participants from different companies to work together to achieve one or more commerce objectives required to get-and-keep customers.

Later in this column, I discuss how a commerce platform can be used in the commercial insurance market.

The key term for me in the long list of descriptors is “commerce.” That one word solidifies for me why a commerce platform is more expansive and pertinent for insurance companies to deploy than the platforms that primarily or only offer services.

Commerce Platform Descriptors

The litany of descriptors — mobile, digital, web-accessible, cloud-enabled — describe how a commerce platform is accessed and used. This mouthful of terms describes the nature of the quickly emerging marketplace that every company, regardless of industry, should align its operations with as one of the firm’s bases of competition.

I assume two of the terms — mobile and digital — are self-explanatory and their meanings universal. Apple introduced the iPhone in June 2007, reinforcing the universality of the two terms, as well as changing how commerce and communication would be conducted by people worldwide.

The term web-accessible refers to a software solution that enables an authorized person or company to access, consume and download whatever exists on the internet (inclusive of text, sound, pictures and video).

Cloud-enabled refers to a software solution that enables an authorized person or company to store, share, access, consume and download whatever exists in their own private, public or hybrid cloud.

The descriptions are obviously similar. As Dynamix Solutions elegantly stated in 2017, and I rephrase slightly: “The cloud is a virtual storage space on the web.”

The word consume means a person or company can view, read and/or listen to content — whether on the web or their own personal storage cloud — or with the appropriate authorizations and security levels can perform those activities in their company’s cloud.

With these descriptions in-hand, let’s turn back to the (commerce) platform focus of this column.

The 5 Elements of a General Commerce Platform

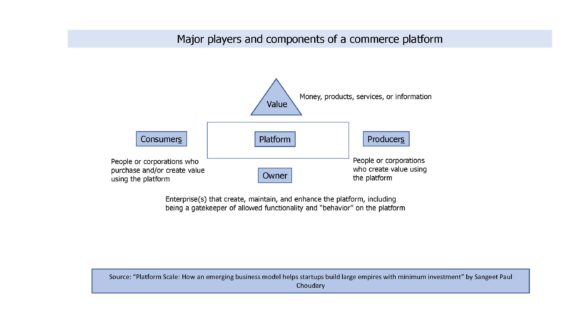

There are five elements of a general commerce platform: the platform itself; consumers; producers; owner; and value. I am using Sangeet Paul Choudary’s description of a commerce platform. (See visual)

There are several points to keep in mind regarding general commerce platforms.

The terms “consumers” and “producers” do not necessarily have the same meaning from the perspective of discussing insurance commerce platforms as they do in the insurance industry. Consumers and producers of value could be the same person or company. The notion of “value” can take many forms from money to products to services to information or any combination. The platform “owner” could be a company, a standards organization, a regulatory authority, or a consultancy (as examples).

Economic Value Versus Integration

A major point about commerce platforms that distinguishes them from other types of platforms was espoused by Bill Gates when he said, discussing the objectives of a commerce platform, “A platform is when the economic value of everybody that uses it, exceeds the value of the company that creates it. Then it’s a platform.”

Put another way, if a technology company or other type of company states they are offering a platform because your carrier or agency can integrate with it, then it is not a commerce platform. Integration is necessary but far from sufficient for a platform to be a commerce platform. For the IT professionals reading this: Application Program Interfaces (APIs) are necessary, but they alone don’t make a platform a commerce platform.

Important Differentiators of Commerce Platforms

It’s critically important to reinforce that the participants, whether they are consumers or producers, are not merely passive consumers of the services — or other value elements — that a commerce platform offers. Instead, they are active participants who are allowed and enabled to create value.

Commerce platform owners have a responsibility to engage with consumers and producers to collaborate and communicate the allowable functionality and behavior on the commerce platform. Insurance commerce platform owners should be neutral insurance organizations such as an insurance standards organization (e.g., ACORD or POLARIS in the UK), or more broadly, a standards and regulatory organization (e.g., NAIC), rather than a technology firm that offers solutions to insurance companies.

