Europe’s four largest reinsurers – Swiss Re, Munich Re, Hannover Re and SCOR – are maintaining their appetite for property-catastrophe risks as well as their ambitious profit targets for 2025 – despite signs of rate softening and hefty claims from January’s California wildfires, according to AM Best.

“This follows a period of right-sizing of [property-cat] portfolios, increases in attachment points, and a move away from aggregate covers and working layers,” said AM Best in a report titled “The European ‘Big Four’ Reinsurers Maintain Their Risk Appetites,” published on Aug. 21.

“Although prices have softened in the 2025 renewals, discipline on attachment points and terms seem to be holding for now,” said the report, adding that there is no material sign, as yet, that this discipline is weakening

The main negative note for the “Big Four” reinsurers, highlighted by the report, was adverse development in U.S. casualty. However, these losses were absorbed by strong margins in property lines and improved investment yields.

The report noted that all four reinsurers continue to benefit from business written through the hard reinsurance market, with strong pricing, terms and conditions, which has allowed them “to maintain robust performance metrics for their property/casualty reinsurance segments.”

At the same time, AM Best said, the “Big Four” composite reinsurers (which write both life and non-life reinsurance) have also been pursuing growth in insurance and reinsurance specialty segments such as cyber, marine, engineering, and other lines. “The growth in these lines is aimed at achieving increased levels of diversification and more stable earnings.”

“The performance of life portfolios in 2024 was strong for three of the ‘Big Four,’ thanks to reduced impact from pandemic-related deaths, although excess mortality in the US, in particular, continued. The exception was SCOR, which reported a large loss for its life segment in 2024,” AM Best said. “Notwithstanding SCOR’s experience in 2024, the cohort’s life books have generally had a stabilizing effect….”

All four companies “benefit from their global reach, strong brands and diversified portfolios,” the report affirmed.

Casualty Concerns

On the main negative note, AM Best said, all four reinsurers have concerns about adverse development in U.S. casualty books, which is no longer limited to the particular underwriting years of 2014-2019.

“Since 2023, all four have taken the opportunity, given the strong operating performance trends, to further strengthen non-life loss reserves. Overall, reserve strengthening charges have been comfortably absorbed by profit margins in other non-life lines of business,” the report said.

IFRS-17 Comparisons

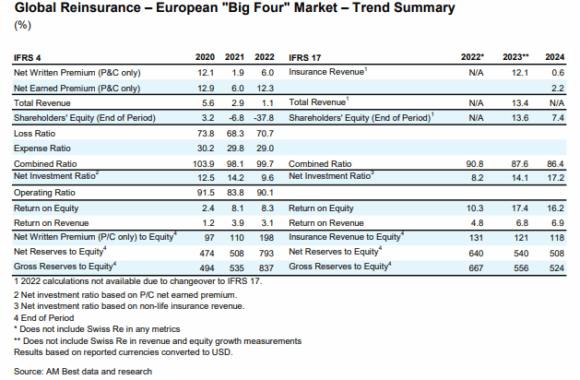

Swiss Re transitioned to reporting under IFRS in 2024, which enhances comparability as all four companies are now reporting under the same accounting standard, AM Best said. “Comparison among groups reporting under IFRS 17 and with those reporting under US GAAP is made difficult by the differences in reporting standards. Discounted combined ratios under IFRS 17 are, for example, not directly comparable with the undiscounted combined ratios reported under US GAAP or IFRS 4.”

Nevertheless, AM Best made some general comparative observations of the “Big Four” versus reinsurers reporting under US GAAP. “The ‘Big Four’ reinsurers have on average reported returns on equity (ROEs) for 2024 in line with the average for the U.S. & Bermuda market composite. However, Lloyd’s ROE of 21.2% is materially higher than that of the European average.” See related graphic below.

Source: AM Best

Related:

- Reinsurers Have Made Major Structural Changes to Improve Profits. Will Discipline Last?

- Swiss Re Tops List of Largest Reinsurers on Its Shift to IFRS-17 Accounting: AM Best

Topics Reinsurance Property

Was this article valuable?

Here are more articles you may enjoy.

Owner of Assisted Living Home Where 10 Died in Fire Denied Access to Insurance Funds

Owner of Assisted Living Home Where 10 Died in Fire Denied Access to Insurance Funds  Former Ole Miss Standout Player Convicted in $194M Medicare, CHAMPVA Fraud

Former Ole Miss Standout Player Convicted in $194M Medicare, CHAMPVA Fraud  Zurich Reveals Beazley Stake After UK Insurer Spurns Bid

Zurich Reveals Beazley Stake After UK Insurer Spurns Bid  Active Tornado Season Expected in the US

Active Tornado Season Expected in the US