The recent upticks in the frequency and severity of weather events has affected insurance premiums for rental properties. According to S&P Global Ratings, insurance is an increasing percentage of total expenses for rental properties and the trend is expected to persist.

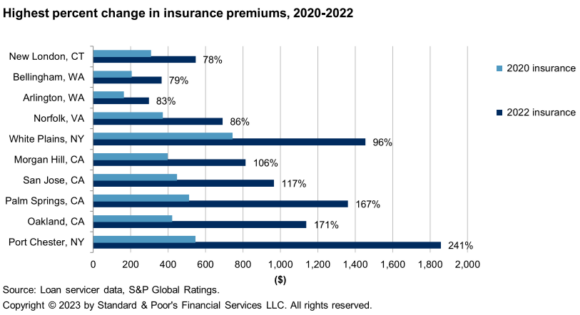

The weighted average for property insurance was about $590.30 in 2022, compared with about $473.60 the year before and about $386.90 in 2020.

S&P Global Ratings analyzed 2020-2022 expense trends on 60 loans on U.S. affordable housing properties receiving low-income housing tax credits. The properties contain over 6,500 units.

“We expect property and casualty insurance premiums for commercial properties, including multifamily, will keep rising through 2023,” S&P Global Ratings said.

Properties with the largest increases in insurance expenses are located in the following markets:

Topics Trends

Was this article valuable?

Here are more articles you may enjoy.

3 Big Questions Facing FEMA With Kristi Noem Out

3 Big Questions Facing FEMA With Kristi Noem Out  Meta Loses Insurance for Defense in Major Social Media Addiction Litigation

Meta Loses Insurance for Defense in Major Social Media Addiction Litigation  Kyle Busch and Wife Settle Lawsuit With Pacific Life and Insurance Agent

Kyle Busch and Wife Settle Lawsuit With Pacific Life and Insurance Agent  What Berkshire’s CEO Abel Said About Insurance

What Berkshire’s CEO Abel Said About Insurance