The reinsurance industry has shown significant improvements in operating performance in recent years. Despite facing substantial insured natural catastrophe losses globally, reinsurers achieved robust earnings growth in 2023 and 2024 exceeding their cost of capital. This is largely attributed to structural changes introduced in early 2023, alongside favorable pricing in reinsurance markets.

However, adverse developments in certain U.S. casualty loss reserves remain a key risk for the industry.

Based on these improvements, the reinsurance sector entered 2025 with a robust capital position, bolstered by excellent underwriting performance in short-tail lines, solid net investment income, and recovering fixed-income asset values over the past two years. In turn, we think global reinsurers are well positioned to manage the elevated natural catastrophe losses seen in first-quarter 2025, alongside the recent financial market volatility, and so maintain our stable view of the sector.

Global reinsurers will see a limited hit from declines in global equity markets, following tariffs and reciprocal tariffs announced by the U.S. and other nations, given their conservative investment portfolios. However, the sector could face exposure to equity market losses in the short term, potential asset impairments in the medium term, and challenges in the longer term from the potential effects on illiquid holdings such as real estate, and private debt and equity. Another key focus area is claims costs, which may be influenced by the announced tariffs.

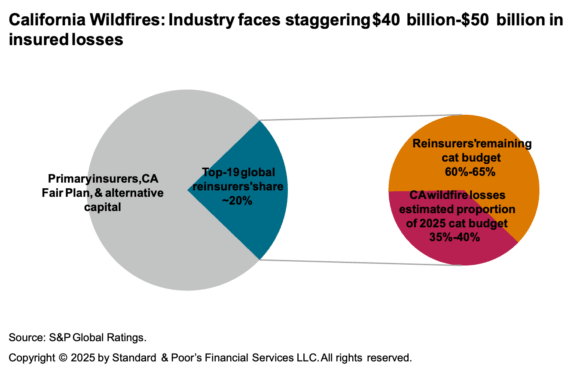

Current equity market volatility follows an already bumpy start to the year, with the January 2025 California wildfires resulting in estimated industry insured losses of up to $50 billion. Reinsurers are expected to absorb a substantial portion of these costs within their annual earnings, reducing the catastrophe budget available for the remainder of the year.

Reinsurance Capital Adequacy Stands Strong

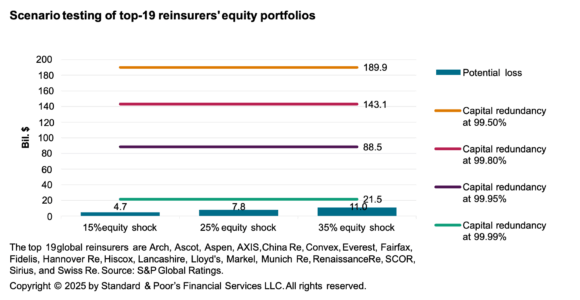

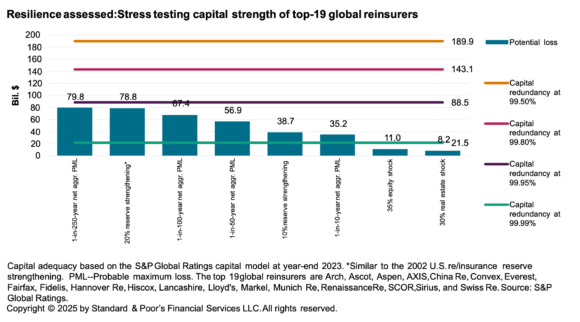

According to S&P Global Ratings’ insurance capital model, industry capitalization, as illustrated in charts 1 and 3, is assessed at varying confidence levels (99.50%, 99.80%, 99.95%, and 99.99%). Based on year-end 2023 financials and surveys, the global reinsurance sector demonstrated robust capital adequacy, maintaining a surplus of approximately $21.5 billion at the highest confidence level of 99.99%.

Hypothetical equity portfolio declines of 15%, 25%, or even 35%, while significant, remain manageable with projected net hits of about $4.7 billion, $7.8 billion, and $11.0 billion, respectively. Across all three scenarios, sector capitalization would retain its redundancy at the 99.99% confidence level, with unrealized investment losses on equities absorbable by the $21.5 billion capital buffer (see chart 1 below).

Although year-end 2024 surveys are still being collected, we anticipate similar capital results, given the industry’s strong operating earnings and the generally stable nature of reinsurers’ investment strategies, which typically show minimal variation year over year. Furthermore, our hypothetical stress scenarios exclude potential earnings contributions or management actions, such as suspending share buybacks, which could further reinforce the sector’s resilience.

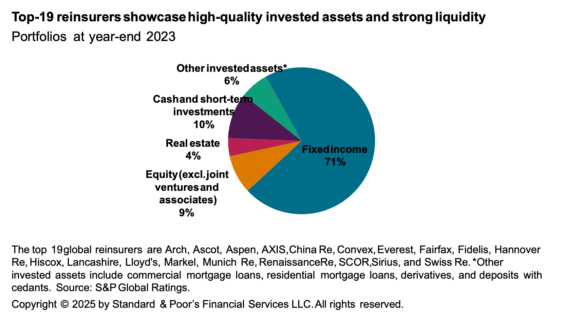

Amid this volatile investment environment, the global reinsurance sector’s conservative portfolio is helping maintain stability (see chart 2 below). The sector’s largest asset allocation remains concentrated in high-quality, fixed income securities, with at least 90% classified as investment grade.

While potential interest rate fluctuations can lead to temporary unrealized gains or losses on these securities, most unrealized losses are expected to unwind over time, as we have seen in the years since 2022 when spikes in interest rates led to losses in fixed-income portfolios. This reflects the robust financial and liquidity profiles of the top-19 reinsurers, the relatively short durations of their fixed-income portfolios, and prudent matching of cash inflows and outflows. These factors collectively enable the sector to hold such investments to maturity, mitigating the impact of market volatility.

The Sector Remains Resilient

The global reinsurance sector remains robustly capitalized and equipped to absorb losses stemming from severe events (see chart 3 below). However, significant risks persist, including the adequacy of property/casualty reserves and the potential for substantial losses from multiple major natural catastrophes, such as hurricanes and earthquakes. Stress testing for tail risks, such as multiple natural catastrophes quantified by the 1-250 net aggregate probable maximum loss (PML), or a 20% unfavorable industry reserve development, reveals the sector’s capital adequacy would lose its 99.99% redundancy but retain resilience at the 99.95% confidence level.

California Wildfires Hit Catastrophe Budgets

The Los Angeles wildfires (Palisades and Eaton) have resulted in substantial industry estimates of insured losses, ranging $40 billion-$50 billion (see chart 4 below). Reinsurers are expected to absorb a significant portion of these costs, primarily stemming from personal lines (approximately 80%-85% of total insured losses) rather than commercial lines (about 15%-20%). We estimated that the top-19 global reinsurers will shoulder roughly 20% of the related losses, consuming 35%-40% of their annual natural catastrophe budgets.

Despite this challenging start to the year, we project the sector will retain 60%-65% of its 2025 natural catastrophe budget, providing sufficient capacity to withstand additional events and still meet its cost of capital. However, the reduced buffer for natural catastrophes highlights the need for cautious risk exposure management as the year progresses.

U.S. Casualty Reserves and Claims Inflation

S&P believes unfavorable developments in casualty loss reserves remain a key risk to the reinsurance sector. As a result, reinsurers’ casualty reserves are expected to need close monitoring amid challenges from both economic inflation and persistent social inflationary pressures – the latter stemming from increased litigation costs and higher jury awards, particularly in the U.S.

Under S&P’s revised global macroeconomic outlook for the U.S., we project inflation will remain closer to 3.0% in 2025, driven by rising tariffs that elevate prices throughout the domestic supply chain and for end consumers. Given that the U.S. remains the largest market for property and casualty business for most global reinsurers, we will continue to closely monitor their exposures and reserving policies, especially throughout 2025.

What Comes Next?

S&P Global Ratings believes the top-19 rated reinsurers are well positioned to navigate market turbulence without immediate consequences for our ratings or outlooks. Historically, most reinsurers have demonstrated strong resilience in managing downside risks. However, the duration and severity of prolonged stress, along with prevailing challenges within the reinsurance sector, will play a critical role in shaping future rating assessments.

Our continued stable view on the sector is underpinned by robust capital adequacy and strong credit fundamentals. It is also based on our expectation that reinsurers will adapt proactively to volatile and evolving environments, leveraging defensive strategies to manage risks while optimizing their use of capital.

Nevertheless, extended periods of macroeconomic uncertainty or instability could hinder premium growth across geographies. In addition, escalating global trade tensions may deteriorate credit conditions, indirectly exerting pressure on reinsurers’ investment portfolios.

S&P Global Ratings believes there is a high degree of unpredictability around policy implementation by the U.S. administration and possible responses–specifically with regard to tariffs–and the potential effect on economies, supply chains, and credit conditions around the world. As a result, our baseline forecasts carry a significant amount of uncertainty. As situations evolve, we will gauge the macro and credit materiality of potential and actual policy shifts and reassess our guidance accordingly.

Topics Natural Disasters Reinsurance

Was this article valuable?

Here are more articles you may enjoy.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows