Tighter in-office mandates and the high cost of eating out are driving more workers to corporate cafeterias, where upgraded amenities and better food are used to lure staff back.

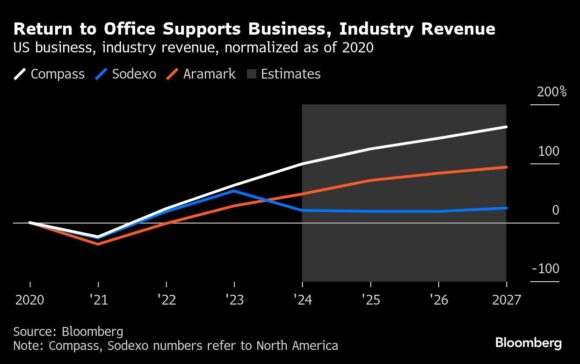

That’s boosting volumes and growth prospects for caterers, including Aramark, Compass Group Plc and Sodexo SA. Higher traffic can lift organic growth by as much as 1% in the next 12 months, Bloomberg Intelligence data shows.

“The return-to-office trend may still have room to run, potentially offering further volume upside for contract-catering providers,” Bloomberg Intelligence senior analysts Stuart Gordon and Evgeniy Batchvarov said. Paired with new contracts and pricing gains, that momentum may prompt analysts to raise estimates.

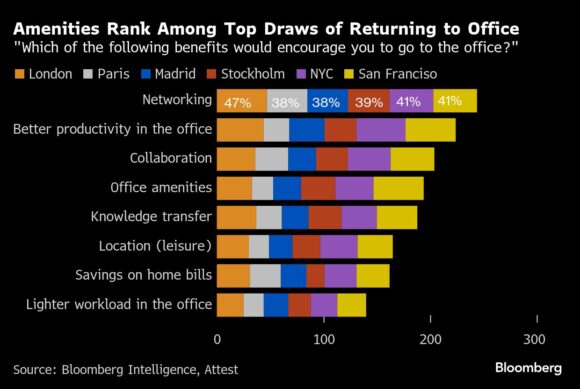

In major hubs including New York, London and Paris, fewer employees expect to work remotely in the next 12 to 24 months, the latest BI Real Estate survey shows. In New York, where 15% of workers had the option to work fully remotely over the past year, only 11% did.

Enhanced benefits beyond salaries — from better food to networking opportunities and productivity gains — remain top reasons for workers to return. “Employers are increasingly relying on such features to lure staff back to the workplace,” Gordon and Batchvarov said.

Demand for catering services is also coming from the other side, with employers chasing better value when it comes to running staff canteens, with almost half of those being self-operated. A good canteen — with employers often footing part of the bill to helps keep meal prices in check — goes far in filling office floors.

Aramark is already seeing the benefits. The Philadelphia-based company’s business and industry unit — about 15% of its US revenue — has been its fastest-growing segment for seven straight quarters.

With the cost of meals outside the office still “elevated,” more employees are opting for subsidized meals in corporate cafes, Chief Financial Officer Jim Tarangelo said on the company’s most recent earnings call.

Rising costs for consumers, from higher National Insurance contributions in the UK to a rebound in food inflation in North America, make Compass’ offerings attractive cost-wise compared with high-street operators, Chief Executive Officer Dominic Blakemore said in connection with Compass’ third-quarter trading update.

It’s not just out-of-pocket costs for employees, or perks to keep office attendance up that are proving tailwinds. In an industry where size matters, caterers’ scale offers them flexibility that most high-street competitors don’t have.

“In a high-cost environment, they have a lot of ability to rotate their menus based on what is expensive or inexpensive,” said Ben Slupecki, an analyst at Morningstar.

Europe Lags

Europe, where hybrid work remains more entrenched and volume recovery is uneven, is seeing a more tempered boost from return-to-office trends.

French caterer Sodexo reported just 1% organic growth in its European business and administration segment in the most recent quarter as “softer volumes” prevailed, CFO Sebastien de Tramasure said on the company’s earnings call. Momentum is set to pick up through 2026, consensus shows.

That contrasts with sharper gains in North America, where business and administration unit organic growth rose 1.7%, outpacing Europe for a fifth consecutive quarter.

In Germany and the Netherlands, legal and contractual protections have strengthened employees’ rights to remote and hybrid arrangements, limiting the ability to enforce full-time returns.

“I don’t think we’re ever going to get back to that hundred percent level,” Slupecki said.

Photograph: Cleaners and office workers work in their illuminated offices at dusk in the City of London, U.K., on Monday, March 16, 2020. Photo credit: Luke MacGregor/Bloomberg

Was this article valuable?

Here are more articles you may enjoy.

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions