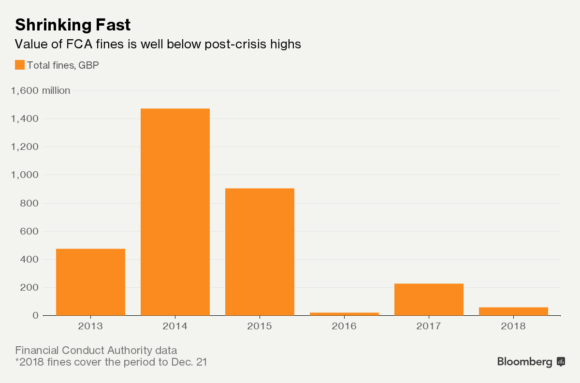

The total value of fines handed out by the U.K.’s Financial Conduct Authority fell by almost 75 percent in 2018, after a bumper year in which it had secured penalties against the likes of Deutsche Bank AG, Merrill Lynch International and Rio Tinto Plc.

The regulator handed out 60.5 million pounds ($76.6 million) in fines in 2018, more than half of which were accounted for by a single 32.8 million-pound penalty issued to Banco Santander SA’s U.K. unit on Dec. 19.

That’s down from 230 million pounds in 2017 — a 74 percent drop. That year saw “a handful of absolutely huge fines,” said Jonathan Cary, a commercial disputes lawyer at RPC in London.

This year’s largest fines, aside from Santander, were a 16.4 million-pound penalty for Tesco Plc’s banking arm for failures that allowed cyber attackers to steal funds, and a 5.2 million pound fine for Liberty Mutual Insurance Europe SE for failures in its oversight of mobile phone insurance claims and complaints handling.

The watchdog fined Barclays Plc Chief Executive Officer Jes Staley 321,000 pounds in April, an amount that pales in comparison to some previous regulatory fines, while allowing him to hold onto his job. The move, which came after an investigation into his two attempts to identify a whistle-blower within Barclays, was seen as an early indication that the Financial Conduct Authority may tread cautiously when enforcing new rules for top executives. In July, it said it won’t fine former Royal Bank of Scotland Group Plc senior executives after an investigation into its small-business lending unit found it put its own profit over clients’ interests.

Last year included a 34.5 million-pound penalty for Bank of America Corp.’s Merrill Lynch for failing to report two years’ worth of exchange-traded derivatives transactions, a 27.4 million-pound fine for Rio Tinto over rule breaches and a 163 million-pound fine for anti-money laundering control failings at Deutsche Bank.

The watchdog hasn’t changed its approach and is “committed to investigating and holding firms and individuals to account for misconduct and ensuring wrongdoers pay for the costs of remediation,” a spokeswoman said. It’s opened significantly more investigations this year than last, she said.

“It would be wrong simply to say the value of fines has fallen, therefore the FCA isn’t being sufficiently active or rigorous,” Cary said. The previous year “could be seen as an aberrational high.”

To be sure, the 2018 figures only cover the period to Dec. 21, leaving room for the watchdog to increase the year’s figure if it hands out new penalties in the final days of the year.

Targeting People

The regulator is starting to shift towards penalizing individuals rather than companies after it introduced the Senior Managers Regime in 2016, Cary said. The message of that reform was that it’ll hold top executives accountable for wrongdoing on their watch. Fines against individuals tend to be lower than those against companies.

“Historically, the FCA was perhaps looking to get ‘heads on sticks’ by way of multimillion-pound fines” against the large institutions, Cary said. Now, the regulator sees making senior individuals take more responsibility as an effective deterrent.

“Nothing focuses the mind like the risk that you personally could be censured, possibly fined or even banned from the industry,” he said.

Topics Carriers

Was this article valuable?

Here are more articles you may enjoy.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  AI Needs Its Own Risk Class: Lockton Re

AI Needs Its Own Risk Class: Lockton Re  Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs