Four months after Donald Trump shocked the world and roiled markets by unveiling a placard full of tariff rates at the White House Rose Garden, his revisions unveiled Thursday generated a more subdued response among investors.

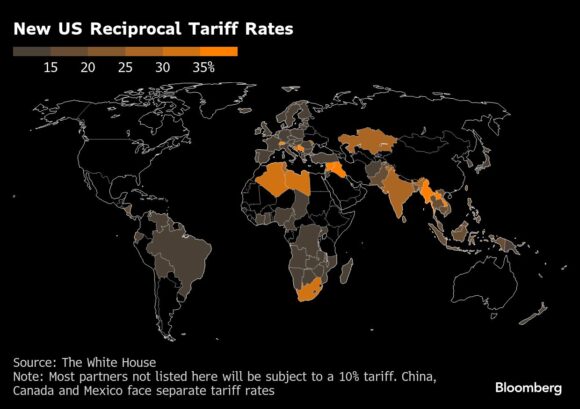

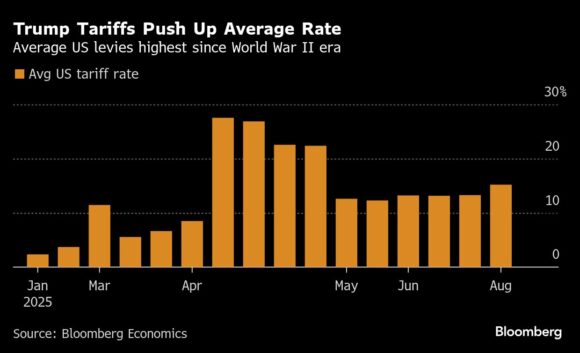

But at an average of 15%, the world is still facing some of the steepest US tariffs since the 1930s, roughly six times higher than they were a year ago. Trump’s latest volley outlined minimum 10% baseline levies, with rates of 15% or more for countries with trade surpluses with the US.

So far, the global economy has held up better than many economists expected after Trump’s initial tariff blitz. A rush to beat the elevated rates spurred a front-loading of exports, aiding many Asian economies and shielding US consumers from price spikes. (See related article: Markets Dive After Trump Hits More Countries With Steep Tariffs).

That could all be about to change.

“For the rest of the world, this is a serious demand shock,” Raghuram Rajan, former India central bank governor and chief economist of the International Monetary Fund, who is now a professor at the University of Chicago Booth School of Business, told Bloomberg TV on Friday. “You will see a lot of central banks contemplating cutting as the rest of the world slows somewhat in the face of these tariffs.”

The months of negotiations, marked by Trump’s social-media threats against US allies and foes alike, ended with new rates that were largely in line or lower than those on April 2, which were paused after stocks plummeted and bond yields surged. Still, there were some shocks, such as a punitive 39% rate for imports from Switzerland and an increase on some Canadian goods to 35%.

Wall Street traders drove stocks to their worst session since May, fueled by weak jobs and manufacturing data. The S&P 500 fell 1.5% as of 11:17 a.m. New York time.

Yields on US two-year debt — among the most sensitive to changes in monetary policy — slumped 21 basis points to a one-month low at 3.75% as money markets added aggressively to wagers on Federal Reserve interest-rate cuts. The Bloomberg Dollar Index tumbled as much as 1%, snapping a six-day advance.

While Trump’s new rates provide some certainty to manufacturers, plenty of tariff uncertainty remains. The US president is expected to unveil separate tariffs on imports of pharmaceuticals, semiconductors, critical minerals and other key industrial products in the coming weeks. And US courts are still assessing the legality of the “reciprocal” tariffs.

The past four months have also shown an increased willingness by Trump to use tariffs to settle geopolitical scores. While the “Liberation Day” rates followed a crude formula linked broadly to a nation’s trade deficit, the ensuing numbers appeared more arbitrary. Trump threatened Brazil over domestic politics, India over its ties with Russia and Canada over plans to recognize a Palestinian state.

If the new levies go ahead in seven days as planned and if deals on car tariffs with the European Union, Japan and South Korea stick, Bloomberg Economics estimates the average US tariff rate will rise to 15.2% from 13.3% — up significantly from just 2.3% before Trump took office.

“It’s a very high tariff wall,” said Deborah Elms, head of trade policy of the Hinrich Foundation. “The cost is going to be significantly higher for American companies and American consumers who will respond surely by buying less.”

Applying model results used by the Federal Reserve in the first trade war, Bloomberg Economics calculates the 12.8-percentage-point hike in the average tariff since Trump came back into office could cut US GDP by 1.8% and lift core prices by 1.1% over a period of two to three years.

That’ll create downside risks for exporters that rely on US demand too.

Bloomberg Economics reckon Canada and Mexico, which has an additional 90 days to negotiate, are “well placed to weather the storm” thanks to carve outs for compliant goods compliant with the USMCA trade deal. The EU, Japan and South Korea — all with 15% rates — also come off better than feared.

Switzerland, by contrast, was hit hard with a tariff of 39% on its products. The franc was initially among the worst performing major currencies on Friday after the announcement, but it rebounded after weaker-than-expected US jobs data.

US Trade Representative Jamieson Greer cast the negotiations with Switzerland as complicated in a Bloomberg Television interview Friday, noting that the country has a large trade deficit with the US and pointing to its pharmaceutical industry exports.

“They ship enormous amounts of pharmaceuticals to our country. We want to be making pharmaceuticals in our country. So this is a challenging situation,” Greer said.

Greer more broadly indicated that talks would continue with many economies eager to lower the rates Trump is setting.

“I woke up this morning to a number of trade ministers texting me and emailing me,” he said. “I’m always going to talk to these folks, and you know, if they have proposals, you know, I’ll talk to them and I’ll brief the president.”

Thursday’s tariff news didn’t apply to China. Trump is set to make a call on whether to extend a tariff truce after talks wrapped in Stockholm this week. A Chinese official earlier said the two sides agreed to keep levies at their current levels for now, part of a trade truce after President Xi Jinping’s government cut off the US from rare earth magnets in the wake of the April 2 levies.

Trump did include a provision to impose a 40% additional tariff on goods deemed to be transshipped, a measure that appeared aimed at China, but it lacked clarity on how such a ruling will be made.

“This provides a bit more clarity but there remains substantial uncertainty for manufacturers,” said Jonathan Kearns, Sydney-based chief economist at money manager Challenger Ltd. “We’ve seen numerous changes in the US tariff regime to date and there could always be more. Companies will be wary of investing and setting plans while uncertainty remains.”

Kearns, a former central bank official, said he expects greater pass through to the US consumer in the months ahead.

Greer on Friday downplayed concerns about the lack of clarity over transshipped goods.

“Sometimes when companies say we want certainty, what they mean is we want a different outcome,” he said on Bloomberg Television.

The Trump administration is hoping the new tariff regime will bring in revenue, shrink the trade deficit and spur companies to set up factories on US shores — all without driving up prices or cratering demand.

Still, since Trump’s Rose Garden rollout in April, he’s faced criticism for over promising on trade deals after he and aides vowed to broker numerous agreements, with at least one pledging “90 deals in 90 days.” Economists are also warning US households will pay a price — with the blow depending on how the burden is split between exporters prepared to eat slimmer margins to retain sales and their US importers.

Fed Dilemma

“Unlike Trade War 1.0, when Chinese exporters and the RMB bore the brunt of the adjustment, this time round since tariffs are universal with minimum rate of 10%, there would likely be some pass-through to the US consumers,” said Selena Ling, an economist at Oversea-Chinese Banking Corp. in Singapore. “This may complicate the picture for the Fed.”

Federal Reserve Chair Jerome Powell this week shrugged off pressure from the White House and rejected arguments for an interest-rate cut from two dissenting officials, maintaining that the central bank needed to stay on guard against inflation risk, while the labor market remained solid.

But the jobs report for July, released Friday, showed strong evidence of a slowing labor market — prompting Trump to renew his attacks on the Fed chief for not lowering rates, and investors to step up bets on a cut at the next meeting.

Also to be seen is whether the US levies spur more tariff barriers around the globe. While the EU has placed tariffs on Chinese electric vehicles and others have mulled similar curbs on cheap Chinese goods, most have eschewed Trump’s protectionist push.

“While we haven’t returned entirely to a ‘law of the jungle’ system, we have taken several huge strides back in that direction,” said Stephen Olson, a former US trade negotiator now with the ISEAS-Yusof Ishak Institute.

“Don’t assume this is the end of the story,” he added. “Trump regards this as an ongoing reality show. More ‘deals’ or further tariff increases are almost certain to follow.”

Photograph: A container ship at the Port of Los Angeles in Los Angeles, California. Photo credit: Tim Rue/Bloomberg

Related:

Was this article valuable?

Here are more articles you may enjoy.

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate