Brit Ltd. and Ki announced that Ki will operate as a standalone company within the Fairfax Group, effective Jan. 1, 2025.

Ki was incubated and launched by Brit in 2020 and began writing business on Jan. 1, 2021 with its own syndicate, 1618. Ki was one of the largest startup syndicates in the history of Lloyd’s and the first digital follow syndicate.

Over the past four years, Ki has grown significantly and evolved to become a digital-follow platform, offering capacity from multiple syndicates with over $1 billion of GWP written through the platform in 2024.

Ki has now reached scale and developed its operations to enable it to operate as a separate company within Fairfax. However, it will continue to maintain a close partnership with Brit as a nominated lead across all classes. These changes to corporate structure and operations do not affect how brokers trade with Ki or Ki’s appetite in any class of business.

Since its inception, Ki Syndicate 1618 has been managed by Brit Syndicates Ltd., but that will change January when the syndicate will be managed by Asta, the third-party managing agent at Lloyd’s.

“Ki is a true success story for Brit, and testament to the vision and ambition of both organisations. The scale, sophistication and growth potential of Ki makes this a natural next step, enabling both companies to focus on their core strengths in ‘lead’ and ‘follow’ respectively,” commented Martin Thompson, CEO Brit Group, in a statement.

“Ki’s achievements since its launch in 2020 validates our unique approach to digital fast-follow, built on underwriting discipline. The support we have had from the market highlights the collective belief in the benefits of a digitally enabled trading environment,” according to Mark Allan, CEO of Ki.

“We could not have wished for a better home than Brit for our first four years, and they remain a cornerstone partner for Ki. Becoming a standalone company is an important milestone for everyone at Ki and positions us to capitalise on the opportunities we have ahead of us,” Allan continued.

About Ki

Ki is the trading name for Ki Financial Ltd. and its subsidiaries, including Ki Digital Services Ltd. Ki is the first fully digital and algorithmically driven Lloyd’s underwriting platform offering instant capacity from multiple Lloyd’s syndicates, accessible anywhere, at any time. In September 2020, Ki raised US$500 million of committed capital from Blackstone and Fairfax, which Ki describes as the largest industry agnostic fundraise for a startup in Europe in 2020 and makes Ki the largest seed stage fundraise for any insurtech globally to date.

Related:

- Markets/Coverages: Digital Lloyd’s Syndicate Ki Partners With Travelers and Aspen to Expand Follow Capacity

- Ki Syndicate 1618 Binds 1st Risk with AmWINS’ Broking Unit THB

- Digital Lloyd’s Syndicate Ki Goes Live with List of Broker Trading Partners

- Digital Lloyd’s Syndicate Ki to Provide Howden with Follow Capacity

- Blackstone Joins Brit’s Parent Fairfax in Investing in Lloyd’s Digital Venture Ki

- UK Insurer Brit and Google Collaborate to Launch 1st Fully Digital Lloyd’s Syndicate

Topics Excess Surplus Lloyd's

Was this article valuable?

Here are more articles you may enjoy.

Buffett’s Berkshire Cash Hits $382 Billion, Earnings Soar

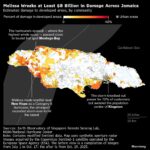

Buffett’s Berkshire Cash Hits $382 Billion, Earnings Soar  Jamaica Catastrophe Bond Has Now Triggered, Government Says

Jamaica Catastrophe Bond Has Now Triggered, Government Says  Don’t Look Now, But Citizens Is No Longer the Largest Property Insurer in Florida

Don’t Look Now, But Citizens Is No Longer the Largest Property Insurer in Florida  France Makes New Arrests in Louvre Heist; Jewels Still Not Found

France Makes New Arrests in Louvre Heist; Jewels Still Not Found