Insurance Commerce Platform

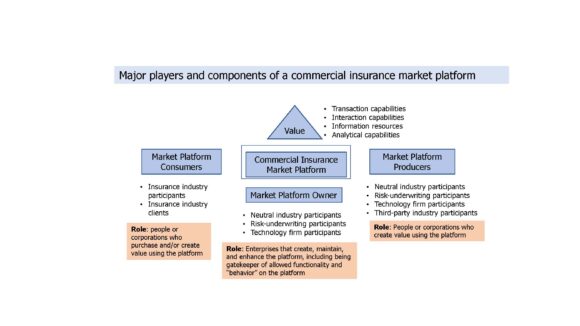

Let’s move from the descriptions of a general commerce platform to a specific example of a commercial insurance commerce platform. (See visual)

The platform itself is the dynamically changing collection of commercial insurance-oriented value capabilities plus the allowed functionality and behaviors for the consumers, producers and platform owners. Platform consumers could be any one or more participants in the portfolio of commercial insurance industry participants including brokers, account executives or producers, CSRs, underwriters, claim adjusters and clients.

Platform producers could be neutral industry participants such as ACORD, industry regulators, risk underwriting participants including insurance companies or producers with the power of the pen (e.g., MGAs). Technology firms such as those providing one or more customer, producer, and/or market-facing systems such as Applied Systems, Vertafore, or Salesforce, and third-party industry participants like loss adjustors and loss assessors, may also be platform producers.

Platform owners could encompass neutral industry participants, risk underwriting participants or technology firms. In the UK, standards organizations, actuarial firms, and technology firms offer commercial insurance commerce platforms.

Value components of a commercial platform include:

- Transaction capabilities that encompass finding coverage, real-time rating of submitted coverage applications, or data downloads/uploads with carriers participating on the commerce platform.

- Interaction capabilities that include chatbots, video chat, or web conference communication and collaboration functionality.

- Information resources enabling search and navigation of a carrier’s procedures or existing regulations for specific jurisdictions, library of policy forms for each carrier participating on the platform, or an on-demand video training for agents.

- Analytical capabilities that encompass predicted next-best offer, estimated maximum probable losses, or an interactive map of each prospective client’s location showing that geographic location’s potential risks such as hailstorms, floods or hurricanes.

Finally, keep in mind that all commercial insurance platform participants with the appropriate authorization must be able to access, create, store, and use any platform value capabilities using mobile web-accessible, cloud-enabled devices.

Are Commerce Platforms in Your Company’s Future?

Here are three questions for your company regarding insurance commerce platforms.

Should your company care about commerce platforms? Yes, they should care about commerce platforms. (Re)insurance companies as well as producer channels that use commerce platforms could have a competitive advantage over competitors who don’t use them.

Should your companies create or participate in an insurance commerce platform? Yes. Insurance commerce platforms would be another solution in your company’s portfolio of tactical initiatives to, as examples, assist producers to find coverage more quickly for clients; develop products in an interactive collaborative manner either within a (re)insurer or between (re)insurer departmental professionals and brokers; understand existing and target markets; and enable clients to consume service more easily, at a minimum. On the last example, I assume that at some point in time, insurance commerce platforms will be open to commercial insurance clients including risk managers, CFOs, and in-house corporate counsel. I’m not sure if personal lines insurance clients will have access or be able to contribute value to an insurance commerce platform in the next 10 years but I hope I’m wrong.

Is a commerce insurance platform in your company’s future? Only your company can answer this question. However, any insurance company thinking about using insurance commerce platforms should consider five factors:

- A commerce platform is not a “magic bullet” that will provide all the solutions to getting and keeping customers or keeping producers satisfied.

- Any commerce platform needs to have a minimal number of producers and consumers to achieve each of the carrier’s commerce objectives.

- Each participant should be encouraged to provide value to the platform.

- Each participant must have the technology applications to enable the consumption and creation of the value elements.

- Each participant company should collect financial awards for engaging with and creating value elements for the commerce platform.

Was this article valuable?

Here are more articles you may enjoy.

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Lawyer for Prominent Texas Law Firm Among Victims ID’d in Maine Plane Crash

Lawyer for Prominent Texas Law Firm Among Victims ID’d in Maine Plane Crash  Florida Senate President Says No Major Insurance Changes This Year

Florida Senate President Says No Major Insurance Changes This Year  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers