A new wave of insurance coverage litigation has taken shape in U.S. federal courts, with lawsuit activity in insurance disputes since 2022 diverging sharply from the patterns of both the pandemic years and the decade preceding them. Recent analysis from Lex Machina, the LexisNexis Legal Analytics platform, reveals a surge in homeowners’ policy claims unrelated to hurricanes, alongside a substantial increase in business liability coverage disputes. Business interruption coverage litigation has also persisted well beyond the early COVID-19 years.

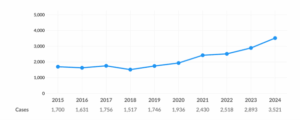

Homeowners’ Policy Claims Rising Beyond Hurricane Events

Homeowners’ insurance cases, excluding those related to hurricanes, have increased every year since 2018. In 2024, more than 3,500 suits were filed in federal district courts, the highest count since at least 2009. Although not directly referencing hurricanes, over half of those cases involve losses from climatic events including rain, flooding, high winds, and storms. Preliminary 2025 figures from Lex Machina (January through October) suggest another substantial increase is underway.

Escalating Business Liability Coverage Disputes

After years of relative stability, disputes over business liability coverage have risen steeply since 2021. Federal courts saw more than 3,000 such cases filed in 2024, marking the busiest year since 2010. The 2025 data continues that upward trajectory.

This growth can be attributed to multiple converging factors. In a recent Lex Machina webcast, legal experts cited rising social costs, shifts in insurers’ approaches to coverage denials, and emerging technological risks as key factors.

“Insurers are taking more assertive stances on denials,” said Daniel Cotter, a member of Aronberg Goldgehn Davis & Garmisa in Chicago, during the webcast. Lexis Practical Guidance Content Manager & Editor for Insurance Law, Karen Yotis, added that insurers are increasingly facing novel, precedent-poor issues, ranging from cybersecurity exposures to ESG-related liabilities and the application of artificial intelligence. “These breed litigation,” she stated.

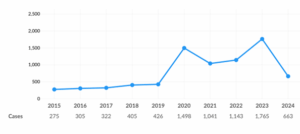

Persistent Wave of Business Interruption Cases

Although mandated business closures from early pandemic years have long passed, new lawsuits concerning business interruption coverage remain frequent. More than 650 such cases were filed in 2024, which is over 50% higher than in any pre-pandemic year in the preceding decade. The latest data from Lex Machina indicates that 2025 is continuing the upward trend.

The bulk of recent business interruption lawsuits stems from weather and climate-related damage, such as flooding, hurricane-force winds, hail, and wildfires. Yotis said the focus has shifted from COVID-19 business interruption disputes to a climate-driven business interruption insurance issues.

Looking Ahead

Today’s coverage litigation reflects a complex convergence of social, environmental, and technological factors that extend beyond widely reported triggers like hurricanes and pandemics. Understanding how these forces interact across homeowners’, commercial liability, and business interruption policies will be critical for insurers, attorneys, and analysts seeking to anticipate litigation patterns and manage risk effectively in this rapidly changing legal environment.

Was this article valuable?

Here are more articles you may enjoy.

Commercial P/C Market Softest Since 2017, Says CIAB

Commercial P/C Market Softest Since 2017, Says CIAB  Waiting for Hormuz, More Oil Tankers Gather in the Persian Gulf

Waiting for Hormuz, More Oil Tankers Gather in the Persian Gulf  Kyle Busch and Wife Settle Lawsuit With Pacific Life and Insurance Agent

Kyle Busch and Wife Settle Lawsuit With Pacific Life and Insurance Agent  Cuts to Funding Mean Risks Will Pivot in Human Services Market

Cuts to Funding Mean Risks Will Pivot in Human Services Market